With how widespread synthetic intelligence (AI) is changing into, each investor wants some publicity to the development. This does not essentially imply shopping for the latest or hottest AI firm on the block, since a number of mature corporations are large gamers on this house.

Whereas none of those corporations will make you a millionaire on their very own (except you make investments an enormous lump sum into one in every of them), they’re prone to speed up your path to changing into a millionaire by beating the market by just a few share factors annually.

So, if you wish to add some AI publicity, have a look at these three shares.

1. UiPath

One of many extra widespread tech investing companies is Cathie Wooden’s Ark Make investments. It may need missed some investments, nevertheless it has nailed it on others.

UiPath (NYSE: PATH) is likely one of the picks they obtained proper, and with the inventory making up practically 6% of Ark’s complete holdings (its third-largest place total), it has been an ideal choose.

UiPath makes a speciality of robotic course of automation (RPA) — software program that enables customers to automate repetitive duties. Whereas this know-how is not AI in its personal proper, the corporate incorporates AI to make its platform extra versatile by mining info from communications or different processes. It even has an AI product that screens duties to pinpoint what different processes will be automated.

This software program could be very widespread, and UiPath’s annual recurring income (ARR) rose 24% to $1.38 billion within the third quarter of fiscal 2024 (ending Oct. 31).

And it ought to solely get a lot greater. Polaris Market Analysis set the worldwide RPA alternative at $2.7 billion in 2022 and projected it to rise to $66.1 billion by 2032. UiPath is poised to seize that vital market growth.

However this doesn’t suggest the inventory comes at a steep worth. It may be purchased for simply 11 instances gross sales, far cheaper than many AI software program corporations.

For those who’re in search of an AI firm with loads of development potential that may be bought at an inexpensive worth, UiPath is your inventory.

2. Adobe

Adobe (NASDAQ: ADBE) is far more mature, however that does not cease it from innovating. It’s identified for its artistic design suite and e-commerce instruments, nevertheless it’s additionally beginning to get into generative AI.

Its most notable product is Adobe Firefly, which generates AI photos with a easy textual content enter. This permits fast picture modification, which might tailor an advert to a particular goal or hold a web site contemporary.

Income within the fourth quarter of fiscal 2023 (ending Dec. 1) grew 12% 12 months over 12 months to $5.1 billion, and earnings per share rose 29% because of share buybacks.

It is not the most affordable inventory round, buying and selling for 34 instances ahead earnings, nevertheless it’s a confirmed firm that has delivered market-beating returns 12 months after 12 months.

I really feel snug including Adobe to my portfolio as an AI inventory that does not essentially want AI to work as an funding.

3. Meta Platforms

Meta Platforms (NASDAQ: META), previously Fb, has been attempting to diversify its income stream from simply promoting (the first type of income from its social media websites Fb, Instagram, Messenger, WhatsApp, and Threads).

This led it to enterprise into the metaverse. This hasn’t labored out but, however a few of its AI ideas might.

Meta is a frontrunner in utilizing AI to seamlessly translate languages, permitting anybody to grasp what somebody anyplace on the planet is saying.

It is also engaged on a mixed-reality product that will permit AI to assist practice individuals to do new duties. Some examples Meta offers are studying how you can cook dinner, play tennis, or create pottery. An software like this could have widespread makes use of and may very well be the holy grail the corporate sought in its Actuality Labs division.

However Meta continues to be simply an promoting firm. Luckily, this trade is seeking to get better all through 2024, and the third quarter was already an indication of that. Income rose 23% 12 months over 12 months, powering earnings-per-share development of 168% to $4.39.

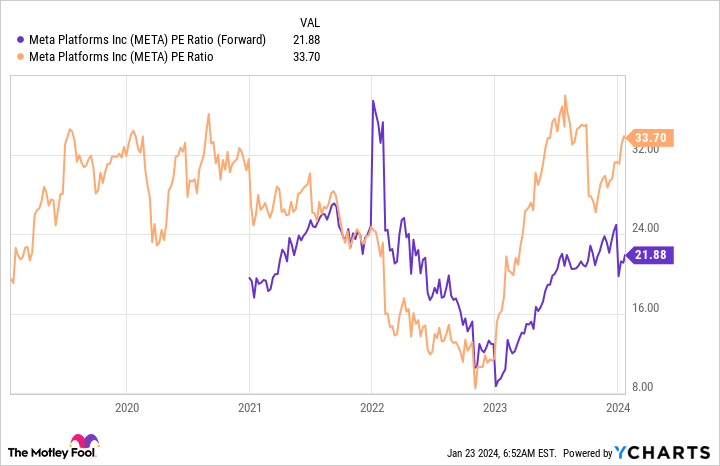

The inventory would possibly look considerably costly from a trailing price-to-earnings (P/E) foundation, however its ahead P/E is kind of low-cost.

A ahead P/E of twenty-two is a good worth for an organization with the upside of Meta, and like UiPath and Adobe, it would not want its AI technologies to work out to be a great investment.

Do you have to make investments $1,000 in UiPath proper now?

Before you purchase inventory in UiPath, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and UiPath wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Adobe, Meta Platforms, and UiPath. The Motley Idiot has positions in and recommends Adobe, Meta Platforms, and UiPath. The Motley Idiot has a disclosure policy.

Millionaire Makers: 3 Artificial Intelligence (AI) Stocks to Transform Your Portfolio was initially revealed by The Motley Idiot