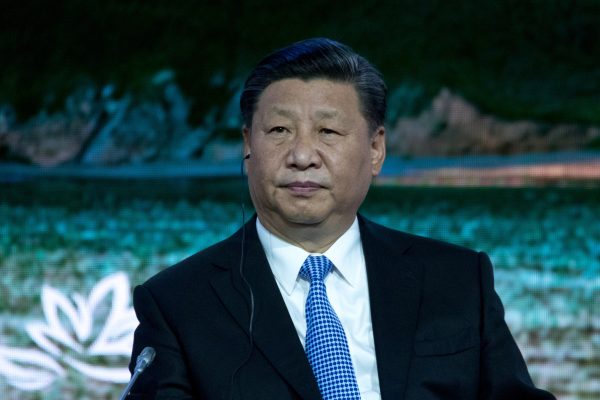

In a bid to deal with the nation’s financial challenges, prime chief Xi Jinping not too long ago met with China’s non-public sector giants. He tried to downplay the problems, stressing that “some difficulties and challenges going through the present non-public financial improvement typically seem within the technique of reform and improvement and industrial transformation and upgrading.” Based on Xi, these issues are “partial slightly than complete, short-term slightly than long run, and will be overcome slightly than being insurmountable.”

China, the world’s second-largest financial system in nominal phrases and the biggest financial system in buying energy parity (PPP), is at the moment grappling with a collection of challenges. These struggles end result from coverage modifications initiated in late 2019 to restructure the financial system. Regardless of its rise to international prominence, China’s financial progress charge peaked in 2007; latest years have seen a noticeable decline in its financial efficiency. In 2024, China’s financial progress projections had been modest, with the International Monetary Fund (IMF) forecasting a progress charge of simply 3.3 p.c by 2029.

Some of the regarding indicators of China’s financial well being is the decline in non-public funding. Based on stories, China’s private investment decreased by 0.1 p.c year-on-year in 2024. This discount is notable because it displays a drop within the proportion of personal funding in whole mounted asset funding, which fell from 56.42 p.c in 2019 to 50.08 p.c on the finish of 2024. This marks a major shift in China’s financial construction dynamics, the place non-public enterprises have lengthy been essential drivers of financial progress.

Xi and the Entrepreneurs

The private sector contributes 60 p.c of China’s GDP, 70 p.c of innovation, 80 p.c of city employment, and 90 p.c of recent jobs. It additionally accounts for 70 p.c of funding and 90 p.c of exports. Nonetheless, because of the coverage shift in the course of the late 2010s, the Chinese language non-public sector, particularly the property sector, is going through extreme challenges. The tech sector has additionally confronted regulatory challenges since Xi took the initiative to overtake the trade.

Amid these challenges, Xi has taken proactive steps to have interaction the company sector. On February 17, he attended a high-level symposium bringing collectively a few of China’s most distinguished enterprise leaders. This assembly aimed to formulate methods to handle the financial stagnation China has skilled lately.

The gathering was attended by senior figures similar to Premier Li Qiang, Wang Hunning, head of the Chinese language Folks’s Political Consultative Convention (CPPCC), and Vice Premier Ding Xuexiang. Key company leaders like Lei Jun (founding father of Xiaomi), Pony Ma Huateng (founding father of Tencent), Jack Ma (founding father of Alibaba Group), and Ren Zhengfei (founding father of Huawei Applied sciences) had been additionally current. In one other signal of its significance, the assembly was additionally highlighted by China’s state media. CCTV broadcast a 40-second video displaying the proceedings.

Equally, earlier than the Third Plenary Session of the twentieth Get together Congress in Could 2024, Xi had convened one other symposium with entrepreneurs and economists in Shandong Province. The involvement of those enterprise leaders underscores the significance of public-private partnerships in tackling the financial points China faces. As China’s non-public sector has lengthy been thought of a key engine of progress, authorities collaboration with influential company figures could possibly be essential in serving to the nation climate its financial difficulties.

Home Challenges in China

China faces numerous inner challenges which can be exacerbating its financial slowdown. Some of the urgent points is the nation’s demographic traits. Marriages in China have fallen dramatically, with a 20 p.c drop recorded in 2024 in comparison with the earlier 12 months. From 7.7 million marriages in 2023, the quantity plummeted to only 6.1 million in 2024, lower than half the quantity seen in 2013. This marks a historic low in marriage charges in China since record-keeping started in 1986.

The demographic shift is additional compounded by a rising divorce charge, with 2.6 million {couples} submitting for divorce in 2024, a 1.1 p.c enhance from 2023. This demographic decline shouldn’t be solely a results of altering cultural attitudes towards marriage but in addition a mirrored image of broader societal pressures.

Amid a slowing marriage and birthrate, China’s inhabitants is growing older quickly. The share of individuals aged 60 and above has risen steadily over the previous 20 years, from 11 p.c in 2004 to an estimated 21 p.c in 2024. The growing older inhabitants presents challenges for the labor market, social welfare programs, and the financial system’s general productiveness.

Alongside these demographic points, China is going through a growing national debt burden. In 2004 authorities debt accounted for simply 26 p.c of China’s GDP. By 2014, this had risen to 40 p.c, and in 2024, authorities debt had reached a staggering 84 p.c of GDP. The rising debt ranges add one other layer of complexity to China’s financial state of affairs, because the nation faces stress to steadiness its fiscal insurance policies with the necessity to keep financial progress.

Youth unemployment can also be a severe concern. The unemployment rate amongst younger individuals in China has steadily elevated, reaching 15 p.c in 2024. This starkly contrasts the 9 p.c youth unemployment charge in 2004 and the 11 p.c charge in 2014. The dearth of job alternatives for younger individuals shouldn’t be solely an financial problem but in addition a social one, contributing to social unrest and discontent.

Moreover, China is experiencing a sharp decline in foreign direct investment (FDI). In 2024, China’s FDI ranges dropped to ranges final seen in 1993. This decline is alarming, as China has lengthy relied on FDI to gas its industrial progress and international integration.

The housing sector, as soon as a serious driver of financial progress in China, has additionally confronted vital difficulties lately. Since 2020, the Chinese language authorities’s “Three Red Lines” policy and a crackdown on property builders have severely impacted the true property market. Earlier than the crackdown, China’s property sector was valued at about $15 trillion.

The stricter laws have led to a lack of roughly $18 trillion in family wealth. Property costs dropped by as a lot as 30 p.c from their peak in 2021, and the housing sector’s contribution to GDP has decreased from 24 p.c to 21 p.c. This contraction in the true property sector has had ripple results throughout the financial system, lowering shopper confidence and slowing general progress.

On the worldwide entrance, exterior pressures have additional strained China’s financial state of affairs. In October 2024, the EU introduced tariffs as excessive as 45 p.c on China’s electrical autos (EVs), citing issues over subsidies and overcapacity. This transfer has added to China’s financial troubles, notably because it seeks to increase its EV market.

China’s financial challenges are complicated and multi-faceted, together with demographic challenges, rising debt ranges, youth unemployment, and a declining actual property sector. Whereas the Chinese language authorities is working laborious to handle these points, the street forward stays arduous. The nation should navigate complicated home challenges whereas responding to growing exterior pressures. The financial slowdown isn’t just a short lived setback however an indication of deeper structural points that will take years to resolve. As China strikes ahead with its restructuring insurance policies, the world can be watching carefully to see the way it manages these obstacles and whether or not it may well obtain sustainable financial progress as soon as once more.