Joe Biden’s US authorities faces its highest borrowing prices since earlier than the worldwide monetary disaster amid considerations that the Federal Reserve will maintain rates of interest larger for longer.

The yield on 10-year Treasuries rose to a 16-year excessive of 4.342pc amid current proof of a sturdy US financial system.

The coupon on 30-year US bonds hit its highest stage since April 2011, reaching 4.468pc. The yield on 10-year UK gilts has pushed 5 foundation factors larger as we speak to 4.71pc.

It comes as buyers keenly await feedback from Federal Reserve chairman Jerome Powell on Friday at a gathering of central bankers at Jackson Gap in Wyoming that begins on August 24. He might supply clues on the outlook for rates of interest.

Rick Meckler, associate at Cherry Lane Investments, mentioned: “I don’t suppose the market is searching for some assertion suggesting price rises are over.

“However buyers are searching for something that may flip the near-term destructive sentiment.”

Merchants have guess there may be an 89pc probability that the Fed will pause its rate of interest will increase in September, in response to the CME Group’s Fedwatch instrument.

Learn the newest updates under.

04:28 PM BST

Handing over

That’s your lot from me as we speak. The ever-dependable Adam Mawardi will take issues from right here.

Some say he’s value his weight in gold, though that may not be the best praise on as we speak’s costs:

04:22 PM BST

US authorities faces shutdown as row over spending deepens

The US authorities faces one other federal shutdown later this 12 months, Goldman Sachs has warned, with Republicans at loggerheads over “root canal” spending cuts.

A scarcity of consensus in Congress over annual spending payments will doubtless carry the American political system to a halt, the funding financial institution warned, resulting in successful of 0.2 share factors per week to the nation’s financial system.

It comes as members of the hardline Home Freedom Caucus are pushing to chop spending to the fiscal 2022 stage of $1.47trn (£1.16trn), which might be $120bn lower than President Joe Biden and Home Speaker Kevin McCarthy agreed to of their Could debt ceiling compromise which averted a doubtlessly disastrous default on US money owed.

With Republicans additionally searching for larger spending on defence, veterans advantages and border safety, analysts say the hardline goal would imply cuts of as much as 25pc in areas corresponding to agriculture, infrastructure, science, commerce, water and vitality, and healthcare.

Consultant Don Bacon, a centrist Republican from Nebraska, mentioned: “The reductions are so deep. They need to make the whole lot a root canal.”

Goldman’s chief US political economist Alec Phillips mentioned: “The federal authorities seems to be extra doubtless than to not briefly shut down later this 12 months.”

04:07 PM BST

US long-term Treasury yields highest in 12 years

The yield on 30-year US Treasury bonds has hit its highest stage since April 2011 amid considerations that rates of interest might stay larger for an extended time frame.

The coupon hit 4.468pc, and was final up 8.5 foundation factors to 4.464pc.

It comes as current proof of a sturdy US financial system stokes considerations the Federal Reserve might maintain charges larger for longer.

Traders at the moment are keenly ready for feedback from Federal Reserve chairman Jerome Powell on Friday at a gathering of central bankers at Jackson Gap in Wyoming that begins on August 24.

The yield on 30-year UK gilts has risen 4 foundation factors to 4.91pc.

03:56 PM BST

Bitcoin hunch deepens amid bond sell-off

Bitcoin added to losses racked up in the course of the digital token’s worst week since November final 12 months because the prospect of higher-for-longer borrowing prices sapped demand for riskier investments throughout international markets.

The most important digital asset fell 0.2pc towards £20,000, buying and selling close to a two-month low after shedding greater than 10pc final week. Smaller cash like Ether and XRP additionally slid.

Long term UK gilts and US Treasury yields are round multi-year highs as a part of a world bond selloff.

The surging yields come as merchants concern a chronic interval of excessive rates of interest to choke inflation. Such a backdrop would restrain liquidity and pose a problem for riskier property like shares and crypto.

High central bankers are attributable to meet in Jackson Gap this week for the Federal Reserve’s annual symposium. Fed Chair Jerome Powell’s feedback due on Friday shall be intently examined for clues in regards to the coverage outlook.

Tony Sycamore, a market analyst at IG Australia, mentioned: “The market doubtlessly is hoping there may be going to be some dovish rhetoric popping out of Jackson Gap. I don’t suppose they’ll be dovish.”

Mr Sycamore expects the S&P 500 inventory index to drop one other 2pc to 3pc amid a climb within the 10-year US Treasury yield previous 4.33pc, with Bitcoin extending its decline to about $25,000 (£19,638).

03:38 PM BST

Gasoline value volatility to ‘stay over subsequent few years,’ warn economists

Gasoline costs stay 9.5pc larger as we speak after surging as a lot as 18pc earlier amid the specter of strikes at crops in Australia.

As much as 10pc of the world’s liquified pure gasoline exports could possibly be disrupted if strikes go forward, with unions setting a deadline of Wednesday for an settlement in pay talks with Woodside Power.

The looming risk of walkouts comes as employees at Chevron crops in Australia additionally started voting on potential strikes final week.

The opportunity of walkouts despatched gasoline costs hovering as a lot as 40pc when the information first broke earlier this month.

Kieran Tompkins, commodities economist at Capital Economics, mentioned the volatility “serves as a reminder that pure gasoline markets are nonetheless carrying the scars of Russia’s invasion of Ukraine”. He added:

We predict that an setting of extra risky costs is about to stay a function of pure gasoline markets over the following few years.

Nonetheless, main investments in new LNG export terminals will increase international export capability from 2025, which ought to assist volatility return nearer to historic norms.

03:20 PM BST

US markets would rebound in occasion of US federal shutdown, says Goldman Sachs

Any losses within the personal sector from a US federal authorities shutdown could be made up within the quarter after the closure, Goldman Sachs predicts.

Inventory markets ended both flat or larger in the course of the extended closures skilled in 1995-96, 2013 and 2018-19.

Goldman’s chief US political economist Alec Phillips mentioned:

Markets haven’t reacted strongly to prior shutdowns.

Nonetheless, in every occasion fairness costs have been decrease in some unspecified time in the future within the days following the beginning of the shutdown than when it started.

03:00 PM BST

Bond buyers warned of ‘bother forward’ over local weather change

Bond buyers have been warned to brace for “bother forward” over local weather change and that they can not depend on credit score scores to present them a good evaluation of the dangers they’re uncovered to because of wildfires and excessive climate brought on by international warming.

The Institute for Power Economics and Monetary Evaluation mentioned that all the massive three credit score scores firms — Moody’s, S&P World and Fitch — have issued warnings however these have gone largely unnoticed.

Hazel Ilango, an vitality finance analyst at IEEFA the US-based non-profit organisation mentioned that contained in the trade, “alarm bells have been sounding for months”.

IEEFA notes that in June, S&P warned that local weather change is turning into a “vital” driver affecting credit score worthiness, however acknowledged that “only a few climate-related score actions” had taken place since early 2022.

Fitch has warned that about 20pc of corporates face downgrades subsequent decade attributable to local weather change, whereas Moody’s has mentioned that credit score dangers linked to environmental, social and governance elements are rising.

Nonetheless, Ms Ilango mentioned he warnings went largely unheeded, which “is regarding”.

In response to IEEFA, failure to steadily replicate the affect of local weather change in credit score scores will expose issuers to larger, sudden losses additional down the highway.

The warning comes as excessive climate dominates information headlines, with massive swaths of North America, Europe, Asia and Africa by the whole lot from floods, to drought to wildfires.

02:34 PM BST

Wall Road good points on the opening bell

US markets elevated on the opening bell after a bruising August up to now for buyers.

The Dow Jones Industrial Common has elevated 0.1pc to 34,529.82 forward of this week’s annual gathering of central bankers at Jackson Gap, Wyoming, with Federal Reserve Chairman Jerome Powell attributable to communicate Friday.

The S&P 500 has gained 0.3pc to 4,383.55 whereas the Nasdaq Composite was up 0.5pc to 13,360.66 after the opening bell.

02:19 PM BST

Greater than half of Premium Bond savers haven’t received a penny

Greater than 13m Premium Bond savers haven’t received a single prize in practically 20 years, figures reveal.

Madeline Ross has the main points.

Premium Bonds are Britain’s favourite savings product with greater than 22m prospects investing greater than £121bn. However tens of millions of savers could be higher off placing their cash elsewhere.

Knowledge from Nationwide Financial savings and Investments (NS&I) reveals that 62pc of Premium Bond savers haven’t received a single prize since Could 2004.

Premium Bonds don’t pay assured curiosity, however as a substitute every £1 bond is entered right into a month-to-month prize draw to have the prospect to win something between £25 and £1m tax-free. The financial savings product will supply its finest charges since 1999 when it rises to 4.65pc from September including £66m to the NS&I’s month-to-month prize pot.

The figures, obtained by way of the Freedom of Info Act, present that the common prize winner had £38,874 stashed away. The common holding of a saver who has not received in practically 20 years is simply £106.

This chart shows the odds of winning on Premium Bonds.

02:01 PM BST

Biden ‘considers assembly’ with MBS at G20

US President Joe Biden is contemplating assembly with Saudi Crown Prince Mohammed bin Salman on the sidelines of subsequent month’s G20 summit, it has been reported.

A gathering between the 2 leaders in New Delhi, India, might give a push to the talks the White Home has been holding with the Saudi authorities for a deal which incorporates US safety ensures for Riyadh, and a normalisation settlement between Saudi Arabia and Israel, in response to Axios.

01:38 PM BST

Driverless automotive firm pressured to chop ‘robotaxi’ fleet after collision

Dozens of driverless cars have been taken off the highway in San Francisco after a “robotaxi” crashed into a hearth engine final week.

Our expertise editor James Titcomb has the newest:

Cruise, the driverless automotive subsidiary of Common Motors, has been ordered to scale back the dimensions of its self-driving fleet within the metropolis by half after the collision.

The corporate had round 100 autos working in the course of the day and 300 at evening, when there may be much less visitors, so may have 50 and 150 respectively beneath the reductions.

The order to shrink down operations follows a collision between a Cruise cab and a hearth engine that had its sirens on final Thursday.

01:12 PM BST

Pound has peaked and can come beneath renewed strain, says HSBC

The pound has peaked and can come beneath strain within the coming months because the housing market stumbles and client resilience fades, in response to HSBC.

Our economics editor Szu Ping Chan has the main points:

The financial institution has joined a rising refrain of Metropolis analysts who’re turning into more and more bearish on sterling, which has been the best-performing G10 currency this 12 months.

Dominic Bunning, head of European international trade analysis at HSBC, mentioned weak retail gross sales information final week raised alarm bells over the sustainability of sterling’s rally, which noticed the pound hit $1.31 in July.

Mr Bunning mentioned: “The buyer resilience that we noticed serving to to drive the pound larger earlier this 12 months seems to be fading barely sooner than we anticipated.

“We have now been bullish on the pound since November final 12 months, with a forecast it could hit $1.30. Having breached that stage – briefly – final month, dangers are constructing that it could now characterize the height within the foreign money slightly than a extra sustainable stage past the tip of the drizzly summer time.”

Up to now this 12 months, the pound has climbed 5.3pc in opposition to the greenback to $1.27 and three.5pc on the euro at €1.13.

This chart shows sterling’s performance versus the dollar.

12:54 PM BST

Want for ECB rate of interest rises questioned

Given the outlook for Germany’s financial system, questions have been requested about whether or not extra rate of interest rises are wanted from the European Central Financial institution.

The ECB deposit price stands at a report 3.75pc:

12:28 PM BST

US chipmaker Broadcom given go-ahead for £54m UK cloud agency takeover

Broadcom’s proposed buy of VMware wouldn’t considerably scale back competitors within the provide of server {hardware} parts within the UK, the trade regulator has mentioned.

The UK’s competitors watchdog has cleared the most important deal in its historical past because it mentioned that the tie-up of US firms Broadcom and VMware wouldn’t injury UK competitors.

The $69bn (£54bn) deal – the most important the Competitors and Markets Authority (CMA) has ever investigated – raises “no competitors considerations”, the regulator mentioned.

It cleared the deal after an in-depth investigation which thought of a number of areas the place there had been some concern.

Broadcom makes laptop chips, whereas VMware is a cloud expertise firm. The CMA had checked out whether or not by proudly owning VMware, Broadcom would be capable of spy on its opponents who used VMware companies.

It assessed whether or not rival chipmakers must share commercially delicate info with VMware to make sure their chips work with VMware’s software program.

However the watchdog mentioned that “that is unlikely to be a priority, particularly since details about new product variations solely must be shared with VMware at a stage when it’s too late to be of economic profit to Broadcom.”

It additionally checked out whether or not the merged firms might make VMware’s software program work much less nicely with merchandise made by Broadcom’s rivals. However it concluded that this could not make sense for the corporate, because the profit could be outweighed by the monetary value.

12:14 PM BST

British landlords face £3bn hit as WeWork warns of collapse

Landlords face dropping billions in hire owed by WeWork, because the work space provider grapples with the rise of home working.

Our expertise editor James Titcomb has the newest:

British landlords are uncovered to greater than £3bn in rental commitments from WeWork, London’s largest personal tenant.

A Telegraph evaluation of WeWork’s UK subsidiaries reveals the pay-as-you-go workplace supplier has signed leases value £3.1bn at greater than 50 places in Britain.

However the agency, once valued at $47bn (£37bn), has warned that there are “substantial doubts” over its skill to maintain working and its shares have misplaced 97pc of their worth over the previous 12 months.

The corporate, which takes lengthy leases from workplace suppliers and sublets them on month-to-month contracts, slammed the brakes on a world growth and pursued profitability after founder Adam Neumann’s 2019 plans for a New York flotation publicly unravelled.

The corporate went public two years later. Nonetheless, the rise of working from home and a surplus of workplace capability has hit the enterprise.

Examine the landlords facing a hit amid the company’s struggles.

11:59 AM BST

Germany’s central financial institution raises alarm on ‘lacklustre’ financial system

Germany’s “lacklustre” financial system will doubtless stagnate once more within the third quarter, the Bundesbank has mentioned, as weak demand from overseas and excessive rates of interest take their toll on Europe’s industrial powerhouse.

After preliminary estimates instructed that the financial system recorded zero development within the second quarter of 2023, the outlook for the July to September interval was not significantly better, the nation’s central financial institution mentioned in its month-to-month report.

“German financial output will in all probability stay largely unchanged once more within the third quarter,” it mentioned.

Europe’s largest financial system is “nonetheless lacklustre” and “nonetheless experiencing a interval of weak point”, it added.

The gloomy outlook provides to considerations that Germany will drag down the eurozone’s financial efficiency this 12 months, with the Worldwide Financial Fund predicting will probably be the one main superior financial system to shrink in 2023.

Nationwide statistics company Destatis will launch last information for the second quarter on Friday.

The German financial system shrank over the 2 previous quarters, assembly the technical definition of a recession.

11:38 AM BST

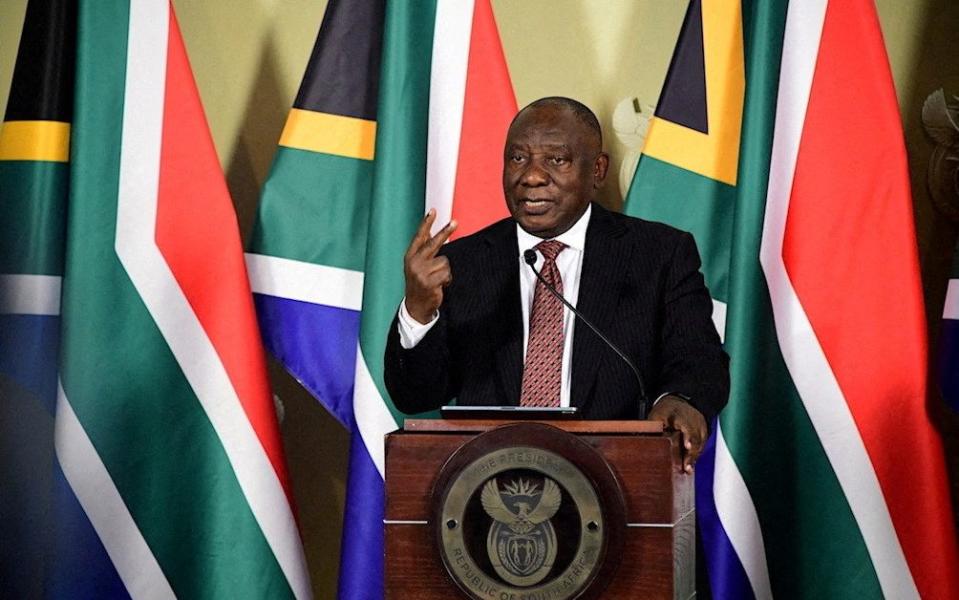

Ramaphosa backs growth of Brics group to rival G7

South African president Cyril Ramaphosa expressed help for an growth of the Brics group of rising market powers, which can collect for its annual summit in Johannesburg this week.

The leaders of Brics — Brazil, Russia, India, China and South Africa — are attributable to maintain three days of talks beginning on August 22, with a doable growth excessive on the agenda.

Greater than 20 nations have formally utilized to affix, Mr Ramaphosa mentioned.

He mentioned: “An expanded Brics will characterize a various group of countries which share a standard want to have a extra balanced world order.”

The summit shall be attended by United Nations Secretary-Common Antonio Guterres and greater than 30 African heads of state, in addition to others from the World South.

Chinese language President Xi Jinping, in an op-ed revealed in a number of South African media shops on Monday, mentioned his nation and South Africa, as “pure members” of the World South, ought to push for growing nations to have extra sway in worldwide affairs.

11:13 AM BST

Wall Road poised to open larger

US shares have risen in premarket buying and selling after a pointy selloff final week, with buyers awaiting extra clues on rates of interest from an upcoming gathering of central financial institution policymakers in Jackson Gap.

Sturdy good points in equities this 12 months have been examined in August, with the S&P 500 dropping greater than 5pc from its intra-day excessive in late July.

Contemporary proof of a sturdy US financial system final week but once more stoked expectations that the Federal Reserve might maintain charges larger for longer, driving 10-year Treasury yield to its highest stage since October.

The yield on the 10-year notice was up at 4.28pc on Monday and a breach above 4.338pc would take it to ranges not seen since 2007.

Traders at the moment are keenly ready for feedback from Fed Chair Jerome Powell on Friday at a gathering of central bankers at Jackson Gap in Wyoming that begins on August 24.

Charu Chanana, a market strategist at Saxo Markets, mentioned:

The symposium shall be key to evaluate Powell’s dovishness meter. If he raises considerations on the financial momentum or the rising credit score dangers, which will immediate the markets to cost in price cuts to start out earlier.

In premarket buying and selling, the Dow Jones Industrial Common was up 0.4pc, the S&P 500 was 0.5pc larger and Nasdaq 100 futures had risen 0.7pc.

10:50 AM BST

Pound weakens as greenback holds agency

The pound has dipped in opposition to the greenback, which has held regular as buyers regarded forward to the Federal Reserve’s Jackson Gap symposium for steering on the place rates of interest would possibly settle.

The occasion – the place Fed chair Jerome Powell is about to talk on Friday – is the most important market focus and will set the path for US Treasury yields.

The pound has fallen 0.1pc in opposition to the greenback to $1.27 and is down 0.3pc in opposition to the euro, which is value greater than 85p.

In the meantime, the Australian greenback, at $0.6402, and the New Zealand greenback, at $0.5919, have been pinned near final week’s nine-month lows after a price reduce from China disillusioned markets nervous a couple of stalling financial system.

China reduce its one-year benchmark lending price by 10 foundation factors and left its five-year price unchanged, in opposition to economists’ expectations for bigger 15 foundation factors cuts to each.

The yuan slid to the weak aspect of seven.3 per greenback regardless of a agency fixing of its buying and selling vary by the central financial institution.

10:24 AM BST

Tesco to cowl value of VAT on interval pants

Tesco has turn out to be the primary retailer to cowl the price of VAT on its vary of interval pants, following an trade marketing campaign calling on the Authorities to take away the 20pc tax that applies to the product.

The 20pc discount in value brings the pants according to different interval merchandise which have been exempt from VAT since 2021, the grocery store mentioned.

The everlasting discount in value is throughout all eight traces of Tesco’s own-brand F&F interval pants, with a three-pack decreased to £14.40 from £18 and a single pack of pants decreased to £6 from £7.50.

The announcement comes after Tesco joined the Say Pants To The Tax marketing campaign, calling on the Authorities to reclassify interval pants as a interval product slightly than clothes to ensure that them to be exempt from VAT.

Marks & Spencer wrote an open letter to the Monetary Secretary in partnership with interval underwear model Wuka earlier this month, calling for the elimination of VAT from the pants.

10:07 AM BST

Greater than £500m wiped off UK housebuilders as downturn deepens

Greater than half a billion kilos has been wiped off Britain’s largest housebuilders amid a deepening downturn within the property sector.

The most important builders throughout the FTSE 100 and FTSE 250 have been the most important fallers as we speak after poor trade information and a significant revenue warning.

Figures from Rightmove confirmed asking prices for homes in Britain suffered the biggest August fall since 2018 this month as hovering mortgage prices put consumers beneath strain.

In the meantime, greater than £50m was wiped off the worth of Crest Nicholson shares because the housebuilder issued a revenue warning as we speak after buying and selling “worsened in the course of the summer time of this 12 months”.

In all, housebuilders have taken successful of greater than £552m in early buying and selling, as Redrow, Sacristy, Taylor Wimpey, Persimmon, Barrett and Berkeley sank to the underside of the UK’s principal inventory markets.

Victoria Scholar, head of funding at Interactive Investor mentioned: “Shares in Crest Nicholson have had a troublesome time these days, underperforming the UK market, weighed down by the prospect of ongoing inflation, larger rates of interest and subdued borrowing.

“And the inventory is buying and selling sharply decrease in as we speak’s commerce, shedding over 12pc, pricing within the hefty revenue downgrade.

“Its replace is weighing on different shares within the sector like Taylor Wimpey, Persimmon and Barratt Developments which have sunk to the underside of the FTSE 100. Actual property is the worst performing sector throughout Europe as we speak.”

09:50 AM BST

Soy hits three-week excessive amid US heatwave

Soybean costs have risen to the best since July as scorching climate grips the US rising area, elevating considerations about crops.

Elements of US states together with Iowa, Illinois and Nebraska — massive corn and soy growers — are beneath extreme warmth warnings, the Nationwide Climate Service mentioned.

Whereas it may be notoriously scorching from mid- to late August, temperatures for the areas are anticipated to interrupt quite a few every day and doubtlessly month-to-month data.

The “warmth dome” might final for greater than every week and is boosting crop costs, Paris-based adviser Agritel mentioned.

The climate is a selected concern for soybeans, as they’re nonetheless in an important growth section — whereas most corn has completed pollinating.

In the meantime, wheat futures fell, reversing earlier good points. It comes as Ukraine might finalise a take care of international insurers as early as subsequent month to cowl grain ships crusing to and from its Black Sea ports, in response to the Monetary Occasions.

09:19 AM BST

Oil ticks larger as greenback rally slows

Oil has risen for a 3rd day amid indicators of tightening provides out there and a stall within the greenback’s rally.

World benchmark Brent traded 0.7pc larger above $85 a barrel, and is up greater than 2pc since final Wednesday’s shut.

Provide curbs from Russia and Saudi Arabia have pushed a rally since late June, whereas US crude stockpiles have shrunk to the least since January.

The greenback was regular as we speak following declines within the earlier two classes, making commodities which are priced within the foreign money cheaper for a lot of consumers. That got here after the buck had been strengthening from mid-July.

Yeap Jun Rong, a market strategist for IG Asia mentioned a stall within the greenback rally over the previous few classes is aiding oil.

He mentioned: “All eyes shall be on whether or not China will be capable of pull off a restoration via the remainder of the 12 months to offer additional conviction for oil costs to proceed larger.”

08:54 AM BST

Domino’s franchisee to declare Russian enterprise bankrupt

The Russian arm of quick meals chain Domino’s is more likely to shut after its London-listed father or mother firm determined to place it into chapter 11.

Apparently failing to discover a purchaser for the Russian enterprise, DP Eurasia mentioned it has determined its subsidiary ought to as a substitute file for chapter.

The franchisee runs round 170 Domino’s pizza websites within the nation, and had beforehand mentioned it was “evaluating its presence” there.

The Russian financial system has been hit by sanctions since President Vladimir Putin launched his unprovoked full-scale invasion of Ukraine in February 2022, a continuation of the Kremlin’s marketing campaign in japanese Ukraine and Crimea which began in 2014.

Though DP Eurasia has not been named by Ukraine as one of many Worldwide Sponsors of Warfare – an inventory which incorporates companies corresponding to Unilever, Procter & Gamble, Yves Rocher, and Mondelez – it has confronted criticism for persevering with to do enterprise in Russia.

Late final 12 months the corporate was named and shamed within the Home of Commons for its ongoing presence within the nation.

DP Eurasia has Domino’s franchise websites in Turkey, Russia, Azerbaijan and Georgia. In Turkey it’s the largest pizza supply chain, with 673 websites, and it’s the third-largest in Russia.

08:37 AM BST

FTSE 250 slumps amid property sector worries

Housebuilders have dragged down the FTSE 250 after disappointing information on asking costs and a revenue warning from Crest Nicholson.

The UK’s midcap inventory index has fallen 0.3pc, with the housing sector index slipping 2.9pc.

Knowledge from web site Rightmove confirmed asking costs for houses in Britain fell sharply this month, as rising mortgage prices brought on sellers to decrease their expectations of what they will get for his or her properties.

It was the most important month-to-month fall for August since 2018 and twice as steep as the standard summertime fall.

In the meantime, Crest Nicholson tumbled 14.4pc after the housebuilder lowered its annual revenue expectations.

The FTSE 100 opened larger because it was boosted by vitality shares in a rebound from six-week lows hit within the earlier session.

The UK’s blue-chip index rose as a lot as 0.2pc as oil and gasoline shares added 1pc amid a bounce in oil costs brought on by decrease exports from Saudi Arabia and Russia.

08:25 AM BST

Asking costs for houses plunge to lowest stage in 5 years

Marketed home costs have fallen by the most important quantity in 5 years as excessive mortgage charges chase away potential consumers.

Our private finance reporter Alexa Phillips has the main points:

The common asking value of newly marketed properties dropped by 1.9pc (£7,012) this month, to £364,895, marking the most important reduce in August since 2018, in response to Rightmove.

Sellers are pricing competitively to attract buyers hit by excessive mortgage charges and value of dwelling pressures, the property web site mentioned.

Whereas a lot of big-name lenders have announced rate cuts over the past few weeks, the common two-year mortgage price has solely marginally slipped from 6.78pc to six.76pc prior to now month, in response to Moneyfacts, an analyst.

The variety of gross sales agreed is now 15pc decrease than in 2019, whereas there was a 10pc decline for properties purchased by first-time consumers.

This chart shows how month-to-month mortgage funds have elevated as a share of earnings.

08:14 AM BST

European gasoline costs soar practically a fifth

European pure gasoline costs have surged as Australian employees put together for a strike if no deal is reached in pay talks on Wednesday.

Benchmark Dutch front-month gasoline soared as a lot as 18pc to €42.90 a megawatt-hour in early buying and selling because the looming walkouts threaten international provides.

The commercial motion might begin as early as September 2 if Woodside Power, the operator of the plant, doesn’t supply an acceptable settlement, unions mentioned over the weekend.

Employees at Chevron crops additionally started voting on potential strikes final week.

The opportunity of provide disruptions in Australia, which can affect 10pc of world LNG exports, has saved European merchants on edge this month.

Nervousness has surged regardless that the continent is well-stocked for winter and it hardly ever receives gasoline from Australia.

08:06 AM BST

Combined begin for UK markets

Inventory markets in London have struggled for path after the rate of interest reduce in China.

The internationally-focused FTSE 100 has gained 0.1pc to 7,266.29 whereas the FTSE 250 was down 0.2pc to 18,068.09.

07:57 AM BST

Housing slowdown triggers revenue warning at Crest Nicholson

Housebuilder Crest Nicholson has mentioned that the housing market has slowed significantly this summer time, particularly in current weeks, because it downgraded its revenue forecast for the 12 months.

The builder mentioned that “buying and selling situations for the housing market have worsened in the course of the summer time of this 12 months”, as “the financial uncertainty is deterring potential dwelling movers”.

It got here regardless of costs remaining resilient as a result of there may be not a lot provide of houses to purchase and never many people who find themselves being pressured to promote due to a deterioration of their monetary conditions.

The enterprise mentioned that it anticipated adjusted pre-tax revenue to succeed in £50m within the 12 months ending October 31. It had beforehand indicated that revenue would attain round £73.7m.

07:54 AM BST

China to spearhead push for G7 rival as financial system weakens at dwelling

China will push the world’s main rising market powers to turn out to be a full-scale rival to the G7 group of rich nations because it seeks to enlist extra members.

The Brics bloc — Brazil, Russia, India, China and South Africa — will use an annual leaders’ summit in Johannesburg this week to start the method of enlisting extra members to bolster its international standing.

The push has been pushed primarily by Chinese language President Xi Jinping but additionally backed by Russia and South Africa.

There may also be talks on speed up a shift away from the greenback, partly by rising the usage of native currencies in commerce between members, which is surging, in response to a draft agenda seen by Bloomberg.

It comes as China’s central financial institution reduce rates of interest as we speak in an try and counter the post-Covid development slowdown on the earth’s second-largest financial system.

Exercise has been dragged down lately by uncertainty within the labour market and international financial sluggishness, weakening demand for Chinese language items.

07:49 AM BST

China cuts key rate of interest in bid to kickstart financial system

China’s central financial institution reduce a key rate of interest however saved one other on maintain in a transfer that has confused economists because it makes an attempt to counter the post-Covid slowdown on the earth’s second-largest financial system.

Exercise has been dragged down lately by uncertainty within the labour market and international financial sluggishness, weakening demand for Chinese language items.

Progress has additionally been hit by monetary troubles in the actual property sector, with a number of main builders on the verge of chapter and struggling to finish initiatives.

The Individuals’s Financial institution of China mentioned as we speak reduce the one-year mortgage prime price (LPR), which serves as a benchmark for company loans, from 3.55pc to three.45pc.

Nonetheless, the five-year LPR, which is used to cost mortgages, was held at 4.2pc, regardless of economists predicting the speed to be reduce by 15 foundation factors following an analogous discount final week to an essential central financial institution coverage mortgage price.

Goldman Sachs economist Maggie Wei described the LPR reduce as “disappointing”, including that it “wouldn’t assist with constructing confidence” as Chinese language authorities pursue an financial restoration.

Zhang Zhiwei, chief economist at Pinpoint Asset Administration, mentioned: “The choice to maintain the 5-year unchanged is puzzling.

“It isn’t clear interpret this determination and the reduce final week.”

China shares fell to round nine-month lows as buyers have been disillusioned by the milder-than-expected measures to spice up confidence.

Raymond Yeung, chief economist for Larger China at Australia & New Zealand Banking Group, mentioned: “The stunning maintain of five-year LPR is inconsistent with the general coverage tone of property bailout.

“The coverage message of this LPR maintain will confuse the market and dilute the sentiment affect.”

Julian Evans-Pritchard, head of China Economics at Capital Economics, mentioned: “The massive image is that the PBOC’s strategy to financial coverage is of restricted use within the present setting and received’t be sufficient, by itself not less than, to place a ground beneath development.”

He added: “However the disappointing follow-through from the MLF reduce to the LPR strengthens our view that the PBOC is unlikely to embrace the sizeable declines wanted to revive credit score demand.”

07:31 AM BST

Good morning

Chinese language banks saved a key rate of interest that guides mortgages on maintain, a shock transfer that sowed confusion over the nation’s strategy to stemming the nation’s property hunch.

The five-year mortgage prime price (LPR) was unexpectedly held regular at 4.2pc on Monday, in response to information from the Individuals’s Financial institution of China.

Most economists had predicted the speed to be reduce by 15 foundation factors following an analogous discount final week to an essential central financial institution coverage mortgage price. That was seen as precursor for a reduce to the 5-year LPR.

The one-year LPR was lowered by 10 foundation factors to three.45pc from 3.55pc, a smaller reduce than what most economists surveyed by Bloomberg had anticipated.

5 issues to start out your day

1) Rudderless EY gripped by soul searching as private equity circles | After tumbling from the peaks of ‘Mission Everest’, the agency’s future hangs within the stability

2) Ocado-backed robot chef sold for pennies in the pound | Karakuri collapses into administration as enterprise funding dries up

3) Taxpayer-funded Welsh sports car factory still empty 12 months after refurbishment | British sports activities automotive model TV has but to formally signal the lease

4) MumsGPT: the AI chatbot trained on two decades of parenting advice | Mumsnet makes use of expertise from OpenAI to comb via threads of 10 million customers

5) Airline baggage and add-on fees boost Ryanair’s revenue by £18bn | Passengers face ‘eye watering’ prices to e-book seats and stow luggage

What occurred in a single day

Asian shares have been blended as buyers have been disillusioned by China’s milder-than-expected measures to spice up confidence, with the nation’s sluggish restoration and property woes holding sentiment fragile.

China reduce its one-year benchmark lending price as we speak however stunned markets by holding the five-year price unchanged, falling in need of market expectations of cuts to each charges.

China’s blue-chip CSI 300 Index dropped 0.5pc by the noon recess to its lowest since late November 2022, whereas the Shanghai Composite Index misplaced 0.4pc.

Hong Kong’s Grasp Seng Index fell 1.4pc, and the Grasp Seng China Enterprises Index declined 1.3pc.

In the meantime, Tokyo shares ended a three-day dropping streak to shut larger, with bargain-hunting supporting the market.

The benchmark Nikkei 225 index gained 0.4pc to finish at 31,565.64, whereas the broader Topix index added 0.2pc to 2,241.49.

The Kospi in Seoul gained 0.1pc to 2,507.16 whereas Sydney’s S&P-ASX 200 shed 0.3pc to 7,124.60.

India’s Sensex opened up 0.3pc at 65,147.47. New Zealand and Singapore retreated whereas Bangkok and Jakarta gained.