The logos of Swiss banks Credit score Suisse and UBS on March 16, 2023 in Zurich, Switzerland.

Arnd Wiegmann | Getty Photos Information | Getty Photos

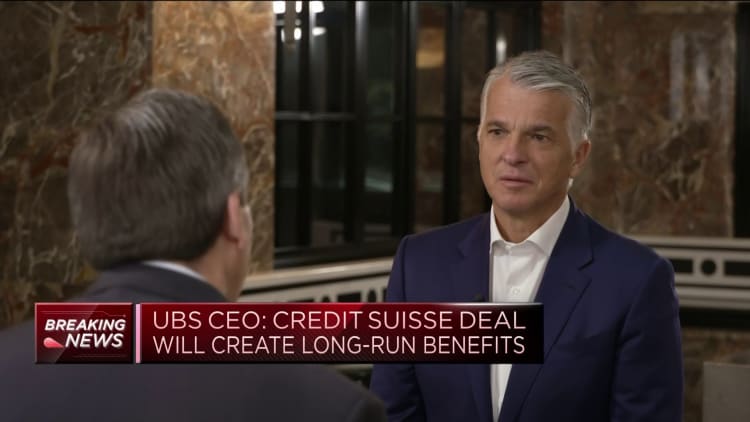

UBS on Friday mentioned that it has ended a 9 billion Swiss franc ($10.27 billion) loss safety settlement and a 100 billion Swiss franc public liquidity backstop that had been put in place by the Swiss authorities when it took over rival Credit score Suisse in March.

UBS mentioned the choice adopted a “complete evaluation” of Credit score Suisse’s non-core belongings that had been lined by the liquidity assist measures.

“These measures, along with the intervention of UBS, contributed to the stabilization of Credit score Suisse and monetary stability in Switzerland and globally,” UBS mentioned in a press release.

Credit score Suisse has additionally totally repaid an emergency liquidity help plus (ELA+) mortgage of fifty billion Swiss francs obtained from the Swiss Nationwide Financial institution in March, because the lender teetered on the brink after a collapse in shareholder and investor confidence, UBS confirmed.

“These measures, which had been created below emergency regulation to protect monetary stability, will thus stop to exist, and the Confederation and taxpayers will now not bear any dangers arising from these ensures,” the Swiss authorities mentioned in a press release Friday.

“Moreover, the Confederation earned receipts of round CHF 200 million on the ensures.”

The Swiss Federal Council plans to submit a invoice in parliament to introduce a public liquidity backstop (PLB) below extraordinary regulation, whereas work continues on a “complete evaluate of the too-big-to-fail regulatory framework.”

The 9 billion Swiss franc LPA was meant to insure UBS on losses above 5 billion Swiss francs following the takeover, which was brokered over a frenetic weekend in March amid talks with the Swiss authorities, the SNB and the Swiss Monetary Market Supervisory Authority.

The emergency rescue deal noticed UBS purchase Credit score Suisse for a reduction value of three billion Swiss francs, making a Swiss banking and wealth administration behemoth with a $1.6 trillion stability sheet.

“After reviewing all belongings lined by the LPA because the closing in June and taking the suitable truthful worth changes, UBS has concluded that the LPA is now not required,” UBS mentioned.

“Due to this fact, UBS has given discover of voluntary termination efficient 11 August 2023. UBS pays a complete of CHF 40 million to compensate the Swiss Confederation for the institution of the LPA.”

The 100 billion Swiss franc public legal responsibility backstop was established on March 19 by the Swiss authorities and allowed the SNB to supply liquidity assist to Credit score Suisse if wanted, underwritten by a federal default assure.

UBS confirmed on Friday that each one loans drawn below the PLB had been totally repaid by Credit score Suisse by the top of Might, and that the group had terminated the PLB settlement after a evaluate of its funding state of affairs.

“Via 31 July 2023, Credit score Suisse expensed a dedication price and a danger premium totaling CHF 214 million, together with roughly CHF 61 million to the SNB and CHF 153 million to the Swiss Confederation,” UBS added.