Halfpoint Pictures | Second | Getty Pictures

President Donald Trump’s signature on his so-called massive stunning invoice was a loss of life blow for tax credit that lowered the price of electrical automobiles.

These tax credit — price as much as $7,500 and $4,000 for purchases of recent and used EVs, respectively — will not be out there after Sept. 30. One other tax break that is ending lets sellers cross alongside financial savings on EV leases.

The credit have been alleged to final for an additional seven years, by 2032.

Analysts suppose the abrupt finish to those federal subsidies will set off a rush by customers to purchase or lease an EV in coming months.

“That is going to be the summer time of the EV,” Ingrid Malmgren, senior coverage director at Plug In America, a nonprofit advocating for a faster transition to electrical vehicles, beforehand informed CNBC.

Automakers have definitely taken discover.

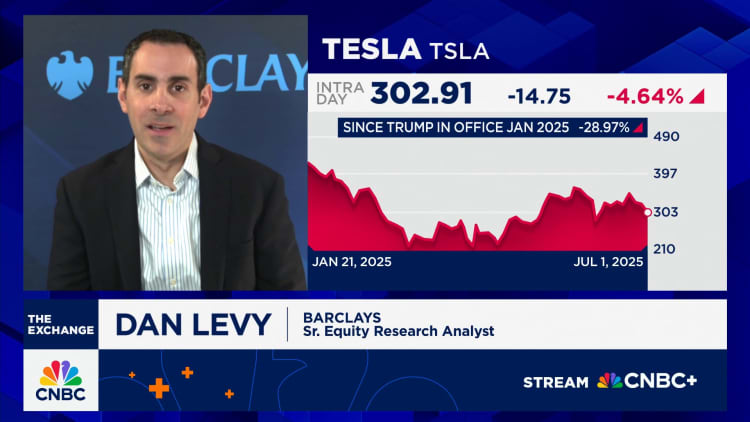

Tesla, the nation’s largest EV maker, has taken to e mail blasts and social media to unfold the phrase that the federal tax credit are quickly disappearing.

“If there ever was a time to yolo your automotive buy, it is now,” the carmaker wrote Tuesday on X. (YOLO means you solely dwell as soon as.)

“Order Quickly to Get Your $7,500,” learn a separate Tesla e-newsletter emailed Tuesday.

(Elon Musk, Tesla’s CEO and former head of the so-called Division of Authorities Effectivity, spoke out in opposition to the laws that axed the tax credit, lambasting the trillions of {dollars} it provides to the nationwide debt.)

‘Sense of urgency’

This can be a theme customers will doubtless see by the summer time, analysts stated.

Automakers and sellers will doubtless “promote a way of urgency: ‘Purchase now, the EV incentive goes away,'” stated Stephanie Valdez Streaty, director of trade insights at Cox Automotive.

One other issue that will pace up purchases: Customers should have the automobile of their possession by Sept. 30, Malmgren stated in an interview after the invoice handed.

Extra from Private Finance:

‘Large stunning invoice’ does not eradicate taxes on Social Safety

Tax adjustments below Trump’s ‘massive stunning invoice’ — in a single chart

Trump’s ‘massive stunning invoice’ slashes CFPB funding

Within the eyes of the IRS, it will not be sufficient that buyers order one by Sept. 30 and take possession later, Malmgren stated. They should be driving it off the lot by that deadline, she stated.

“Having this deadline so quickly, simply in a pair months, positively lights a hearth below individuals’s butts,” Malmgren stated. “I count on that people who find themselves form of fascinated with it or on the fence about it might take motion now.”

Customers will doubtless see some “actually good” monetary incentives like reductions or financing offers earlier than Sept. 30, on high of the federal tax credit, Valdez Streaty stated.

For instance, Ford extended a “complimentary dwelling charger and customary set up provide” within the U.S. till Sept. 30, Stacey Ferreira, the automaker’s director of U.S. gross sales technique, wrote on the corporate’s web site Tuesday.

‘The coaching wheels are being taken off’

Maskot | Maskot | Getty Pictures

The Inflation Discount Act, which offered historic investments by the U.S. to combat local weather change, created, prolonged or enhanced tax breaks (together with the EV credit score) meant to cut back the nation’s planet-warming greenhouse fuel emissions.

EVs are “unambiguously higher for the local weather” than gasoline-powered vehicles, even when trying throughout all the lifecycle of the automobile, from manufacturing to recycling, according to researchers on the Massachusetts Institute of Know-how.

Nevertheless, they’re usually costlier — a main sticking level for would-be consumers, Valdez Streaty stated.

The typical transaction value for a brand new EV in June was about $56,000, earlier than any tax credit or incentives, according to Cox Automotive information. By comparability, the common value for all new automobiles was about $49,000, it stated.

Monetary incentives have helped carry EVs nearer to cost parity with conventional vehicles, and certainly, there’s hardly a value premium for some fashions, analysts stated.

The typical EV purchaser bought monetary incentives price over $8,400 in June, along with federal tax credit, Valdez Streaty stated. Customers can also be eligible for subsidies provided by their state or electrical utility, Malmgren stated.

The top of the federal EV tax credit is like “the coaching wheels are being taken off” of a nascent know-how, Valdez Streaty stated. “And people coaching wheels have helped steadiness and help EV adoption.”

Whereas EVs are usually costlier upfront, they might save customers cash over the long run, since recurring prices for upkeep and gas are usually cheaper, specialists stated.

What to know earlier than getting an EV

Begin quickly: EV demand could surge if there is a rush to purchase this summer time, and costs could rise if provide is constrained, analysts stated. It is in customers’ finest curiosity to start out sooner slightly than later, they stated. Guarantee your vendor has registered with the IRS to offer a federal tax credit score earlier than shopping for, they stated.

Stack tax credit: “Do your analysis to determine what credit you are eligible for,” Valdez Streaty stated. Customers could possibly stack subsidies from the federal authorities, and their state and utility firm, analysts stated. “Stacking of EV credit” is usually a sturdy worth proposition, particularly in areas the place gasoline costs are excessive and electrical energy charges are low, Valdez Streaty stated.

Take a look at used EVs: “There are a ton of nice offers on used EVs,” Malmgren stated. “If I have been looking for a automobile proper now, that is what I would be .” Used EVs are comparable on value to used gasoline-powered vehicles, have far fewer upkeep points, and have sturdy warranties on their batteries and drive practice, she stated.

Take into account a lease: Shopping for a brand new EV comes with varied eligibility necessities for the driving force and automotive to qualify for a tax credit score. Leasing sidesteps a lot of them — opening up these federal subsidies to a wider viewers, Malmgren stated. Test the lease settlement earlier than signing to make sure the worth displays the tax credit score.

Go for upfront tax credit score: Customers ought to decide to get their tax break upfront as a reduction as a substitute of later when submitting their annual tax return, Malmgren stated. “Given all of the uncertainty proper now with the administration and IRS, I would advise in opposition to doing the tax credit score later,” she stated. “Plus you compound your worth as a result of that is cash you do not finance.”