The returns of the “Magnificent Seven” shares have trounced the returns of the growth-centric Nasdaq Composite index over the past 12 months, and so they proceed to take action in 2024. 12 months up to now, the group has returned 12.4%, nearly doubling the Nasdaq’s returns, based mostly on the efficiency of the Roundhill Magnificent Seven ETF.

Amongst this elite group of tech shares, Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN) are displaying stable enterprise progress and nonetheless provide upside from their current highs. This is why these two Magnificent Seven stocks stay stable picks proper now.

Nvidia

Nvidia has been top-of-the-line shares to experience the expansion in synthetic intelligence (AI), as its share value soared by 239% over the past 12 months. The excellent news for buyers late to the occasion is that its skyrocketing progress might have some time to play out. The inventory stays attractively valued relative to its underlying enterprise progress, and it is nonetheless top-of-the-line AI shares to purchase for a number of causes.

One approach for getting a learn on end-market demand for a corporation’s merchandise is to take a look at what different corporations with adjoining companies are reporting. Tremendous Micro Laptop makes plug-and-play rack methods for information facilities, which embody Nvidia’s GPUs.

Supermicro reported that its income grew 103% 12 months over 12 months in the latest quarter as demand grew for AI rack options based mostly on Nvidia’s H100 chip. This was a large acceleration over Supermicro’s earlier quarter and suggests demand for Nvidia’s chips shouldn’t be slowing down.

Analysts are elevating their annual income estimates for Nvidia for the subsequent few years, although progress expectations had been already sky-high for the GPU chief. The inventory’s modest valuation nonetheless makes Nvidia a sexy inventory to purchase. It at present trades at 35 instances subsequent 12 months’s consensus earnings estimate, which seems to be cheap given Nvidia’s sturdy progress.

There’s $1 trillion value of knowledge heart infrastructure to gas Nvidia’s progress for a very long time.

The emergence of AI is forcing extra corporations to undertake accelerated computing and put money into GPUs, which is why Nvidia is seeing such large progress. It generates $32 billion in trailing income from its information heart section, and given its estimated 80% market share within the AI chip market, it’s effectively positioned to ship extra progress and returns for buyers.

Amazon

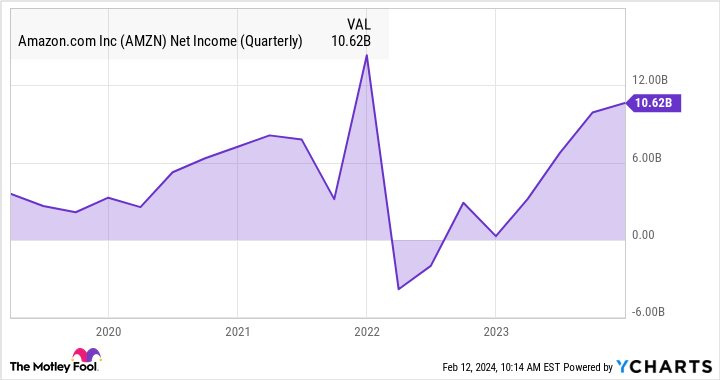

Amazon is an extremely robust enterprise that has a number of income streams to drive returns for shareholders, together with cloud providers, promoting, and on-line retail gross sales. Whereas its cloud unit, Amazon Net Companies, will get a lot of the consideration on Wall Road, it is the corporate’s bettering progress in e-commerce that’s driving the inventory increased.

Some may argue that AI expertise may make it simpler for shoppers to go looking the net and discover the merchandise they need at different retailers, which may damage Amazon in the long term. Nevertheless, this underestimates the human tendency to stay with trusted manufacturers. It additionally overlooks the investments Amazon is making in AI and infrastructure to enhance its retail service.

Amazon is within the technique of boosting its supply pace, which is able to make it harder for rivals to catch up. It mentioned it achieved the quickest supply speeds in its historical past in 2023, with over 7 billion items arriving the identical or subsequent day.

One advantage of quicker supply is extra frequent procuring conduct. Amazon’s on-line gross sales progress accelerated each quarter final 12 months, however the firm’s earnings are additionally up due to value cuts and improved stock effectivity.

AI will solely make Amazon’s model stronger. Many shoppers go to Amazon.com nearly by default as an alternative of trying to find merchandise on Google, and Amazon is about to push its worth proposition additional with the launch of Rufus, a brand new procuring assistant powered by generative AI.

Amazon’s bettering transport pace and alternatives to reinforce the procuring expertise with new AI instruments will shield its aggressive moat. In the meantime, the inventory nonetheless trades at a good valuation of about 3.1 instances trailing income, which is inside its 10-year buying and selling vary. Which means that as the corporate’s e-commerce enterprise recovers, the inventory may ship market-beating features over the subsequent few years.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. John Ballard has positions in Nvidia. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot recommends Tremendous Micro Laptop. The Motley Idiot has a disclosure policy.

2 Best “Magnificent Seven” Stocks to Buy in February was initially printed by The Motley Idiot