If the 2023 inventory market had an MVP, it must be Nvidia (NASDAQ: NVDA).

The chip maker and inventor of the graphics processing unit (GPU) has been the most important winner within the generative synthetic intelligence (AI) gold rush thus far by far. Its income and earnings have soared this yr, and the inventory has greater than tripled yr thus far by Dec. 20. Alongside the way in which, the inventory crossed the $1 trillion market cap, including roughly $700 billion in market worth and making it simply certainly one of 5 U.S. corporations in that membership.

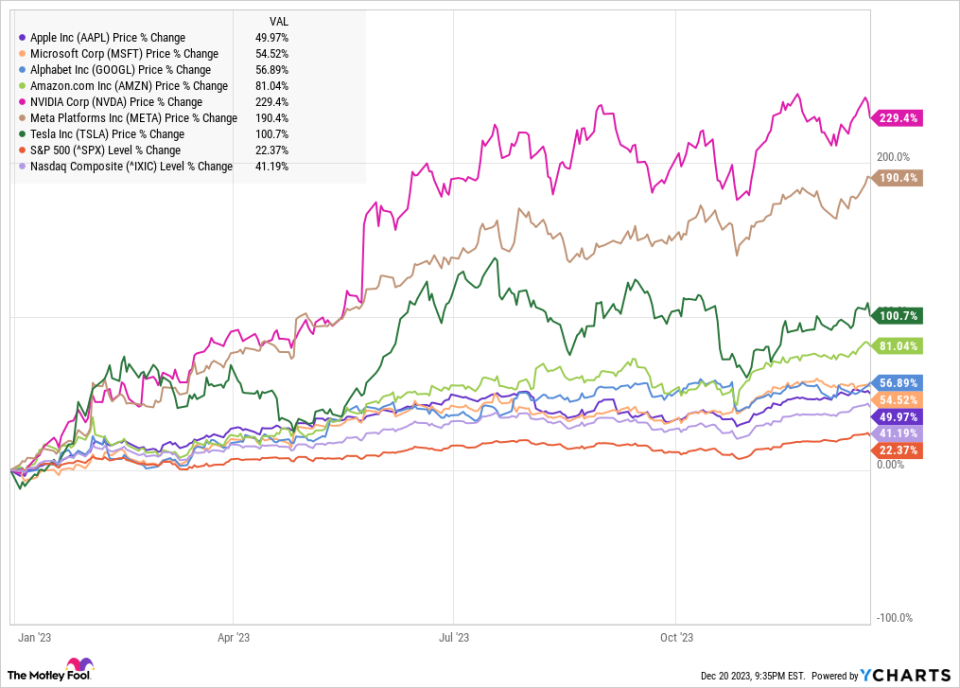

The opposite 4 corporations are Apple, Microsoft, Amazon, and Alphabet. Along with Meta Platforms and Tesla, they’ve come to be often known as the “Magnificent Seven,” which has changed FAANG stocks as shorthand for giant tech shares. Collectively they symbolize roughly $12 trillion in market cap, and the group has delivered monster returns this yr, with every one outperforming the S&P 500 and the Nasdaq, as you possibly can see from the chart beneath.

Why Nvidia was probably the most magnificent inventory of 2023

Nvidia began 2023 nonetheless reeling from the cryptocurrency crash in 2022, as demand for the corporate’s chips had spiked throughout the crypto mining increase in 2021.

Early in 2023, nevertheless, Nvidia emerged as a possible winner from the brand new generative AI know-how revealed by the launch of OpenAI’s ChatGPT, and Nvidia has not disillusioned.

As 2023 attracts to a detailed, the chip maker has capitalized on the generative AI increase in a approach that no different firm has, and it has the numbers to indicate it. In its third quarter, income tripled from a yr in the past to $18.12 billion, and its margins expanded considerably, with typically accepted accounting ideas (GAAP) earnings per share leaping greater than 12 occasions to $3.71. On a GAAP foundation, its revenue margin was 51% within the quarter, and the corporate expects a good greater fourth quarter, concentrating on income of $20 billion and a modestly larger gross margin.

Why 2024 may very well be one other profitable yr for Nvidia

Nvidia is getting into 2024 with a goal on its again. It is confirmed the marketplace for AI accelerators and GPUs, and now semiconductor rivals like Superior Micro Gadgets and Intel are launching their very own AI accelerators. Large tech corporations like Amazon and Apple are additionally getting into the fray, designing their very own chips for issues like machine studying and neural engines, and for coaching massive language fashions.

Nonetheless, regardless of growing competitors, there is a cause to guess on Nvidia’s continued development in 2024. There’s nonetheless a major scarcity of AI chips as cloud infrastructure companies, information facilities, start-ups, and basis fashions race to get ahold of the important thing infrastructure elements to run new generative AI know-how, which requires monumental computing energy.

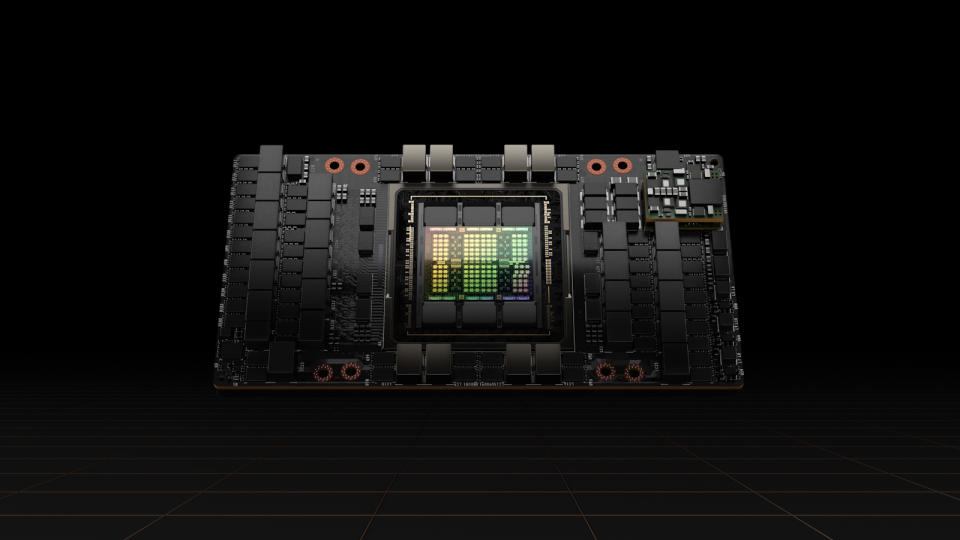

Firms together with OpenAI, Oracle, Microsoft, and Alphabet have all complained a few scarcity of AI chips, however that is anticipated to ease subsequent yr — which means Nvidia will face extra competitors for its H100 processors, which may value greater than $40,000.

Nonetheless, Nvidia itself is betting on demand persevering with to ramp up, with plans to triple manufacturing from 500,000 GPUs to no less than 1.5 million subsequent yr. Elevated competitors may decrease costs, but it surely’s unclear if anybody can compete with Nvidia in efficiency.

Nvidia has maintained a lead in GPUs because it invented them in 1999, and it may do the identical within the AI house. The corporate additionally advantages from entrenched relationships with cloud infrastructure companies like Microsoft, Oracle, Alphabet, and Amazon, in addition to key clients like Tesla and OpenAI, and it is constructed a robust community of chips, software program, and complementary merchandise that will likely be tough for rivals to match.

Costs for AI {hardware} may come down, however Nvidia appears prone to preserve its status because the chief in AI efficiency. Repeating its efficiency as the most effective inventory among the many Magnificent Seven will not be simple in 2024, however Nvidia seems effectively positioned to maintain gaining subsequent yr because the generative AI increase solely appears to be heating up.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

This Is the Best-Performing “Magnificent Seven” Stock of 2023. Will That Change in 2024? was initially revealed by The Motley Idiot