The synthetic intelligence (AI) market exploded in 2023 and exhibits no indicators of slowing. The debut of ChatGPT reignited curiosity within the sector and compelled many to rethink what they thought was at the moment doable with the know-how. In consequence, numerous firms pivoted their companies to growing the business.

Knowledge from Grand View Analysis exhibits the AI market is projected to increase at a compound annual development fee of 37% by way of 2030. That may see it hit annual gross sales exceeding $1 trillion earlier than the last decade’s finish. That makes now a good time to speculate on this quickly increasing business and doubtlessly revenue from its promising outlook.

Listed here are three AI shares you would possibly wish to contemplate shopping for hand over fist in January.

1. Superior Micro Gadgets

Superior Micro Gadgets (NASDAQ: AMD) has an thrilling 12 months forward, with plans to strengthen its function in AI by launching a brand new chip. The corporate will start transport its MI300X graphics processing unit (GPU) in 2024, designed particularly to problem Nvidia‘s dominance.

Nvidia soared to the highest of the market in 2023, getting a headstart because it snapped up an estimated 90% market share in AI chips. Its success within the business highlighted how far chipmakers like AMD are behind on the subject of AI.

Nonetheless, AMD spent the final 12 months refining its AI know-how and it is hoping to make an enormous splash within the sector this 12 months. As the price of AI chips rises, the business is determined for elevated competitors and options to Nvidia. Consequently, AMD’s MI300X has assist from corporations throughout tech, with Microsoft‘s Azure asserting in December that it’ll change into the primary cloud platform to make use of the brand new GPU to optimize its AI choices.

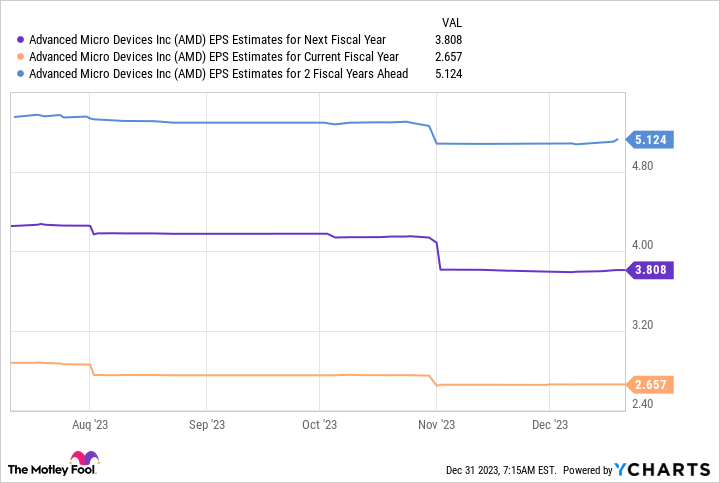

The chart above exhibits AMD’s earnings might hit $5 per share by fiscal 2025. When that determine is multiplied by the corporate’s forward price-to-earnings ratio of 55, it provides a inventory value of $275, suggesting development of 87% over the subsequent two fiscal years.

AMD is on a promising development trajectory and may very well be one of many smartest investments this month.

2. Intel

Like AMD, Intel (NASDAQ: INTC) is tough at work designing a brand new AI chip to tackle Nvidia in 2024. In December the corporate unveiled a number of new additions to its product lineup, together with the Gaudi3, which is launching this 12 months and is able to powering demanding AI fashions.

Intel has reworked itself over the previous couple of years. A protracted historical past of dominance in central processing models (CPUs) noticed it develop complacent, leaving it weak to competitors. Its CPU market share fell from 82% to 61% between 2017 and 2023 as AMD strengthened its place within the business. Then in 2020, Apple ended its partnership with Intel in favor of in-house {hardware}, taking a major chunk out of the chipmaker’s earnings.

Nonetheless, as a substitute of falling by the wayside, the hurdles appeared to mild a hearth below Intel once more. The corporate unveiled its first shopper GPUs in October 2022, venturing into a brand new market that may see it go head-to-head with Nvidia and AMD. The transfer was a wise one within the run-up to the growth in AI, as GPU know-how is essential to its success within the business over the long run.

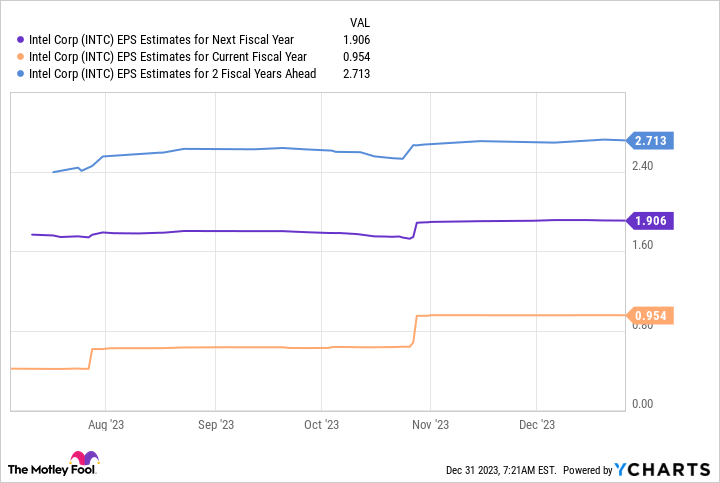

Intel’s huge development potential is clear in its EPS estimates. This chart exhibits its earnings are projected to succeed in practically $3 per share over the subsequent two fiscal years. In an analogous calculation to AMD, multiplying the determine by Intel’s ahead P/E of 53 yields a inventory value of $140. If the estimates maintain, the corporate’s shares would ship development of 180% by fiscal 2025.

In consequence, Intel is totally an AI inventory price shopping for hand over fist this January.

3. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) loved a glowing 2023. Its digital advert enterprise made a powerful turnaround from the earlier 12 months, with income rising 11% 12 months over 12 months in its newest quarter (the third quarter of 2023) because it beat analysts’ expectations by $980 million.

In the meantime, the tech big has thrilling prospects in AI. Alphabet’s extremely anticipated massive language mannequin Gemini debuted in early December, and is able to crunching varied types of information with extra subtle reasoning than any of the corporate’s earlier know-how.

Gemini and Alphabet’s potent platforms, like Google Search and Android, might show a strong mixture, presenting numerous methods for the corporate to increase in AI. Alongside free money movement that rose 29% during the last 12 months to $77 billion, Alphabet has the monetary assets and model loyalty to go far within the business.

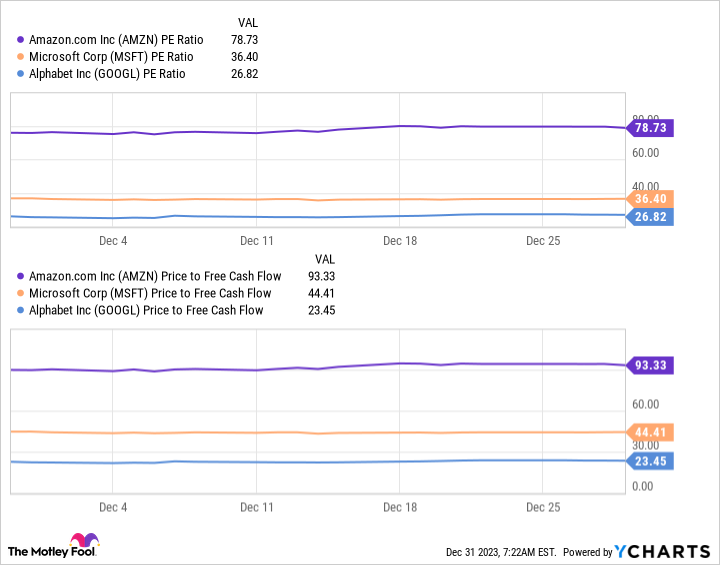

Alphabet’s greatest opponents in AI are cloud giants Amazon and Microsoft. Nonetheless, Gemini and Alphabet’s huge person base suggests the corporate has equal, if no more, earnings potential in AI. In the meantime, this chart exhibits Alphabet’s P/E and price-to-free money movement are considerably decrease than these of its rivals, making its inventory a discount in comparison with Amazon and Microsoft.

Alphabet probably has a shiny future in AI and is a no brainer funding this month.

Must you make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Superior Micro Gadgets wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

3 Artificial Intelligence (AI) Stocks to Buy Hand Over Fist in January was initially revealed by The Motley Idiot