The so-called “Magnificent Seven” shares have been the celebs of 2023. Collectively, they account for nearly two-thirds of the S&P 500‘s complete return during the last 12 months.

However, the true query is, will the “Magnificent Seven” — Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla — lead the market once more in 2024? Or may different shares prepared the ground within the new 12 months?

I believe the latter is extra probably. Listed here are the shares — which I might name the “Fab 4” — I’ve my eye on:

Visa

Topping this record is Visa (NYSE: V).

Let me be clear: Visa isn’t probably the most thrilling inventory round. The corporate has been round for many years; it isn’t within the headlines each day. Its enterprise mannequin is straightforward, bordering on boring.

However oh boy, has that enterprise mannequin delivered.

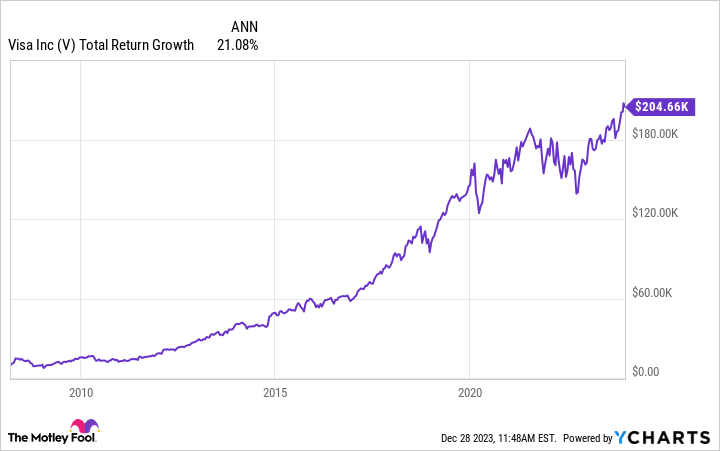

Over the 15 years since its preliminary public providing (IPO) in 2008, Visa shares have recorded a compound annual progress fee (CAGR) of 21%. Which means $10,000 invested in Visa shares at its IPO would now be value over $204,000.

Behind that monster efficiency is a lovely enterprise mannequin — charging charges in change for facilitating funds on Visa’s gigantic funds community. For fiscal 12 months 2023 (the 12 months ending on Sept. 30), Visa processed 212 billion transactions, with a complete fee quantity of over $12 trillion. From that, the corporate generated $32.7 billion in income and $17.3 billion in internet revenue.

What’s extra, the corporate then rewarded shareholders with $16.1 billion in share repurchases and dividend funds. That is a recipe each investor ought to love, and I believe it’s going to proceed to repay for Visa and its shareholders in 2024.

CrowdStrike Holdings

The smallest firm by market cap on my record, CrowdStrike (NASDAQ: CRWD), is nonetheless a inventory that each investor ought to know. That is as a result of the corporate is likely one of the main cybersecurity providers round.

CrowdStrike offers AI-enabled safety modules that shield its shoppers’ networks, knowledge, and endpoints. This has change into all of the extra necessary in the present day because the variety of cyberattacks has skyrocketed.

Certainly, in 2023 alone, organizations starting from hospitals and colleges to casinos and retailers have all been hacked. In some circumstances, hackers demanded ransoms to return delicate knowledge or to reactivate crucial operations.

This huge enhance in cybercrime signifies that demand for CrowdStrike’s merchandise is bursting on the seams.

As of its most up-to-date quarter (the three months ending Oct. 31), the corporate reported income progress of 35%. Furthermore, CrowdStrike’s subscription-based mannequin is engaging and scalable. Over the past 9 months, 94% of the corporate’s income has come from subscriptions. As well as, 63% of CrowdStrike’s prospects use 5 or extra of the corporate’s safety modules.

Due to its red-hot progress and scalable know-how, I believe CrowdStrike is a reputation to look at in 2024.

Shopify

Subsequent up is Shopify (NYSE: SHOP). The corporate, which operates one of many world’s fastest-growing e-commerce platforms, is poised for an enormous 2024.

Like many high-octane progress shares, Shopify shares suffered a setback in 2022, as rates of interest screamed increased and the inventory market slumped.

Nonetheless, that momentary setback lit a hearth. Administration has lower prices in every of the final two years, beginning with workers reductions of 10% in 2022 and 20% in 2023.

Because of this, Shopify’s free money move has rebounded. It stands at $548 million as of the corporate’s most up-to-date third quarter.

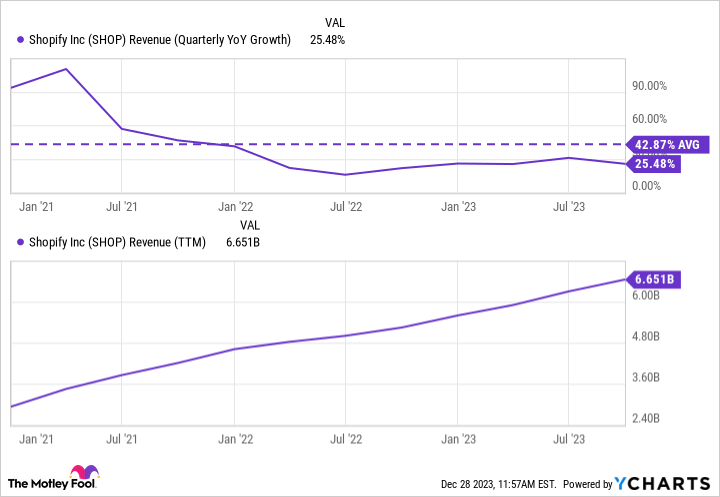

But regardless of the associated fee reductions, Shopify remains to be rising. Income progress has averaged 43% during the last three years, as complete income has surged from $2.9 billion in 2020 to $6.7 billion in the present day.

Extra to the purpose, Shopify is turning into the go-to e-commerce platform for influencers and up-and-coming manufacturers. For instance, Shopify has partnered with Crate & Barrel, Allbirds, and Blendjet to construct on-line storefronts, enhance conversion charges, and supercharge gross sales.

As we enter 2024, Shopify has all of the hallmarks of a inventory on the rise.

Nvidia

Lastly, Nvidia (NASDAQ: NVDA) rounds out the Fabulous 4.

Granted, Nvidia is a widely known member of the Magnificent Seven. Nonetheless, I view Nvidia as a lower above the remaining. That is as a result of Nvidia is using an unprecedented tidal wave of demand.

Merely put, the AI revolution is altering the way in which enterprise is completed. Contemplate these examples:

-

Amazon now has over 750,000 robots working in its huge achievement warehouses.

-

Generative AI instruments like OpenAI’s ChatGPT, Adobe‘s Firefly, and Alphabet’s AlphaCode are reshaping textual content, picture, and supply code composition.

-

AI studying instruments, like these utilized by Duolingo, are reshaping how college students be taught.

To place it one other method, AI is taking up. Not in Terminator-like trend, extra like the way in which the web began reshaping the world 30 years in the past. Organizations are actually speeding to scale up their AI instruments to remain forward of — or no less than even with — the competitors.

Because of this, demand for Nvidia’s prime AI chips is thru the roof. Equally, Nvidia’s income and earnings are skyrocketing, and analysts are scrambling to lift subsequent 12 months’s estimates. Over the past 90 days, the consensus estimate for Nvidia’s 2025 earnings per share (EPS) has jumped from $16.71 to $20.50 — a rise of 23%.

In abstract, 2024 may very well be one other stellar 12 months for Nvidia, maybe much more so than 2023.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Adobe, Alphabet, Amazon, CrowdStrike, Duolingo, Nvidia, Tesla, and Visa. The Motley Idiot has positions in and recommends Adobe, Alphabet, Amazon, Apple, CrowdStrike, Duolingo, Meta Platforms, Microsoft, Nvidia, Shopify, Tesla, and Visa. The Motley Idiot recommends the next choices: lengthy January 2024 $420 calls on Adobe and quick January 2024 $430 calls on Adobe. The Motley Idiot has a disclosure policy.

Forget the “Magnificent Seven”: 2024 Will Be All About the “Fab Four”. Learn About Them Here. was initially printed by The Motley Idiot