China Energy | Financial system | East Asia

China’s home financial realities are colliding with Xi’s geopolitical ambitions and impacting Beijing’s Russia coverage.

The Chinese language financial system is in bother. Weak funding and client spending – what some have termed a “basic erosion of public religion” – is compounding different, structural issues within the Chinese language financial system. A China-led international slowdown or recession could hit commodity exporters, together with Russia, comparatively onerous whereas leaving different, much less China-dependent economies comparatively unscathed.

China’s financial stumbles might also have important geopolitical penalties, as governments of all kinds are inclined to cut back international coverage ambitions amid financial difficulties. Concretely, China’s financial weak spot could incentivize Beijing to play a extra lively position in pressuring Russia to enter negotiations over the conflict. Nonetheless, whereas Beijing could dial again its assist for Moscow’s conflict resulting from home financial concerns, China’s pro-Russia tilt will however persist.

The indicators of a pointy Chinese language financial slowdown are all over the place. Official information exhibits that client costs dropped 0.3 p.c final month, doubtlessly signaling China’s descent right into a Japan-style deflationary spiral. Imports and exports are slumping, and anecdotal however compelling proof suggests Chinese language customers have fallen right into a “psycho-political funk” amid issues over black swan occasions like a future invasion of Taiwan or an actual property collapse.

These real-time indicators are of little shock to long-time observers of the Chinese language financial system. Some analysts have been warning for over a decade that China’s extreme reliance on debt would finally go away it with few good options, whereas latest gold-standard studies have warned that financial development of 1-3 p.c is achievable within the medium time period – however provided that China undertakes main structural reforms. China’s invoice for many years of financial mismanagement, together with historic misallocations of funding, surging debt hundreds, unfavorable demographics from Mao-era insurance policies, and repressed consumption, is coming due.

There are indicators that home financial difficulties are compelling Beijing to undertake a softer international coverage. China’s coverage towards Australia is commonly a number one indicator of its posture towards the West, and Beijing seems to be easing tariffs on Australian items as rapidly as politically possible. In early August, China rolled back tariffs on Australian barley that had been in place for 3 years; additional tariff reductions on different merchandise could also be forthcoming.

Washington has additionally detected a newfound curiosity in engagement from the Chinese language facet in latest months, probably triggered by Beijing’s home financial anxieties. Proof to assist this thesis contains China’s curiosity in holding sure financial and local weather government-to-government dialogues; conducting meetings with cabinet-level U.S. officers; resuming the journey of Chinese language government-affiliated suppose tanks to Washington; and lifting a ban on group vacationer journey to the U.S., U.Ok., and different key allies.

Beijing’s participation within the Jeddah peace negotiations over Ukraine suggests it additionally could also be contemplating modulating its coverage towards the Russian invasion of Ukraine. Russia was not invited to the talks, which had been attended by representatives from over 40 international locations, together with Ukraine, the USA, and different Western powers. The Chinese language and Russian international ministers spoke by phone quickly after the talks concluded, with newly (re)appointed Chinese language International Minister Wang Yi stressing China’s “impartial and neutral stance” on Ukraine. Whereas Beijing’s attendance at Jeddah was no less than partially motivated by a need to restore China’s picture in Europe, there was additionally an plain substance to this symbolic act. Whereas China’s participation at Jeddah isn’t dispositive proof of a shift in Russia coverage, it’s however necessary.

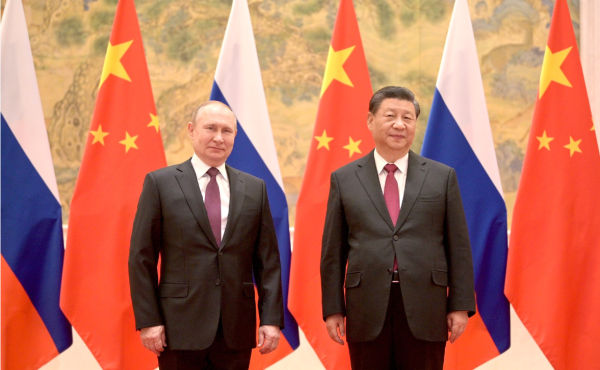

There are different indicators that Beijing is altering its strategy to Russia. There’s strong evidence that the Prigozhin mutiny spooked Beijing, which is now modifying tactical political engagement with the Russian political elite. Throughout Russian Federation Council Speaker Valentina Matviyenko’s latest go to to Beijing, Chinese language Communist Celebration Basic Secretary Xi Jinping framed Sino-Russian relations as a “strategic selection made by the 2 international locations primarily based on the basic pursuits of their respective international locations and peoples.” Xi’s novel characterization of the connection suggests Beijing seeks to institutionalize ties with Moscow and de-emphasize the Putin-Xi private relationship.

China’s slumping financial system is probably going curbing a lot of its international coverage ambitions and prompting a rethink of its coverage towards the Russian invasion of Ukraine. Nonetheless, a scientific transformation of Beijing’s perspective on Ukraine or different key international coverage issues is unlikely. Xi shares Moscow’s anti-Western hostility; demonstrates a really shaky grasp of economics, limiting his understanding of the scope of China’s home issues; and presides over a system that doesn’t make main self-corrections simply. Xi could dial again China’s pro-Russia neutrality, however solely reluctantly and partially.