-

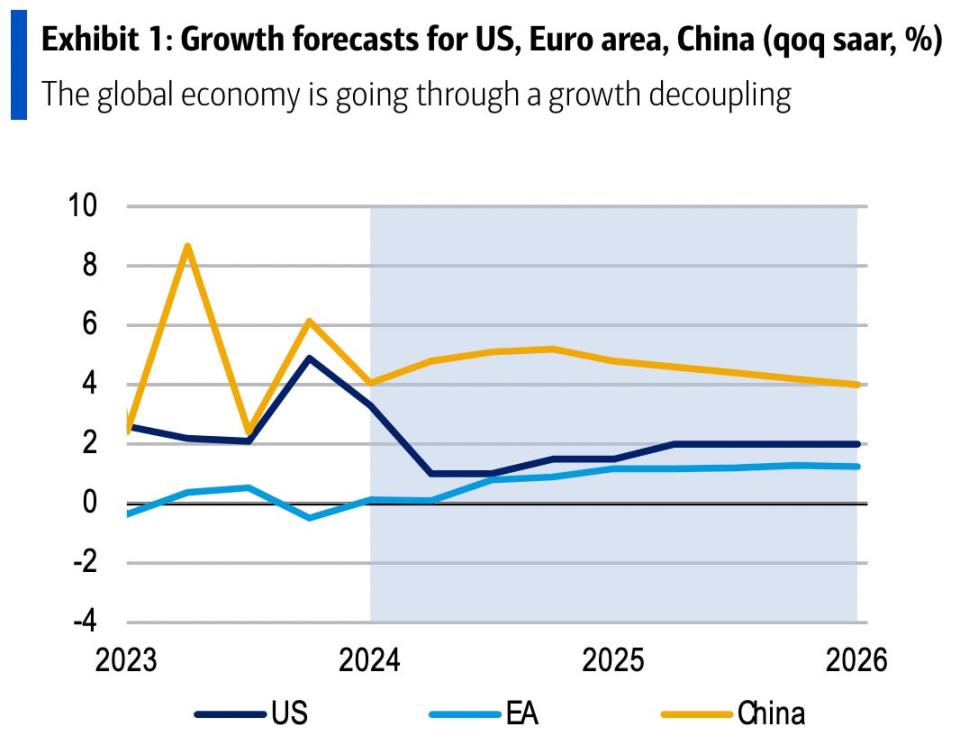

The world’s largest economies are seeing a “decoupling,” Financial institution of America says.

-

The US is displaying stunning resilience, European development is weak, and China is faltering.

-

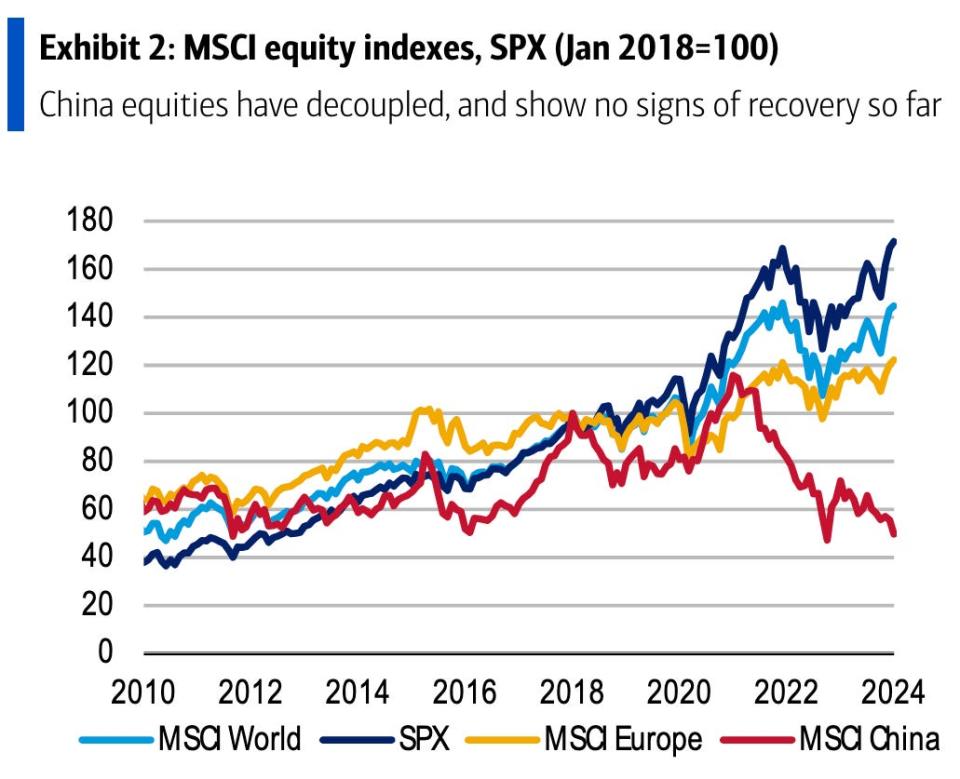

World shares have mirrored the shifting tides in commerce and provide chains.

The most important gamers within the global economy are on completely different trajectories, and markets all over the world are reflecting the shifting panorama.

In Financial institution of America’s view, the US financial system continues to point out outstanding resilience, European development has faltered, and China faces the most challenging outlook amid real estate woes, deflation, and demographic headwinds.

“Indicators of decoupling are current in world development, commerce, and fairness markets,” Financial institution of America strategists wrote in a Friday be aware.

The US specifically has seen robust GDP development in current quarters and steadily cooling inflation, in addition to promising financial knowledge and a stock market rally that will not give up.

Financial institution of America holds a tender touchdown and easing financial coverage starting in June as their base case for the US. Many on Wall Road share an identical view, and traders have traded on that optimism, with the S&P 500 hitting a string of information over current weeks.

Stronger-than-expected development and sturdy labor market knowledge to shut out 2023 recommend continued positive momentum in the new year, in line with BofA.

Tighter monetary situations have put the US business actual property sector beneath extra stress, the agency famous, and that is manifested in greater pain the office-building market. Treasury Secretary Janet Yellen has voiced her concern on CRE, however stays assured that it will not devolve right into a systemic danger to the banking sector.

There’s nonetheless some uncertainty on what the Federal Reserve will do subsequent to deal with the “final mile” of inflation, however that will not dramatically sway the US’s positioning in comparison with different financial powerhouses.

To that time, the outlook for the Euro space seems softer.

“[G]rowth within the Euro space has been very anemic, together with weaker-than-expected knowledge in Germany,” strategists stated. “Despite this, our base case stays for the ECB to start out slicing charges in June.”

BofA expects Euro space development at 0.4% in 2024 and 1.1% in 2025. However Germany, the bloc’s largest financial system, might be weak at -0.4%, and Spain will present its energy with 1.3% development. The vast spectrum of outlooks inside Europe will finally converge, assuming there aren’t any extra development shocks.

“From a market perspective, weak point in Germany is less complicated to digest than weak point within the periphery,” strategists maintained. “German home demand stays a big driver for different Euro space international locations’ exports, however so do German exports themselves given the combination of the inner-Euro space manufacturing chain.”

And China, for its half, faces a novel bearish cocktail of unfavorable demographics, bleak shopper confidence, and an exodus of foreign investors.

These contrasting financial performances have proven up in shares, with China lagging the world and struggling to shake the “uber-bearish” narrative.

“SPX has outperformed the MSCI World Index, whereas European equities underperformed compared,” BofA strategists stated. “Furthermore, the decoupling of China equities is starker, and has but to point out any indicators of restoration.”

Learn the unique article on Business Insider