For traders trying on the synthetic intelligence (AI) sector, 2024 is shaping as much as be a landmark yr. So it is excessive time to set your portfolio up for the brand new yr, and you do not have to do it alone.

Three Motley Idiot contributors put their heads collectively to current their greatest AI investments for the brand new yr.

Within the ensuing dialogue, you may discover three standout AI shares with market-beating prospects in 2024 and past. Worldwide Enterprise Machines (NYSE: IBM) made a strategic pivot towards AI and cloud computing. Nvidia (NASDAQ: NVDA) is a trailblazer in specialised {hardware} and generative AI techniques. ASML Holdings (NASDAQ: ASML) kinds the spine of AI chip manufacturing.

These corporations not solely characterize the head of innovation in AI but additionally provide distinctive funding alternatives.

Do not underestimate this AI pioneer’s capability to shine

Nicholas Rossolillo (Nvidia): It might sound like a “too-easy” decide, and even one which’s overhyped, however after Nvidia’s final earnings replace, there could possibly be loads of room for the generative AI system pioneer to climb larger throughout the brand new yr. How so?

Throughout the third-quarter fiscal 2024 earnings name (for the interval led to October 2023), income soared 206% larger than the yr previous to $18.1 billion, pushed by the info heart phase (the place a lot of the generative AI chip and system gross sales are registered). Astoundingly, one other sequential improve is anticipated within the fourth quarter with administration predicting $20 billion in gross sales.

However here is the place issues get fascinating and the place the talk is available in (as Anders, Billy, and I wrote about a couple of months ago): CEO Jensen Huang and the highest group have been clear that they anticipate their knowledge heart gross sales (80% of whole income final quarter) to proceed rising in calendar yr 2024 as extra provide of its AI chips involves market to satisfy insatiable demand. The market appears to have wrapped its head round this, with Wall Avenue analysts’ consensus for subsequent yr’s income pegged at practically $91 billion, which suggests a greater than 50% improve.

However semiconductor gross sales are typically cyclical. Durations of surging income are sometimes adopted by a droop. All eyes at the moment are on what is going to occur in 2025. However for the document, on the final earnings name, Huang stated he “completely consider[s] that knowledge heart can develop by way of 2025.”

The jury is, in fact, nonetheless out on this. Sooner or later, I anticipate the world to take a breather on constructing new AI computing infrastructure. Maybe that may lastly arrive in 2025, or perhaps it would delay till 2026 or later.

But when Huang is right, and that the roughly $1 trillion world AI data-center alternative continues to develop unabated over the following couple of years, Nvidia appears to be like like a fairly valued semiconductor inventory. Shares commerce for 25 occasions subsequent yr’s (calendar yr 2024) anticipated earnings per share. I’ve no plan on promoting any of my place in Nvidia simply but as one other busy yr will get rolling.

It is time to dive into Large Blue’s AI ocean

Anders Bylund (IBM): The IBM you see right this moment is miles aside from the one-stop-IT-shop from the flip of the millennium. In a prescient but painful technique shift that began in 2012 and by no means actually ended, Large Blue refocused its huge property on the high-growth “strategic imperatives” of cloud computing, knowledge safety, analytics, and AI.

The watsonx.ai platform is a improvement platform custom-built for enterprise-scale companies in the hunt for machine studying and generative AI instruments. It consists of generative AI assist within the app-writing expertise and the choice to generate apps in a drag-and-drop graphical interface somewhat than handbook coding, and it depends on IBM’s many a long time of AI analysis.

And the corporate is not resting on its digital laurels. The corporate has $11 billion of money equivalents and generated $10.3 billion of free money circulation over the past 4 quarters. And people funds are aimed squarely on the AI alternative proper now.

As an illustration, IBM not too long ago dedicated to coaching 2 million AI consultants within the subsequent three years, collaborating with universities around the globe. It additionally began a $500 million funding fund targeted on modern AI start-ups.

Consequently, IBM is poised to make up for its strategy-shifting ache with sturdy positive factors within the years to return. Buying and selling at simply 2.4 occasions trailing gross sales and 12.3 occasions free money circulation, IBM’s inventory appears to be like like a no brainer purchase right this moment.

But, market makers appear to have forgotten concerning the large shadow IBM casts over the AI alternative. The inventory has solely gained 16% in 2023, falling behind the S&P 500 index’s 25% improve.

I do not imply to throw market-beating performers like Nvidia beneath the bus, and I personal that inventory myself. Nevertheless, the chip designer’s shares are altering arms at 27 occasions gross sales or 70 occasions free money circulation. When you’re on the lookout for a robust AI funding on the threshold of 2024, IBM combines incredible development prospects and an unbeatable AI historical past with bargain-bin share costs.

This important AI inventory lagged friends this yr however may soar in 2024

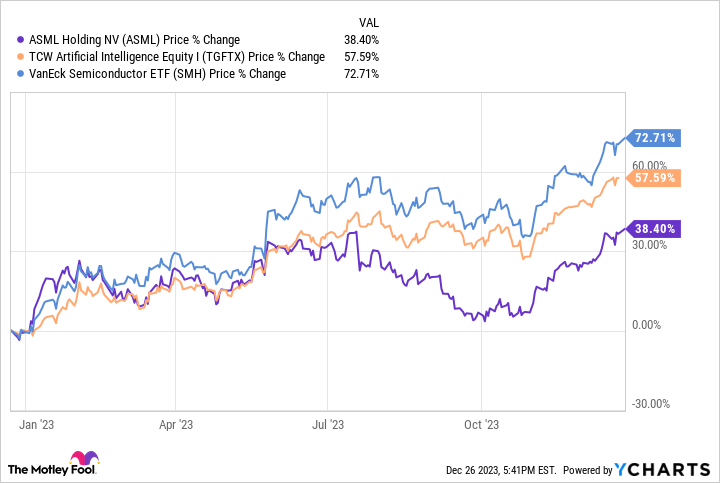

Billy Duberstein (ASML Holdings): Quite a lot of synthetic intelligence shares have gone up rather a lot this yr, so there aren’t that many bargains left. Nevertheless, ASML Holdings, at the least by comparability, underperformed a number of AI shares, rising “solely” 38% regardless of its machines being important to the AI chipmaking course of. As well as, the inventory stays about 15% beneath its all-time excessive set again in late 2021, whereas many different semiconductor and AI shares at the moment are above these prior highs.

There are a number of causes for this yr’s underperformance. First, ASML is a European inventory, so the relative efficiency of every market might have some impact. Second, ASML traded at a comparatively larger valuation than different semiconductor-equipment corporations coming into the yr. So, there wasn’t as a lot floor to “make up” after the 2022 sector plunge. Even now, ASML trades at 35 occasions earnings.

As well as, ASML administration already stated the corporate will not see a lot development in 2024. This can be stunning, since most different semiconductor corporations had a weak 2023 and now challenge a restoration yr in 2024. Nevertheless, ASML’s development has been just a little totally different. Throughout the pandemic, ASML’s excessive ultraviolet (EUV) and deep ultraviolet (DUV) lithography machines had been in such excessive demand and are so sophisticated and costly to construct that the manufacturing bottleneck stretched into this yr. So, whereas many different semiconductor-equipment corporations noticed revenues decline in 2023, ASML will truly see 2023 income development of about 30%. Solely subsequent yr in 2024 will it endure the post-pandemic downturn impact.

Nevertheless, as chip shares are likely to look forward a few yr, ASML may outperform a few of its friends going into 2025. That is a yr administration has predicted might be an enormous development yr, as a number of new modern fabs come on-line utilizing ASML’s newest EUV machines. The truth is, ASML simply shipped the primary elements of its first high-numerical aperture (NA) EUV machine, the newest and most superior mannequin of EUV, to Intel. The high-NA machine is completely huge and must be shipped in 250 separate crates! Despite the fact that the primary batch is being shipped now, manufacturing with them most likely will not occur till late 2025.

Whereas ASML inventory is not low cost, it has a monopoly on EUV know-how wanted to make chips beneath 7nm, which the business simply surpassed a few years in the past. Final yr’s modern chips, such because the Nvidia H100, had been manufactured on the 5nm node, and 2023 noticed the manufacturing of the primary 3nm chips.

However the first 2nm chips might be made in 2025, which is the node by which each Samsung and Intel hope to catch as much as foundry chief Taiwan Semiconductor Manufacturing in modern logic chips. That intense competitors for the 2nm node means all of those corporations might be shopping for numerous ASML’s machines to make these goals a actuality.

And the story would not finish there, as all main dynamic random entry reminiscence (DRAM) producers can even start utilizing EUV to make DRAM chips going ahead. Whereas Samsung started utilizing EUV two years in the past, 2025 can even see Micron start to make use of EUV for the primary time in its reminiscence manufacturing because the final reminiscence holdout to make use of the advanced course of.

Generative AI will rely closely on modern processors and high-bandwidth reminiscence, so search for ASML to maybe outperform its friends in 2024 after lagging in 2023.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Anders Bylund has positions in Intel, Worldwide Enterprise Machines, Micron Expertise, and Nvidia. Billy Duberstein has positions in ASML, Micron Expertise, and Taiwan Semiconductor Manufacturing. Nicholas Rossolillo has positions in ASML, Micron Expertise, and Nvidia. The Motley Idiot has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and Worldwide Enterprise Machines and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

3 Great AI Stocks to Own in 2024 was initially printed by The Motley Idiot