-

The S&P 500 might soar one other 18% by year-end, in line with Oppenheimer.

-

That is as a result of the financial system is robust and the Fed is prone to finish its charge hike cycle.

-

Whereas 5% Treasury yields have sparked concern amongst traders, that is regular in comparison with earlier eras.

The S&P 500 is due for a monster rally by the tip of the yr, because the Federal Reserve appears to be like poised to dial again its battle on inflation, in line with Oppenheimer’s chief funding strategist John Stoltzfus.

In an interview with CNBC on Thursday, Stoltzfus reiterated his S&P 500 price target of 4,900 by the tip of the yr. That factors to the benchmark index skyrocketing 18% in simply over two months, a forecast that is predicated on the Fed probably ending its charge hike cycle.

“You have to keep in mind that after we raised that concentrate on, we had been anticipating that the Fed would proceed be vigilant towards inflation however would stay delicate to the results of its coverage on the financial system. And it has remained so,” he mentioned.

Central bankers have hiked rates of interest aggressively since March 2022 to tame inflation, with the fed funds charge now at 5.25%-5.5%. That has sparked fears that the Fed might push the US right into a recession with its aggressive coverage, although the financial system has stayed impressively resilient up to now, with GDP growing 4.9% in the third quarter.

Company earnings additionally look to have held up, regardless of some disappointing outcomes this week from the biggest tech corporations. Of the 17% of S&P 500 firms that reported third-quarter earnings final week, 73% have overwhelmed analysts’ estimates, in line with FactSet data.

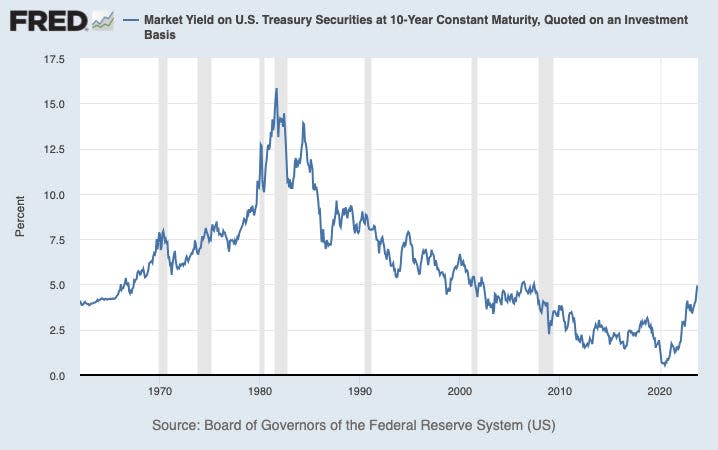

And although shares have offered off in latest weeks, that is largely because of fears stemming from larger Treasury yields, with the 10-year US Treasury yield recently topping 5% for the first time since 2007. However yields round 5% are literally pretty regular relative to historical past, Stoltzfus mentioned:

“From a historic perspective, 4%-5% is absolutely what the 10-year yield often can be like throughout regular intervals,” he added, noting that rates of interest had been unusually low for the previous 15 years.

The Fed has warned that charges might keep higher-for-longer because it continues to observe inflation and the energy of the financial system. Nonetheless, markets predict rate of interest cuts by mid-next yr, with traders pricing in an 80% likelihood that charges could possibly be decrease than their present degree by July 2024, in line with the CME FedWatch device. That could possibly be bullish for shares, contemplating that charge hikes weighed the S&P 500 down closely in 2022.

Stoltzfus has been one in every of Wall Road’s most bullish forecasters, regardless of issues brewing in markets over surging bond yields and the potential of a recession on the horizon. In 2022, he predicted the S&P 500 would surge to 5,330, however then slashed that target a number of occasions because the yr went on.

Learn the unique article on Business Insider