A version of this post first appeared on TKer.co

Shares closed decrease final week with the S&P 500 shedding 1.1%. The index is now up 14.6% 12 months to this point, up 23% from its October 12 closing low of three,577.03, and down 8.3% from its January 3, 2022 file closing excessive of 4,796.56.

I used to be not too long ago at a cheerful hour with a few of my colleagues in enterprise information, and a query got here up: What has shocked me out there or the financial system over the previous 12 months?

Common readers of TKer know that main themes we discuss right here haven’t actually modified a lot in a very long time. And after they do change, they occur very step by step. Simply check out the “Putting it all together” part of the weekly e-newsletter: The language has primarily been unchanged for months.

So if there’s something that’s actually shocked me, it’s the diploma to which most Wall Avenue economists have been unsuitable in regards to the trajectory of the financial system. Particularly, many have spent many of the previous 12 months warning that a recession was around the corner, and now they’re both retracting their calls or arguing the risks are fading.

Whereas I believe the percentages of a recession might have risen from very low ranges, I’m nonetheless not satisfied the chance of a recession was ever significantly excessive. That is largely because of the truth that the financial system has been and continues to be bolstered by some large tailwinds.

3 large financial tailwinds 🌬️

One of the clicked and shared TKer newsletters ever has been the March 4, 2022 concern: Three massive economic tailwinds I can’t stop thinking about 📈📈📈

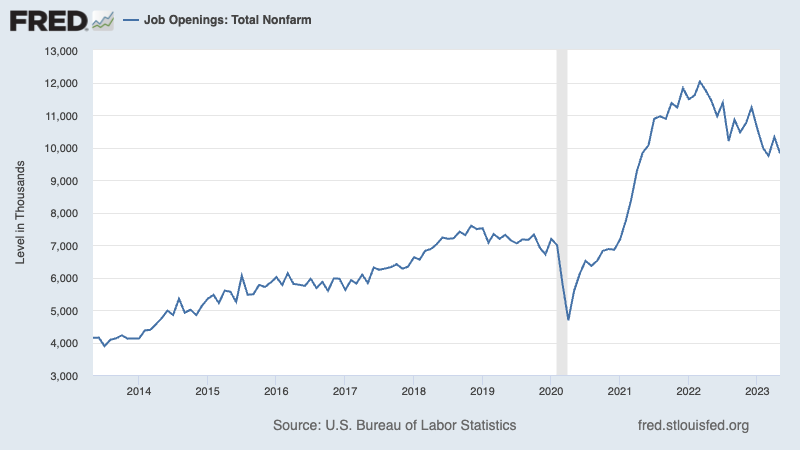

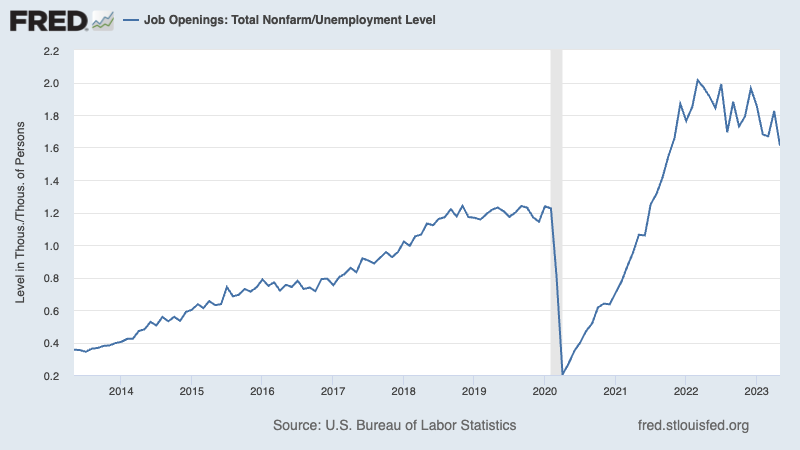

These three tailwinds: The unprecedented trillions of {dollars} price of excess savings amassed by shoppers, the eye-poppingly excessive variety of job openings, and the record-high ranges of core capex orders.

These metrics are notable as a result of they’re main indicators: Extra financial savings characterize extra cash that has but to be spent; elevated job openings characterize hiring that has but to occur, which additionally means incremental shopper spending energy that has but to be realized; and core capex orders characterize capital items companies have but to place in place, which implies there’s nonetheless work to be carried out by producers and there’s extra capability coming for the companies that ordered these things.

These narratives all emerged at across the identical time in 2021 because the financial system was “re-opening” amid the COVID-19 pandemic. I put spotlights on all of them in June 2021, again after I wrote the Axios Markets e-newsletter. See here, here, here, and here.

The economists I spoke to on the time had been all tremendous bullish about these developments. So I’ve been staying on high of those numbers ever since.

Regardless of threats, they endured ⚠️

Over the previous two years, there have been all kinds of developments within the financial system and markets that offered threats to the tailwinds: Consumer sentiment plunged, new COVID-19 variants emerged, Russia invaded Ukraine, energy prices exploded, the Federal Reserve began hiking rates at an aggressive pace, the yield curve inverted, inflation rates surged to the best ranges in many years, the inventory market went into a bear market, the housing market turned, the U.S. authorities confronted a debt ceiling crisis, and a few big banks failed.

Truthfully, I’ve been frightened that anybody of those developments would trigger a number of of the tailwinds to fade and drive the financial system into recession.

However the knowledge all the time urged in any other case. Client finances remained strong, job openings remained high, and businesses continued to invest for future progress.

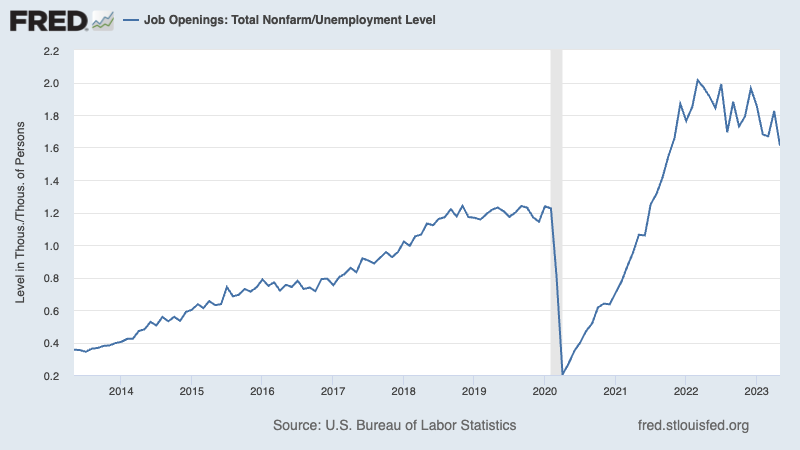

And now two years later — as you’ll learn in TKer’s overview of the macro crosscurrents beneath — these tailwinds are very a lot intact (whereas displaying some indicators of cooling). Whereas extra financial savings have turn into increasingly difficult to estimate, most economists consider there’s nonetheless a pair hundred million {dollars} sitting in shoppers’ financial institution accounts. Whereas the extent of job openings is off its excessive, there continues to be a really excessive 1.6 job openings per unemployed particular person. And whereas core capex order progress has been decelerating, they proceed to be at a file excessive.

Placing all of it collectively 🌎

In some ways, the financial system is extremely sophisticated.

However in some methods, it’s not that sophisticated. You give individuals cash, after which they’ll spend it. When companies create jobs, extra individuals may have cash to spend. When extra individuals have cash to spend, companies must broaden to handle increased demand. When companies broaden, they create extra jobs.

It’s a virtuous cycle. And the three large financial tailwinds continue to perpetuate this cycle.

For buyers, all of this helps drive earnings, which helps to elucidate why strategists are searching for appreciable earnings growth in 2024 and 2025. And earnings are the most important long term driver of stock prices, which explains why stocks are up this year.

If there’s a draw back to those tailwinds, it’s that they are keeping inflation from cooling faster. The excellent news is inflation has nevertheless been easing for months, and the tailwinds have helped make this happen while preventing the economy from going into recession.

An unexpected economic shock might definitely derail issues. Although it’s price remembering that the destructive shocks of the previous two years have had restricted destructive affect.

Who is aware of how lengthy these dynamics persist. For now, issues proceed to look favorable for the financial system’s near-term outlook.

Reviewing the macro crosscurrents 🔀

There have been a couple of notable knowledge factors and macroeconomic developments from final week to contemplate:

🤯 Exhausting knowledge > comfortable knowledge. As we frequently say at TKer: What businesses do > what businesses say. Certainly, in latest months it’s been the case that precise exhausting knowledge in regards to the financial system has been surprisingly sturdy whereas comfortable survey-based knowledge has been disappointing. From Bloomberg’s Michael McDonough: “Leaping on the financial shock index bandwagon, here’s a have a look at it for exhausting vs comfortable (survey) knowledge. It suggests the precise financial system is doing higher than anticipated, however economists suppose individuals’s opinions of the financial system are higher than they are surely.”

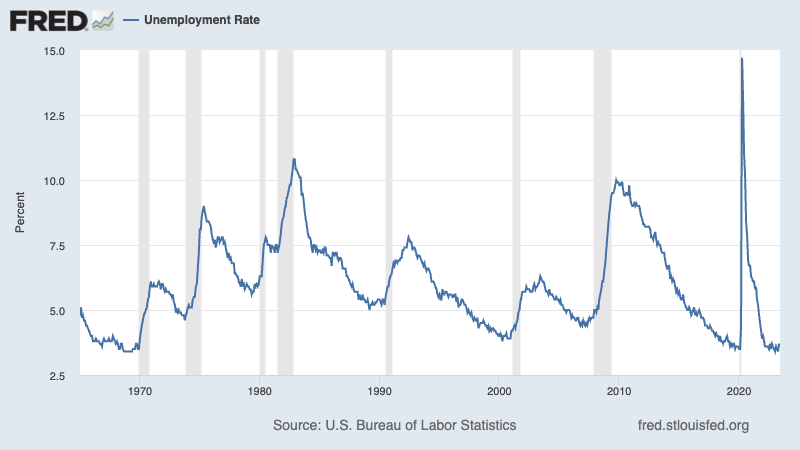

💼 The labor market stays sizzling, but it surely’s cooling. In line with the Bureau of Labor Statistics, U.S. employers added a formidable 209,000 jobs in June. Whereas the tempo of job good points has been cooling, the numbers proceed to verify an financial system with strong demand for labor.

Employers have added 1.7 million jobs because the starting of the 12 months. Whole payroll employment is at a file 156.2 million jobs.

Throughout the interval, the unemployment fee fell to three.6% from 3.7% the month prior — the bottom degree since 1969. Whereas it’s barely above its cycle low of three.4%, it continues to hover close to 53-year lows.

Common hourly earnings rose by 0.4% month-over-month in June, unchanged from the tempo in Could. This metric is up 4.4% from a 12 months in the past, a fee that’s been cooling however stays elevated.

📈 Job switchers get higher pay. In line with ADP, which tracks non-public payrolls and employs a special methodology than the BLS, annual pay progress in June for individuals who modified jobs was up 11.2% from a 12 months in the past. For individuals who stayed at their job, pay progress was 6.4%.

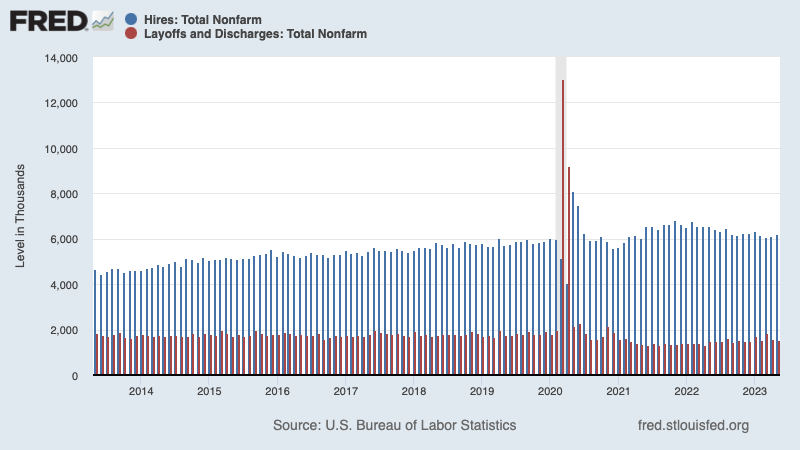

💼 Jobs openings cool, layoffs keep low. The Could Job Openings & Labor Turnover Survey confirmed that the labor market, while still hot, continues to cool. Job openings declined to 9.82 million in the course of the month, down from 10.32 million in April.

Throughout the interval, there have been 6.09 million unemployed individuals — which means there have been 1.61 job openings per unemployed particular person. This continues to be one of the most obvious signs of excess demand for labor.

Employers laid off 1.55 million individuals in Could. Whereas difficult for all these affected, this determine represents simply 1.0% of complete employment. This metric continues to pattern beneath pre-pandemic ranges.

Hiring exercise continues to be a lot increased than layoff exercise. Throughout the month, employers employed 6.21 million individuals.

From Indeed’s Nick Bunker: “If you happen to look previous among the unstable topline knowledge you’ll see as we speak’s JOLTS report continues to replicate a step by step slowing but still-robust labor market, one that’s cooler than a 12 months in the past however nonetheless sizzling…. The labor market isn’t all the time going to be this sturdy. Recessions occur. However for now, demand for brand new hires stays elevated and employers are nonetheless holding onto the employees they’ve.”

💼 Unemployment claims tick up. Initial claims for unemployment benefits climbed to 248,000 in the course of the week ending July 1, up from 236,000 the week prior. Whereas that is up from the September low of 182,000, it continues to pattern at ranges related to financial progress.

⛽️ Shoppers are hitting the highway. Weekly EIA data by way of June 30 present gasoline demand is up from a 12 months in the past.

🛢️Fuel costs cool as summer season driving season kicks off. From AAA: “Pump costs barely budged over the previous week, regardless of the anticipated demand surge as a result of July 4th vacation. AAA predicted that greater than 43 million individuals would hit the highway to rejoice the nation’s birthday. Regardless of the file quantity, the nationwide common for a gallon of fuel drifted two cents decrease since final week to $3.52.”

⛓️ Provide chain pressures nonetheless unfastened. The New York Fed’s Global Supply Chain Pressure Index — a composite of varied provide chain indicators — ticked up in June, however stays effectively beneath ranges seen even earlier than the pandemic. It is definitely method down from its December 2021 provide chain disaster excessive.

From the NY Fed: “There have been vital upward contributions from Nice Britain and Euro Space backlogs in addition to United States and Taiwan supply instances. Trying on the underlying knowledge, the readings for Nice Britain backlogs (the biggest contributor to the upward transfer within the GSCPI this month) are above their historic common for the primary time since February.”

💵 Shoppers nonetheless appear to have extra financial savings. From Financial institution of America: “U.S. shoppers had round $675bn in extra financial savings from pandemic-era fiscal stimulus and spending distortions. These financial savings had been operating down at a fee of $70bn monthly. Subsequently on the present fee, extra financial savings will run out in 9-10 months.”

BofA cautions that these are all simply estimates. Certainly, relying on who you ask, these estimates range broadly. A latest San Francisco Fed examine estimated U.S. households nonetheless had about $500 billion in excess savings. Apollo World’s Torsten Slok, in contrast, estimated households had been sitting on nearer to $1.2 trillion in excess savings. A Federal Reserve Board examine not too long ago estimated that extra financial savings had been depleted as of Q1.

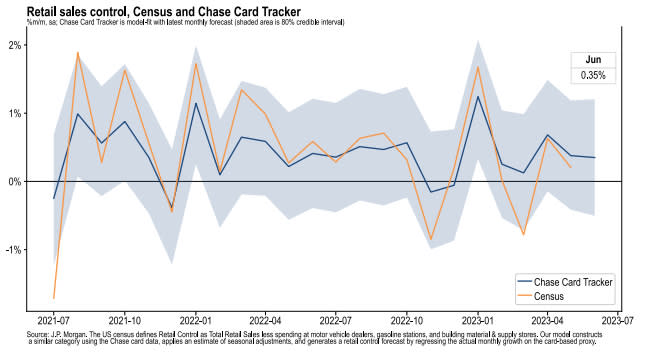

💳 Card spending progress is constructive. From JPMorgan Chase: “As of 30 Jun 2023, our Chase Client Card spending knowledge (unadjusted) was 1.3% above the identical day final 12 months. Based mostly on the Chase Client Card knowledge by way of 30 Jun 2023, our estimate of the US Census June management measure of retail gross sales m/m is 0.35%.”

🏭 Manufacturing surveys look dangerous. From S&P World’s June U.S. Manufacturing PMI (by way of Notes): “The well being of the US manufacturing sector took a pointy flip for the more serious in June, including to issues over the financial system probably slipping into recession within the second half of the 12 months.”

Equally, the ISM’s June Manufacturing PMI (by way of Notes) signaled contraction within the sector for the eighth consecutive month.

These unfavorable survey outcomes proceed to return as exhausting broad measures of the economy proceed to carry up.

HOWEVER, construction spending data from the Census Bureau suggests the state of producing is way stronger than implied by the comfortable survey knowledge.

Particularly, manufacturing building spending (h/t Joseph Politano) grew to a brand new file excessive in Could.

Additionally Orders for nondefense capital items excluding plane — a.okay.a. core capex or business investment — rose 0.7% to a file $74.1 billion in Could.

👍 Providers surveys look good. From S&P World’s June U.S. Providers PMI: “June noticed encouraging resilience of the US companies financial system, which helped offset a renewed contraction of producing output to make sure the general tempo of financial progress remained encouragingly strong. The surveys sign GDP progress of slightly below 2% for the second quarter as an entire, albeit with June seeing some lack of momentum.”

Equally, the ISM’s June Services PMI signaled growth within the sector for the sixth consecutive month.

📈 Close to-term GDP progress estimates stay constructive. The Atlanta Fed’s GDPNow model sees actual GDP progress climbing at a 2.1% fee in Q2. Whereas the mannequin’s estimate is off its excessive, it’s however very constructive and up from its preliminary estimate of 1.7% growth as of April 28.

Placing all of it collectively 🤔

We proceed to get proof that we might see a bullish “Goldilocks” soft landing scenario the place inflation cools to manageable ranges with out the financial system having to sink into recession.

The Federal Reserve not too long ago adopted a much less hawkish tone, acknowledging on February 1 that “for the primary time that the disinflationary course of has began.” On May 3, the Fed signaled that the top of rate of interest hikes could also be right here. And at its June 14 coverage assembly, it stored charges unchanged, ending a streak of 10 consecutive fee hikes.

In any case, inflation nonetheless has to return down extra earlier than the Fed is snug with worth ranges. So we must always expect the central bank to keep monetary policy tight, which implies we ought to be ready for tight monetary circumstances (e.g. increased rates of interest, tighter lending requirements, and decrease inventory valuations) to linger.

All of this implies monetary policy will be unfriendly to markets in the meanwhile, and the danger the economy sinks right into a recession might be comparatively elevated.

On the identical time, we additionally know that shares are discounting mechanisms, which means that prices will have bottomed before the Fed signals a major pivot in monetary policy.

Additionally, it’s vital to do not forget that whereas recession dangers are elevated, consumers are coming from a very strong financial position. Unemployed persons are getting jobs. These with jobs are getting raises. And lots of nonetheless have excess savings to faucet into. Certainly, sturdy spending knowledge confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to turn into economic calamity on condition that the financial health of consumers and businesses remains very strong.

And as all the time, long-term buyers ought to do not forget that recessions and bear markets are simply part of the deal once you enter the inventory market with the intention of producing long-term returns. Whereas markets have had a pretty rough couple of years, the long-run outlook for shares remains positive.