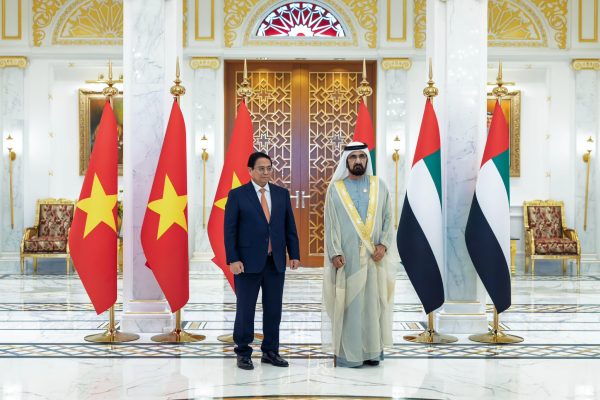

In a interval of shifting international dynamics, the signing of the great financial partnership settlement (CEPA) between Vietnam and the United Arab Emirates (UAE) on October 28, 2024, indicators each nations’ intent to deepen their partnerships past conventional alliances.

For Vietnam, the UAE represents a pathway to diversifying commerce companions and enhancing financial resilience by establishing ties with a area it has not historically engaged deeply. In the meantime, the UAE is eager to construct a strategic bridge into fast-growing Southeast Asian markets, aligning with its broader imaginative and prescient to strengthen its international commerce and logistics community. This settlement has great potential because it opens up a gateway for market entry not solely between each nations however the complete area. Nevertheless, to have the ability to obtain that, there are a lot of sensible challenges to beat.

UAE’s enterprise into the Southeast Asian market is a major step to develop its attain internationally. The Gulf state signed a CEPA with Indonesia in 2020, which subsequently attracted roughly $10 billion in Emirati investments in logistics and power. An settlement with Cambodia adopted swiftly after, coming into drive earlier this 12 months. This new settlement with Vietnam thus indicators a rising partnership between the Affiliation of Southeast Asian Nations (ASEAN) and the Gulf Cooperation Council (GCC), encouraging connectivity between these two areas.

With Vietnam, Cambodia and Indonesia formalizing financial ties with the UAE, the inspiration is rising for a broader ASEAN-GCC relationship that displays a shift towards South-South cooperation. Medium-sized nations like Vietnam and the UAE are forging mutually helpful partnerships, setting a precedent for related agreements that scale back dependency on main powers and foster a extra multipolar diplomatic panorama.

Though economically vital, the Vietnam-UAE relationship has to date been modest. The commerce quantity between the 2 nations is round $6 billion, far decrease than Vietnam’s commerce with conventional companions equivalent to South Korea ($100 billion) and Japan ($50 billion). The brand new settlement goals to unlock financial potential throughout two major pathways: increasing the commerce of Vietnamese items into the UAE and the broader GCC area, and inspiring UAE funding into Vietnam’s development sectors equivalent to infrastructure, renewable power, and expertise.

With the UAE’s small home market of 10 million, this settlement is much less about native consumption than about positioning the UAE as a re-export hub for Vietnamese items throughout the broader GCC. Key Vietnamese exports – together with agricultural merchandise, seafood, textiles, and client electronics – stand to profit from the UAE’s strategic place as a transit level to the GCC’s mixed inhabitants of 54 million. For example, seafood tariffs, beforehand starting from 5 p.c to fifteen p.c, are anticipated to scale back considerably, boosting competitiveness for Vietnamese exporters. Presently, Vietnamese agricultural merchandise account for round 4 p.c of the UAE’s agricultural imports, however with improved entry and decreased tariffs, this share may rise considerably, probably positioning Vietnam as a top-five provider to the UAE in agriculture.

Past commerce, the CEPA is meant to facilitate UAE funding in Vietnam’s infrastructure, expertise, and renewable power. In alignment with the UAE’s Imaginative and prescient 2030, which directs billions towards international direct funding (FDI) throughout Asia, the UAE’s dedication to joint ventures in ASEAN nations is clear, significantly in Indonesia, the place Emirati funding in infrastructure has already exceeded $3 billion. This collaborative mannequin can function a blueprint for related UAE initiatives in Vietnam, the place capital funding can additional strengthen Vietnam’s manufacturing and logistics sectors. Vietnamese infrastructure, power, and digital innovation maintain explicit curiosity for Emirati buyers looking for new alternatives for development.

Whereas this settlement opens vital new avenues for collaboration, each nations might want to handle sensible challenges to completely notice its potential. Vietnamese exporters face excessive delivery prices and sophisticated regulatory necessities within the UAE, the place branding and client recognition of Vietnamese merchandise are nonetheless comparatively low. Compliance with halal requirements, essential for entry to the UAE’s Muslim-majority market, may pose obstacles for smaller Vietnamese companies new to the sector.

For UAE buyers, Vietnam gives substantial long-term potential, however understanding and adapting to Vietnam’s regulatory panorama would require cautious navigation. Success will rely on coordinated efforts from each governments to facilitate enterprise trade and compliance help. Joint initiatives for customs simplification, regulatory coaching, and commerce schooling can assist overcome entry limitations, making certain that companies from each nations maximize the CEPA’s advantages.

The Vietnam-UAE partnership can result in great potential advantages for Vietnam, and on the identical time, it’s a step towards UAE’s strategic roadmap of development domestically and internationally. With present agreements with Indonesia and Cambodia, in addition to the scope of negotiations finalized with the Philippines, the UAE’s presence in ASEAN is about to develop additional.