Berkshire Hathaway is likely one of the world’s premier funding conglomerates. Via strategic investments, subsidiary companies working in insurance coverage and logistics, and a disciplined enterprise method, it has grown to a virtually $800 billion firm.

Led by Warren Buffett and his workforce, Berkshire Hathaway and its investments have influenced numerous traders globally. Nonetheless, copying Berkshire’s portfolio, inventory for inventory, will not be the best choice as a result of your targets and threat tolerance could not fully align with it.

Nonetheless, for traders on the lookout for Berkshire Hathaway shares to load up on now, listed below are three which can be nicely value contemplating.

1. Coca-Cola

Coca-Cola (NYSE: KO) has been a staple in Berkshire Hathaway’s portfolio since its first funding in 1988. Since then, Berkshire Hathaway has gathered 400 million Coca-Cola shares, representing round 9% of the corporate’s shares.

Within the U.S., Coca-Cola had a 46% market share within the carbonated delicate drink market on the finish of 2022, far outpacing its largest competitor, PepsiCo. No matter Coca-Cola’s market dominance over the many years, I respect the way it has but to get complacent and continues prioritizing innovation and adapting to shoppers’ ever-changing preferences. A testomony to this has been Coca-Cola’s Transformational Innovation Staff, whose sole objective is driving product growth and exploring new market traits.

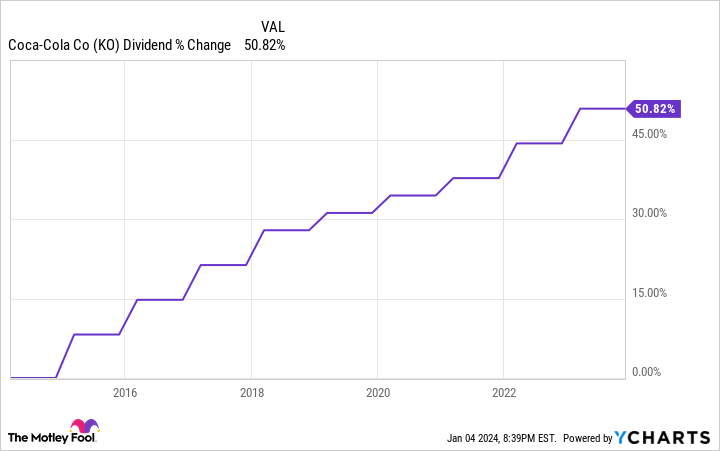

Coca-Cola’s inventory value has underperformed towards the S&P 500 over the previous decade, however its dividend is what usually attracts traders. Coca-Cola’s quarterly dividend is $0.46, with a trailing 12-month yield of round 3%. Arguably extra spectacular is that it has elevated its yearly dividend for 61 consecutive years, giving it the esteemed title of Dividend King. Previously 10 years alone, Coca-Cola’s quarterly dividend has elevated by over 50%.

Coca-Cola is not a progress inventory that’ll constantly return double-digit percentages yr in and yr out, however it will possibly present traders with as dependable a dividend as you will discover on the inventory market.

2. Visa

Visa (NYSE: V) is the worldwide chief in digital funds, with an unlimited, consistently increasing attain. It operates in over 200 international locations, has over $4.3 billion playing cards in circulation, and is accepted by over 130 million service provider areas.

Visa’s attain is its key aggressive benefit, principally due to the community impact. Think about you are a retailer and have to decide on which playing cards you will settle for. Chances are high excessive that you will go along with Visa since you perceive your prospects will possible have a Visa card over different choices. Not accepting Visa playing cards might imply lacking out on gross sales. The identical applies to shoppers trying to get a card. Many favor a Visa card as a result of companies that settle for playing cards are very prone to settle for Visa.

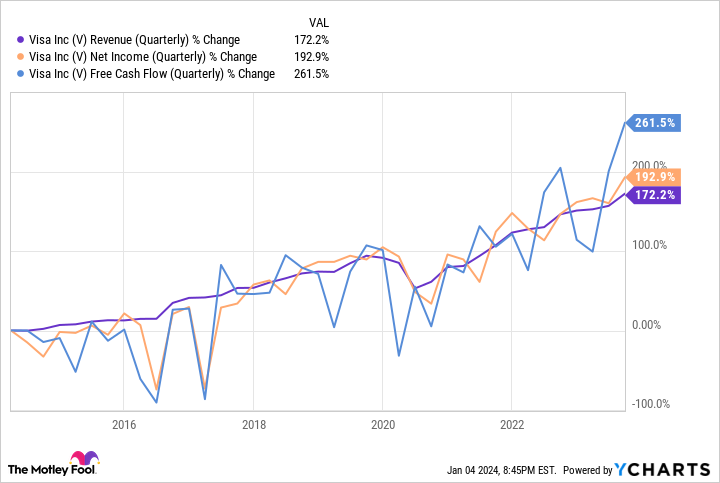

Visa’s latest progress has translated nicely to its financials as nicely. Over the previous decade, its income is up 172%, however its web revenue and free money circulation have grown sooner, signaling the corporate is working extra effectively.

The U.S. could also be a pacesetter in digital funds, however a lot of the world nonetheless operates in a money economic system. That offers Visa loads of market alternative as international locations transition towards digital and digital funds. It is a inventory I really feel comfy holding onto for the lengthy haul.

3. Amazon

Amazon (NASDAQ: AMZN) is not an organization that wants a lot of an introduction. Its e-commerce enterprise has made it a family identify across the globe. Nonetheless, it possible will not be Amazon’s e-commerce enterprise that drives quite a lot of its progress within the foreseeable future — it might be the logistics community that powers it.

Amazon lately introduced “Provide Chain by Amazon,” a completely automated set of provide chain companies. The service permits sellers to reap the benefits of Amazon’s complicated logistics, warehousing, distribution, achievement capabilities, and transportation (together with worldwide).

Amazon has spent billions constructing out its logistics community, and Provide Chain by Amazon permits the corporate to capitalize from it exterior of its core e-commerce enterprise.

E-commerce will proceed to be Amazon’s most important income driver, and Amazon Net Providers will probably be its most important revenue generator, however it’s encouraging to see different segments starting to drag their very own weight somewhat extra. Within the third quarter of 2023, Amazon’s third-party vendor companies income grew 20% yr over yr (YOY). Promoting led the best way, rising 26%.

Amazon has its arms in lots of high-growth industries, so there needs to be loads of worth to be returned to shareholders as the corporate continues to broaden throughout industries.

Must you make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Berkshire Hathaway wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Stefon Walters has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Berkshire Hathaway, and Visa. The Motley Idiot recommends the next choices: lengthy January 2024 $47.50 calls on Coca-Cola. The Motley Idiot has a disclosure policy.

3 Berkshire Hathaway Stocks to Buy Hand Over Fist in January was initially revealed by The Motley Idiot