Pedestrians stroll previous a billboard asserting the World Financial institution Group and Worldwide Financial Fund annual conferences, on the aspect of the Worldwide Financial Fund headquarters in Washington DC on October 5, 2023.

Mandel Ngan | Afp | Getty Photographs

High economists and central bankers look like in settlement on one factor: rates of interest will keep increased for longer, clouding the outlook for world markets.

Central banks around the globe have hiked rates of interest aggressively over the previous 18 months or so in a bid to rein in hovering inflation, with various levels of success to this point.

Earlier than pausing its mountaineering cycle in September, the U.S. Federal Reserve had lifted its predominant coverage price from a goal vary of 0.25-0.5% in March 2022 to five.25-5.5% in July 2023.

Regardless of the pause, Fed officers have signaled that charges might have to stay increased for longer than markets had initially anticipated if inflation is to sustainably return to the central financial institution’s 2% goal.

This was echoed by World Financial institution President Ajay Banga, who instructed a information convention on the IMF-World Financial institution conferences final week that charges will doubtless keep increased for longer and complicate the funding panorama for firms and central banks around the globe, particularly in gentle of the continued geopolitical tensions.

U.S. inflation has retreated considerably from its June 2022 peak of 9.1% year-on-year, however nonetheless got here in above expectations in September at 3.7%, in keeping with a Labor Division report final week.

“For positive, we’ll see charges increased for longer and we noticed the inflation print out of the U.S. lately which was disappointing should you had been hoping for charges to go down,” Greg Guyett, CEO of world banking and markets at HSBC, instructed CNBC on the sidelines of the IMF conferences in Marrakech, Morocco final week.

He added that considerations round persistently increased borrowing prices had been leading to a “very quiet deal surroundings” with weak capital issuance and up to date IPOs, equivalent to Birkenstock, struggling to search out bidders.

“I’ll say that the strategic dialog has picked up fairly actively as a result of I feel firms are searching for development and so they see synergies as a technique to get that, however I feel it is going to be some time earlier than folks begin pulling the set off given financing prices,” Guyett added.

The European Central Financial institution final month issued a tenth consecutive rate of interest hike to take its predominant deposit facility to a report 4% regardless of indicators of a weakening euro zone economic system. Nonetheless, it signaled that additional hikes could also be off the desk for now.

A number of central financial institution governors and members of the ECB’s Governing Council instructed CNBC final week that whereas a November price enhance could also be unlikely, the door has to stay open to hikes sooner or later given persistent inflationary pressures and the potential for brand spanking new shocks.

Croatian Nationwide Financial institution Governor Boris Vujčić stated the suggestion that charges will stay increased for longer shouldn’t be new, however that markets in each the U.S. and Europe have been gradual in repricing to accommodate it.

“We can’t count on charges to return down earlier than we’re firmly satisfied that the inflation price is on the best way right down to our medium-term goal which won’t occur very quickly,” Vujčić instructed CNBC in Marrakech.

Euro zone inflation fell to 4.3% in September, its lowest stage since October 2021, and Vujčić stated the decline is anticipated to proceed as base results, financial coverage tightening and a stagnating economic system proceed to feed via into the figures.

“Nonetheless in some unspecified time in the future when inflation reaches a stage, I might guess someplace shut to three, 3.5%, there may be an uncertainty whether or not, given the energy of the labor market and the wage pressures, we can have an extra convergence with our medium-term goal in a means that it has been projected for the time being,” he added.

“If that doesn’t occur then there’s a threat that we must do extra.”

This warning was echoed by Financial institution of Latvia Governor and fellow Governing Council member Mārtiņš Kazāks, who stated he was completely satisfied for rates of interest to remain at their present stage however couldn’t “shut the door” to additional will increase for 2 causes.

“One is after all the labor market — we nonetheless have not seen the wage development peaking — however the different one among course is geopolitics,” he instructed CNBC’s Joumanna Bercetche and Silvia Amaro on the IMF conferences.

“We might have extra shocks that will drive inflation up, and that is why after all we have now to stay very cautious about inflation developments.”

He added that financial coverage is coming into a brand new “increased for longer” section of the cycle, which can doubtless carry via to make sure the ECB can return inflation solidly to 2% within the second half of 2025.

Additionally on the extra hawkish finish of the Governing Council, Austrian Nationwide Financial institution Governor Robert Holzmann urged that the dangers to the present inflation trajectory had been nonetheless tilted to the upside, pointing to the eruption of the Israel-Hamas warfare and different potential disturbances that would ship oil costs increased.

“If further shocks come and if the data we have now proves to be incorrect, we might should hike one other time or maybe two instances,” he stated.

“That is additionally a message given to the market: do not begin to discuss when would be the first lower. We’re nonetheless in a interval by which we do not know the way lengthy it’s going to take to return to the inflation we wish to have and whether or not we have now to hike extra.”

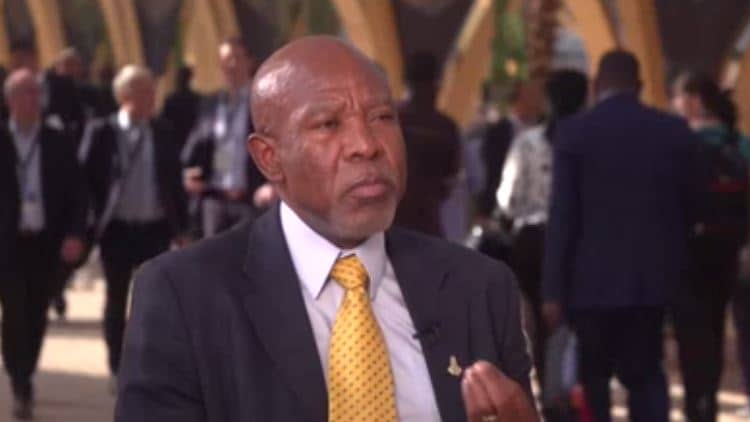

For South African Reserve Financial institution Governor Lesetja Kganyago, the job is “not but finished.” Nonetheless, he urged that the SARB is at a degree the place it will probably afford to pause to evaluate the complete results of prior financial coverage tightening. The central financial institution has lifted its predominant repo price from 3.5% in November 2021 to eight.25% in Might 2023, the place it has remained since.