Pushed by China’s Belt and Street Initiative (BRI), from 2015 onwards rail-borne containerized cargo flows between the European Union (EU) and China elevated steadily. Volumes hit a peak between 2020 and early 2022, the beginning of the battle in Ukraine.

Throughout 2021, effectively over 600,000 TEUs (twenty-feet equal models) had been moved between Chinese and European railports, with westbound cargo accounting for some two-thirds of the full. The commerce represented a complete worth of some $40 billion. By comparability, containerized ocean freight between Asia and Europe by way of the Suez Canal route amounted to some 26.5 million TEUs in the identical yr, of which over 19 million TEUs had been westbound.

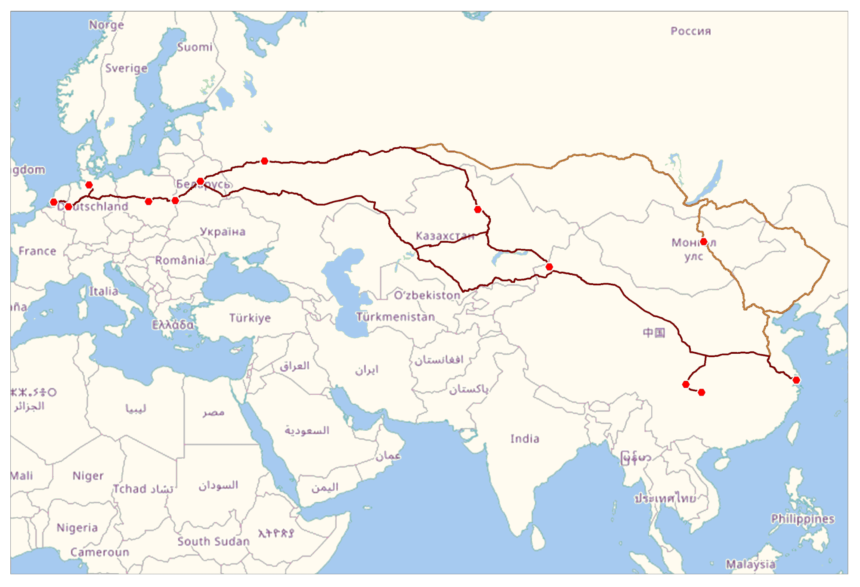

A very powerful intercontinental railway hall, now and within the foreseeable future, connects the 2 continents by Poland, Belarus, Russia, and Kazakhstan. Departure factors are a lot of massive cities in western China, together with Xi’an, Chengdu, Chongqing, Yiwu, and Wuhan, whereas crucial locations in Europe embody Duisburg, Hamburg, Lodz, Tilburg, and in addition Moscow. Adjustments in railway gauge, and subsequently transshipment dealing with, happen on the Polish-Belarusian border (sometimes Malaszewicze/Brest) and on the Kazakh-Chinese language border (sometimes Dostyk/Alashankou or Khorgos).

The principal China-Europe railway corridors.

From an financial perspective, railway transport is competitively positioned between ocean and air transportation. With lead occasions ideally some 20 days, rail is far quicker than ocean, whereas cheaper than air freight. Due to this fact, the intercontinental hall may be aggressive for capital-intensive and time-sensitive merchandise reminiscent of machine components, electronics, perishable foodstuffs, and so forth. Nonetheless, peak volumes reached over 2020 and 2021 could possibly be partially defined by capability shortages, obstructions, and subsequent larger tariffs in ocean freight, shifting to rail cargoes for which this dearer possibility would usually not be justified.

Instantly after Russia’s invasion of Ukraine, cargo volumes transported on the Eurasian hall dropped sharply. For one, the insecure worldwide circumstances, sanctions risk, and public consciousness made many cargo homeowners reluctant to make use of the route. One other trigger for the thinner movement is that Western sanctions forbade transferring particular varieties of items, together with army and so-called “dual-use” merchandise, into Russia and Belarus. However, European operators to this point haven’t been obstructed in shopping for providers from Russian Railways (RZD).

Though the long run appears lower than sure, there are two principal causes for the relative insulation of railway providers from Western sanctions. First, though their gusto for energetic participation within the BRI has largely light, EU member states, particularly Germany, continue to attach great value to their commerce relations with China. Second, as Russia serves as transit territory, inhibiting the route would probably not obtain important injury to the Russian financial system. As the prices of sanctioning the hall outweigh the perceived advantages, European transporters are quietly allowed to proceed their operations.

After the preliminary months of the battle, volumes recovered to about half of their earlier ranges: over the entire of 2022 greater than 400,000 TEUs had been moved alongside these rail corridors. Nonetheless, over the primary half of 2023, the movement additional decreased to some 114,000 containers, albeit with steady month-to-month volumes.

This may nonetheless appear extra dramatic than it truly is: throughout 2022 ocean freight tariffs regularly recovered, relieving a few of the earlier stress on the railway hall. Additionally, business orders have reportedly fallen, resulting in a lower in demand. Due to this fact, present rail freight volumes is perhaps nearer to their pure state than it might appear at first look.

China-Europe rail freight quantity by yr.

Evidently, cargo homeowners and railway operators in Europe and China wish to diversify their intercontinental providers with various corridors, bypassing Russia. The so-called Center Hall transits Kazakhstan, the Caspian Sea, and Southern Caucasus; from there, southeast Europe may be reached by both Turkey or the Black Sea. Certainly, since 2022 a restricted shift has taken place from one path to the opposite.

Nonetheless, regardless of upgrades, capacity on the Middle Corridor will remain limited, and its complexity and longer lead occasions largely prohibit a convincing enterprise case. Though the Caspian route’s significance should definitely not be dismissed, its financial potential lies in facilitating the landlocked area’s personal financial growth and regionalization rather than accommodating large East-West flows.

The way forward for intercontinental rail freight appears undecided. Barring any focused sanctioning of the Russian hall by the EU, so long as the Ukraine battle persists, establishing new providers will stay a dangerous enterprise. Alternatively, the market has by no means skilled critical operational difficulties in Russia, whereas a rise in financial exercise or a return to larger tariffs for ocean freight may result in larger demand.

Certainly, European operators have reported a mutual understanding with their Chinese language counterparts on persevering with their concentrate on the northern route. Maybe curiously, such an outlook additionally seems to be mirrored by current upgrades of the Malaszewicze border crossing, deliberate for a complete of 800 million euros, below the auspices of the Polish authorities.

On steadiness, all hope might not be misplaced for this image of Eurasian connectivity.