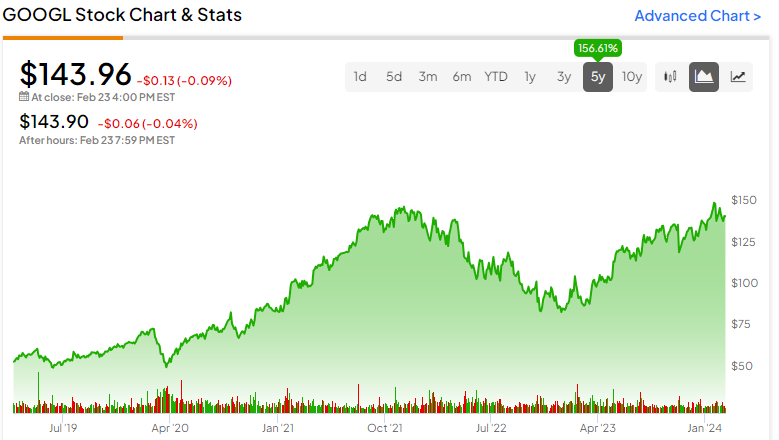

Magnificent Seven shares have attracted loads of buzz as buyers gravitate towards their huge market share and distinctive returns. Each Magnificent Seven inventory has greater than doubled over the previous 5 years. These property have considerably outperformed the market throughout that point. Nevertheless, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has been a largely underappreciated inventory.

The company has amassed a $1.75 trillion market cap and is up by 56% over the past year. Nonetheless, that acquire falls behind many of the Magnificent Seven shares. New alternatives and an excellent valuation may also help Alphabet acquire momentum and accumulate long-term returns for buyers. These catalysts make me bullish on the inventory.

Alphabet Has Underperformed the Magnificent Seven

Though the corporate owns the biggest search engine on the earth, it’s fallen behind the Magnificent Seven shares in recent times. These are the one-year and five-year returns for every inventory inside the cohort.

One-year returns:

-

Nvidia: 223%

-

Meta Platforms: 171%

-

Amazon: 77%

-

Microsoft: 58%

-

Alphabet: 56%

-

Apple: 22%

-

Tesla: -2%

5-year returns:

-

Nvidia: 1,579%

-

Tesla: 882%

-

Apple: 320%

-

Microsoft: 260%

-

Meta Platforms: 187%

-

Alphabet: 157%

-

Amazon: 106%

These are nonetheless spectacular returns and outpace the S&P 500 (SPX) and Nasdaq 100 (NDX). Nevertheless, Alphabet has been outclassed by each Magnificent Seven inventory besides Amazon (NASDAQ:AMZN) over the previous 5 years.

Alphabet Trades at a Nice Valuation

Whereas the inventory has underperformed its friends inside the cohort, Alphabet has a greater valuation than most tech corporations. The inventory trades at a 24.5 P/E ratio and has stable revenue margins. The corporate’s internet revenue margin often exceeds 20% and may get an enormous increase in future quarters.

Alphabet has three elements on its aspect: rising revenue, extra income, and cost-cutting measures. The tech big reported 13% year-over-year income progress and 51.8% year-over-year internet earnings progress in This autumn 2023. Alphabet’s efforts to trim its workforce contributed to increased margins and appear to be ongoing.

A contributing issue to Alphabet’s rising internet earnings is the current profitability of Google Cloud. The cloud computing phase has been taking over a bigger proportion of income and attributed to greater than 10% of This autumn-2023 income. Google Cloud generated $9.2 billion of the corporate’s $86.3 billion in income. Google Cloud swung from a $186 million working loss in This autumn 2022 to producing $864 million in working earnings in This autumn 2023.

Google Cloud’s margins ought to enhance considerably in future quarters and scale back the corporate’s P/E ratio by growing its earnings.

Promoting Income Is Rebounding

Whereas it’s good to see Alphabet increasing in different verticals, it’s no secret that promoting is the primary engine for this company. Promoting gross sales slowed down in 2022 however got here again to life in 2023. Its fourth-quarter results additional spotlight this reality and counsel that Alphabet has extra to achieve.

The fourth quarter featured $76.3 billion in Google Providers income. This phase primarily consists of the corporate’s promoting and grew by 12.5% year-over-year. Promoting ought to obtain a further increase from the Olympic Video games and the upcoming Presidential Election.

Increased promoting income additionally interprets into extra income. Whereas the identical may be mentioned about most companies, Alphabet achieved a 35.0% working margin with its Google Providers phase in This autumn.

AI Presents One other Lengthy-Time period Development Alternative

Among the many Magnificent Seven shares, Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT) are the clear leaders within the synthetic intelligence business. Nevertheless, Alphabet can be poised to achieve a significant slice of the pie by utilizing its present know-how and making new investments.

Alphabet not too long ago launched Gemini in a bid to bolster its AI presence. The tech agency additionally invested over $2 billion into an OpenAI competitor. Alphabet has been utilizing synthetic intelligence to enhance its search outcomes and cloud platform, however these investments symbolize the subsequent steps to achieve market share.

Alphabet can shut the hole within the AI race with Microsoft. The corporate began Google Cloud two years after Amazon received a head begin with Amazon Internet Providers. Now, Google Cloud is a crucial part of the corporate’s enterprise. Alphabet has invested in lots of ventures often known as Different Bets which are rising at a excessive fee. Whereas this phase makes up a small a part of complete income, it’s value monitoring the gathering of companies underneath the umbrella time period.

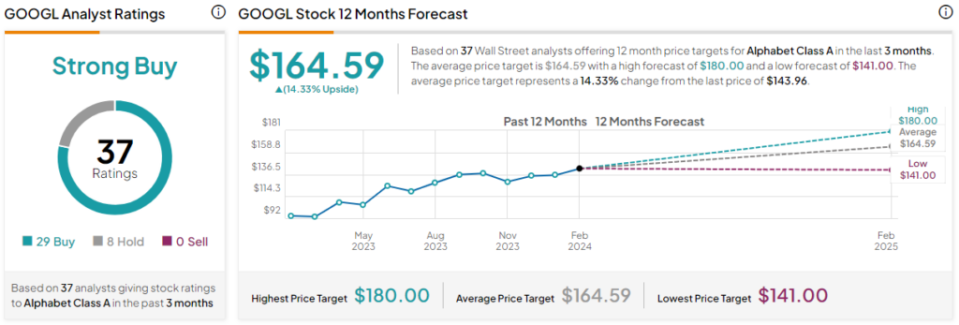

Is GOOGL Inventory a Purchase, In keeping with Analysts?

Most analysts are bullish on Alphabet inventory. The inventory sports activities 29 Buys and eight Maintain scores from analysts, giving it a Robust Purchase consensus ranking. The average GOOGL stock price target of $164.59 implies 14.3% upside potential.

The Backside Line on Alphabet Inventory

Alphabet is an under-the-radar inventory (comparatively) because of the spectacular performances of different Magnificent Seven shares. The tech big has outperformed the market however has underperformed many of the firms in its cohort.

Rising income and income from promoting and cloud computing current a terrific alternative. Alphabet additionally appears decided to achieve extra market share in synthetic intelligence, which is a superb long-term transfer for the company.