After months of delays and uncertainty, Pakistan and the Worldwide Financial Fund (IMF) have lastly reached a vital $3 billion bailout deal.

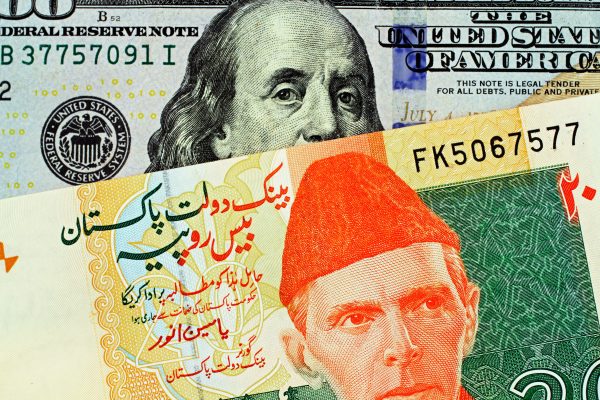

This final minute Stand-By Arrangement (SBA) agreement, which releases greater than the anticipated $1.1 billion forward of the expiration of a ninth evaluation on June 30, comes as a much-needed respite for Pakistan, which has been on the point of collapse. The information has been welcomed by traders and monetary markets, resulting in a big strengthening of the Pakistani foreign money in opposition to the US greenback and a historic rise on the nation’s inventory trade.

The take care of the IMF not solely gives instant monetary aid, but in addition gives Pakistan with an financial roadmap for the following 9 months. This time period covers three quarters, together with the interval of a caretaker authorities previous to elections. With the reassurance of the IMF, Pakistan can now navigate this crucial interval with larger stability and confidence.

With this deal, plainly Pakistan has realized the necessity to give attention to implementing structural reforms that may strengthen its economic system in the long term. In a present of dedication to the IMF framework, Pakistan final week launched further taxes, minimize its improvement funds and raised its key rate of interest to a brand new all-time excessive.

The involvement of the IMF additionally lends credibility to Pakistan’s financial insurance policies, making it extra enticing to international traders. The IMF funding is anticipated to “launch an extra $3 billion in loans pledged by Saudi Arabia and the UAE,” according to to a Bloomberg report. “Collectively, the loans ought to allow the nation to repay its money owed by way of April 2024, assuming the present account deficit for the fiscal 12 months is lower than $4 billion, because the central financial institution expects,” it mentioned.

Amid various financial challenges, Pakistan finds itself on the brink, even after closing an IMF deal. The nation’s future relies on its skill to keep away from coverage errors and follow the fiscal stance agreed with the IMF. With a staggering $24 billion in debt service this 12 months, excluding import payments, Pakistan can’t afford to deviate from its monetary obligations to worldwide lenders.

As well as, the political developments within the nation will play a vital function in shaping the sentiment of each the IMF and traders within the coming weeks. With the elections approaching, there’s a danger that politicians will overlook their commitments to the IMF, which might worsen the scenario in a method that the brand new authorities will discover troublesome.

Trying forward, Pakistan could require a bigger mortgage from the IMF for an extended interval after the elections. Nonetheless, this chance can solely materialize if Islamabad efficiently fulfills its present settlement with the IMF. Within the coming weeks there will likely be no room for the federal government to allocate cash for election campaigns or to supply beneficiant improvement budgets. It’s also crucial that there’s political stability within the nation to make sure that Pakistan can meet its monetary challenges successfully and with out disruptions or setbacks.

The stakes are excessive and any misstep might have severe penalties for the Pakistani economic system. With elections looming, political events should come collectively and agree on a constitution for the economic system. This settlement not solely demonstrates their dedication to the IMF program, but in addition demonstrates their dedication to fulfilling their obligations with worldwide lenders.

Months of negotiations have been spent convincing the IMF that Pakistan will honor its commitments, and now is just not the time to deviate from the agreed deal. Failing to take action is not going to solely create a brand new wave of belief deficits between Pakistan and the IMF, but in addition threaten to wreck relations with different bilateral and multilateral lenders. Political events should prioritize the financial stability of the nation and work collectively in direction of a standard purpose.

Policymakers should stay steadfast of their dedication to monetary self-discipline and prudent decision-making. By sticking to the agreed fiscal stance, Pakistan can pave the best way for stability and sustainable progress in these difficult instances.