There have by no means been extra millionaires than at present. Certainly, Statista estimates that as of December 2023, there have been 22.7 million millionaires in america, roughly 9% of the American inhabitants.

One massive purpose why: The present bull market, and, specifically, the artificial intelligence (AI) shares which can be powering it larger. So, let’s check out two millionaire-maker AI shares that also have loads of room to run. These shares might not be low-cost at present, however they might be price each premium penny in the long term.

1. Microsoft

First up is Microsoft (NASDAQ: MSFT). There are numerous explanation why the world’s largest firm has made, and can proceed to make, numerous millionaires, however I need to cowl one particularly: Microsoft is poised to develop its usually underappreciated search and information promoting enterprise.

In its most up-to-date quarter (the three months ending on Dec. 31), Microsoft’s search and information ad segment generated $3.2 billion in income. That is a tidy sum, just like the income Roku generated during the last 12 months ($3.4 billion).

Nonetheless, for Microsoft, the $3.2 billion it generates from promoting is however a drop within the bucket. The corporate makes about $62 billion in quarterly income. So to some traders, its digital advert section income is usually an afterthought — significantly when in comparison with the true digital advert giants like Alphabet and Meta Platforms.

Nonetheless, because of its partnership with OpenAI, Microsoft would possibly be capable of pressure its means into the digital advert dialog. Current experiences recommend that OpenAI could also be engaged on a search engine designed to rival Alphabet’s flagship Google Search. Crucially, Microsoft was fast to undertake key ChatGPT options into its Bing search engine final 12 months, resulting in the likelihood that Microsoft would possibly as soon as once more rapidly undertake any future breakthroughs.

At any price, it’s clear Microsoft has room to develop in the case of the digital advert market. The general market is more likely to develop to $966 billion by 2028. If Microsoft can use AI improvements to enhance the recognition of its search and information merchandise, it might flip an unsung income stream into an enormous in its personal proper.

2. Nvidia

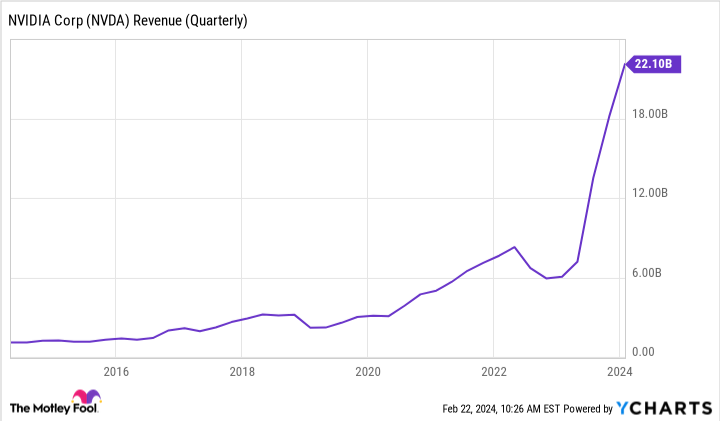

Subsequent is Nvidia (NASDAQ: NVDA), the undisputed AI king. Certainly, Nvidia has undergone nothing in need of an explosion in demand, each for its merchandise and its inventory, since AI took the limelight final 12 months. By way of market cap, Nvidia is now America’s third-largest firm, trailing solely Microsoft and Apple.

The corporate’s surging fortunes are partly because of its graphics processing models (GPUs), that are used to coach massive language fashions like ChatGPT. There’s, nevertheless, another excuse that is not mentioned as usually: Nvidia’s compute unified machine structure (CUDA) interface.

With out getting too technical, CUDA is a proprietary software program framework that helps builders faucet into the facility of GPUs for coaching AI fashions. In brief, it’s Nvidia’s secret weapon that makes its GPUs so fascinating for AI builders, and it helps clarify why Nvidia doubtless has round 90% share of the info heart GPU market.

Financially, CUDA provides Nvidia a powerful, strategic moat — making it troublesome for rivals like Superior Micro Gadgets or Intel to achieve market share. They depend on the OpenCL customary as a substitute, however this open-source system gives considerably slower efficiency than Nvidia’s proprietary language.

At any price, there isn’t any doubt that Nvidia is sort of a freight prepare cruising downhill — seemingly unstoppable. In its newest quarter (the three months ending Jan. 28), Nvidia reported $22.1 billion in income, up 265% from a 12 months earlier. Sure, you learn that accurately, Nvidia’s quarterly income nearly tripled from a 12 months in the past. Its information heart income elevated 409%, going from $4.5 billion to $18.4 billion.

In brief, Nvidia’s CUDA moat is driving monumental shareholder returns, and it stays an organization that would make extra millionaires for a while.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it will probably pay to hear. In spite of everything, the publication they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they imagine are the 10 best stocks for traders to purchase proper now… and Microsoft made the listing — however there are 9 different shares you could be overlooking.

*Inventory Advisor returns as of February 20, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, and Roku. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief February 2024 $47 calls on Intel, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 Millionaire-Maker Artificial Intelligence (AI) Stocks was initially printed by The Motley Idiot