Common view of the UBS constructing in Manhattan on June 5, 2023 in New York Metropolis.

Eduardo Munoz Alvarez | View Press | Corbis Information | Getty Photos

UBS shares reached their highest level since late 2008 throughout early commerce in Zurich on Thursday, after the Swiss banking large posted a mammoth revenue beat and introduced 1000’s of layoffs because it plans to totally take up Credit score Suisse’s Swiss financial institution.

UBS posted second-quarter revenue of $28.88 billion in its first quarterly earnings report since Switzerland’s largest financial institution accomplished its takeover of stricken rival Credit score Suisse.

Analysts had projected web revenue of $12.8 billion for the three months to the top of June, in accordance with a Reuters ballot.

UBS mentioned the outcome primarily mirrored $28.93 billion in detrimental goodwill on the Credit score Suisse acquisition. Underlying revenue earlier than tax, which excludes detrimental goodwill, integration-related bills and acquisition prices, got here in at $1.1 billion.

Unfavourable goodwill represents the truthful worth of belongings acquired in a merger over and above the acquisition value. UBS paid a reduced 3 billion Swiss francs ($3.4 billion) to amass Credit score Suisse in March.

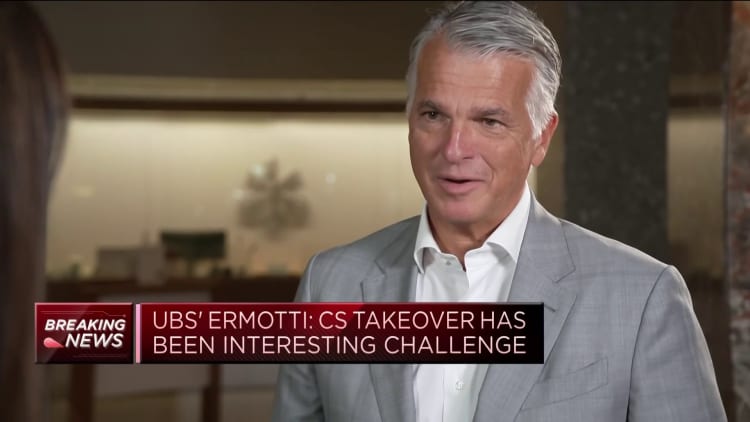

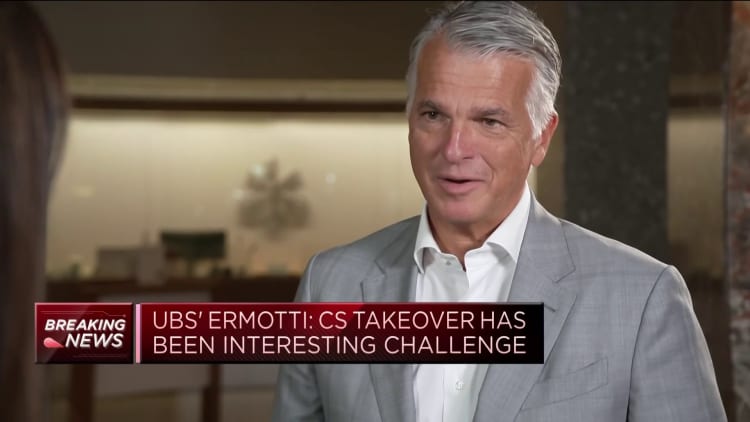

UBS CEO Sergio Ermotti advised CNBC’s “Squawk Field Europe” on Thursday that the financial institution is making “excellent progress” with its integration plans.

“When folks look into these numbers, they are going to clearly perceive that this detrimental goodwill is the fairness essential to maintain $240 billion of risk-weighted belongings and the monetary sources to undergo a deep restructuring that’s essential at Credit score Suisse, as a result of our evaluation has confirmed that the enterprise mannequin was not viable any longer,” he advised CNBC’s Joumanna Bercetche.

“Credit score Suisse has glorious folks, purchasers and product capabilities, however the enterprise mannequin was not sustainable any longer and must be restructured.”

UBS shares had been up 4.9% round an hour into buying and selling.

Listed here are another highlights:

- CET1 capital ratio, a measure of financial institution liquidity, reached 14.4% versus 14.2% within the second quarter of 2022.

- Return on tangible fairness (excluding detrimental goodwill, integration-related bills and acquisition prices) was 4.3%.

- CET1 leverage ratio was 4.8% versus 4.4% a yr in the past.

Credit score Suisse’s Swiss financial institution to be totally absorbed

Credit score Suisse’s stalwart home banking unit might be totally built-in into UBS, the group additionally introduced on Thursday, with a merging of authorized entities anticipated to shut in 2024.

The destiny of Credit score Suisse’s flagship Swiss financial institution, a key revenue heart for the group and the one division nonetheless producing optimistic earnings in 2022, was a focus of the acquisition, with some analysts speculating that UBS may spin it off and float it in an IPO.

Ermotti mentioned the financial institution’s evaluation had decided that that is “one of the best final result for UBS, our stakeholders and the Swiss economic system.”

The mixing might show extra controversial in Switzerland due to the opportunity of heavy job losses within the course of. UBS confirmed Thursday that the combination of the Swiss financial institution will end in 1,000 redundancies, starting in late 2024, whereas an additional 2,000 layoffs are anticipated because of the wider restructure of Credit score Suisse.

The Credit score Suisse acquisition was a part of an emergency rescue deal mediated by Swiss authorities over the course of a weekend in March. Earlier this month, UBS introduced that it had ended a 9 billion franc ($10.24 billion) loss safety settlement and a 100 billion franc public liquidity backstop that had been put in place by the Swiss authorities when it agreed to take over Credit score Suisse in March.

“Shoppers will proceed to obtain the premium stage of service they anticipate, benefiting from enhanced choices, knowledgeable capabilities and international attain,” Ermotti mentioned of the combination of Credit score Suisse’s Swiss banking division.

“Our stronger capital base will allow us to maintain the mixed lending exposures unchanged, whereas sustaining our threat self-discipline.”

The financial institution additionally introduced that it’s focusing on gross value financial savings of at the least $10 billion by 2026, when it hopes to have accomplished the combination all of Credit score Suisse Group’s companies.

UBS delayed reporting its second-quarter outcomes — initially scheduled for July 25 — till after finishing the Credit score Suisse takeover on June 12.

Within the earlier quarter, UBS suffered a shock 52% annual drop in web revenue as a consequence of a legacy litigation subject regarding U.S. mortgage-backed securities.

UBS shares closed Wednesday’s commerce up almost 30% for the reason that flip of the yr, in accordance with Eikon.

In a separate Thursday filing, the Credit score Suisse subsidiary posted a second-quarter web lack of 9.3 billion francs, because it noticed web asset outflows of 39.2 billion francs, with belongings below administration falling 3% amid a mass exodus of purchasers and workers.

The Thursday report was Credit score Suisse’s final as an unbiased entity, and confirmed that, regardless of the rescue, the lack of shopper confidence that precipitated the financial institution’s close to collapse in March has but to be reversed.

UBS however famous that this attrition charge was slowing, and the financial institution might be eager to retain as many Credit score Suisse purchasers and clients as potential, with a purpose to make the colossal merger work in the long term.

UBS’ Ermotti advised CNBC on Thursday that each UBS and Credit score Suisse had seen an uptick in deposit inflows within the second quarter and within the present one thus far, and that this was proof that purchasers are “staying loyal.”

For the second quarter, web inflows into deposits for the mixed group had been $23 billion, of which $18 billion got here from Credit score Suisse’s wealth administration and Swiss financial institution divisions.

Although Credit score Suisse continued to undergo web asset outflows, UBS mentioned that these slowed over the second quarter and turned optimistic after the acquisition was accomplished in June.

“Credit score Suisse misplaced round $200 billion throughout its tough occasions in 2022 and 2023, and we’re seeing now a few of this coming again, and our purpose is to attempt to get again as a lot as potential. It is not simple, however it’s our ambition,” Ermotti added.

UBS’ flagship international wealth administration enterprise obtained $16 billion in web new cash over the three months to the top of June, its highest second-quarter web inflows for over a decade.