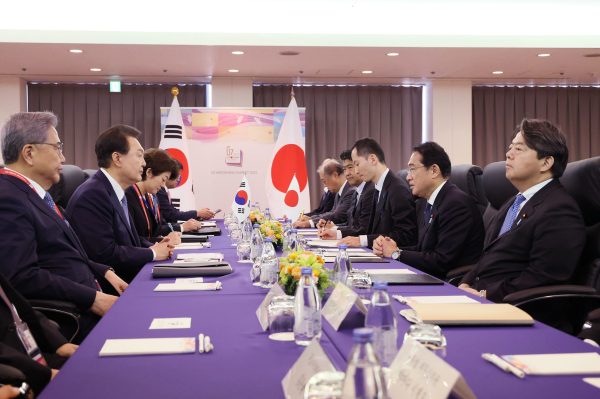

The third meeting in two months between Japan’s Prime Minister Kishida Fumio and South Korea’s President Yoon Suk-yeol, this time on the sidelines of the Hiroshima G-7 summit on Might 21, marked a milestone within the relationship between the 2 Northeast Asian neighbors.

The 2 nations have lengthy been at loggerheads over Japan’s colonial and wartime legacy. Whereas ongoing hostility towards Tokyo in South Korean society and political opposition could make the 2 nations’ rapport short-lived, these developments nonetheless mark a turnaround within the bilateral relationship, which had deteriorated over the course of former South Korean President Moon Jae-in’s tenure.

The rationale for the advance in ties has been attributed to a gathering of minds between two conservative leaders on safety points.

Topping the listing is the escalating menace posed by North Korea’s more and more subtle nuclear missile arsenal. However clearly the China dimension is essential, given the Chinese language authorities’s growing authoritarianism at house, and aggression within the maritime domains by means of which these international locations’ key maritime lifelines run. Each leaders have confronted rising tensions with Xi Jinping’s China.

The China-South Korea relationship specifically has deteriorated on the again of a complaint lodged by Beijing over Yoon’s views on Taiwan, and a public spat between South Korea’s embassy in Beijing and a Chinese language state media tabloid about his pleasant overtures towards Washington and Tokyo.

However there’s one other necessary issue that warrants consideration within the China-Japan-South Korea triangular dynamic. Each Seoul and Tokyo have seen their commerce relationships with China materially reworked, shifting from robust complementarities to growing competitors in key strategic industries.

The rising rapport between Japan and South Korea is going on as long-running commerce rivalries between the 2 democratic nations are being overshadowed by threats posed by China’s financial transformation. That is occurring, furthermore, on the very time that the advantages South Korea and Japan have reaped from the China market are declining considerably.

Underlying this transformation is a set of shifts in every nation’s key export industries. Key amongst these are automobile exports, together with the quickly rising market of electrical automobiles (EVs).

Japan’s Automotive Business Feels the Pinch

Japan’s automotive business specifically is feeling the influence of the rise of China as a car-exporting superpower. Primarily based on recent data, China has already taken the mantle of the world’s largest automobile exporter from Japan, whose exports fell 8 % in 2022.

Japanese carmakers are additionally seeing quickly diminishing returns within the Chinese language market. Chinese language producers have begun to dominate home gross sales, whereas the fortunes of Japanese carmakers have fallen dramatically. Nissan’s gross sales in China fell by 25 % within the first quarter of 2023; Honda and Toyota each recorded drops of 19 %.

Led by this fall in demand for automobiles and auto components, Japan’s exports to China total fell 6.2 % year-on-year in worth in December. In January of this 12 months, they plunged to a seven-year month-to-month low, and continued to fall by means of to March, which noticed a year-on-year decline of seven %.

Whereas this already presents troubling milestones for Japan’s champion automotive business, China’s progress within the EV sector probably presents larger challenges.

The EV market is more and more important to the sector, with the Boston Consulting Group final 12 months forecasting that EVs will make up one-fifth of worldwide gentle automobile gross sales by 2025, and nearly 60 % by 2035. In response to an International Energy Agency report, China final 12 months grabbed a share of roughly 35 % of the worldwide EV export market, up 10 share factors in a single 12 months. Japan, which has seen its share drop from round 25 % to lower than 10 % in 4 years (2018-2022), is properly behind within the race with China to consolidate its market place within the sector that’s possible ultimately to dominate the automotive business.

That’s a giant downside, given the importance of Japan’s automotive business to its financial system as a complete.

Two of Japan’s three largest corporations (Toyota and Honda) are within the automotive sector, with Toyota, Japan’s company champion, rating number 13 within the 2022 Fortune World 500 listing. Automobiles and automobile components had been Japan’s second top export in 2022, producing $136 billion and representing 18 % of Japan’s whole export worth.

The business instantly and not directly employs about 5.4 million individuals, or round 8 % of Japan’s workforce. The federal government’s Japan Exterior Commerce Group describes the automotive business as a “key driver of Japan’s manufacturing business” on account that it has a “vital influence” on “the procurement of supplies and components, which in flip drastically influences the general Japanese financial system.”

On this context, China’s quickly rising competitiveness and market share within the EV export market specifically probably pose vital financial risks for Japan. In response to a brand new Local weather Group report, Japan’s sluggishness within the EV market, which Chinese language carmakers want to dominate, means Japan’s automobile business dangers dropping 1.7 million jobs, and billions in earnings. This might, in keeping with the report, immediate a 14 % drop within the nation’s GDP.

South Korea’s Automotive Business: A Comparable Story

South Korea, whose automotive business performs a comparatively much less pivotal however nonetheless necessary position in shaping that nation’s financial fortunes, to a level shares these anxieties.

The business in 2020 accounted for roughly 3 % of the nation’s GDP and over 11 % of employment within the manufacturing sector. Three automotive/auto components corporations are within the listing of the nation’s top 10 companies by market capitalization – Hyundai (4th), Kia (fifth), and Hyundai Mobis (sixth) – whereas Samsung, the main agency, is a provider of high-tech automotive elements.

The business, together with semiconductors and digital units, has additionally turn out to be a key image of South Korea’s rise as a sophisticated manufacturing hub, with two Korean corporations within the international high 20 automobile makers in 2022, and 9 Korean corporations among the many high 100 auto components makers in 2021. The business’s strategic significance was mirrored by Seoul saying a $72 billion investment final 12 months, with the purpose of capturing 12 % international market share within the EV market by 2030.

To date South Korea’s automotive business has fared far better than Japan’s within the face of rising Chinese language competitors. After hitting a new high in 2022 – during which exports exceeded an annual determine of $50 billion for the primary time – 2023 has seen continued positive aspects, with February seeing a 34.8 % year-on-year achieve. The sum of vehicle and components exports reached $7.6 billion for that month, making it the primary performing export for the primary time in six years, accounting for 15.2 % of exports by worth.

South Korean carmakers additionally made positive aspects in EV gross sales, which crossed the earlier annual file of $5.42 billion (2022) in solely two months in 2023. February’s exports had been 83.4 % greater than these of the identical month within the earlier 12 months.

However the information has not all been good for South Korean carmakers, notably concerning alternatives in China and competitors from Chinese language rivals.

South Korean automobiles’ share of the Chinese language market dropped beneath 2 % in 2022, down from practically 8 % in 2016. Within the first quarter of 2022, Korean carmakers closed some factories in China after a 40 % lower in year-on-year gross sales.

The Korea Car Producers Affiliation not too long ago voiced its issues about the way forward for South Korea’s business, saying, “The sharp improve in Chinese language vehicle exports has a detrimental influence on the growth of Korean exports.” It additionally said that “Korean corporations’ competitors with their Chinese language counterparts… is anticipated to accentuate as Chinese language corporations are increasing their exports with governmental assist.”

But the influence of each declining market share in China, and growing Chinese language competitors elsewhere, shouldn’t be restricted to South Korea’s automotive business.

Complete South Korean exports to China have shrunk dramatically in 2023, with most months round 30 % down from the identical month final 12 months. That detrimental pattern introduced South Korea’s exports to China beneath 20 % of the worldwide whole for the primary time since 2005, and dragged down South Korea’s total export volumes, which had been down 14 % year-on-year in April. Except for decrease automobile gross sales, the drop was led by a steep decline in China-bound exports of South Korean semiconductors – one in all South Korea’s champion industries, and its most profitable export in recent times – after Korean imports misplaced floor to native or regionally primarily based suppliers.

Furthermore, these setbacks may properly be a harbinger of larger risks for South Korea’s high-tech exports extra typically.

A 2022 report from the Korea Worldwide Commerce Affiliation’s Institute for Worldwide commerce famous that China has already turn out to be a market chief in three of 5 key rising industries: superior shows, rechargeable batteries, and newer-generation semiconductors. A survey of 300 South Korean exporting corporations by the Korean Chamber of Commerce and Business reported that almost 40 % of business respondents mentioned that China was lower than three years behind south Korea in “technological competitiveness,” a Korean measure of technological superiority, marketability, and feasibility, whereas nearly the identical quantity felt the 2 nation’s ranges had been roughly comparable. Greater than 40 % of respondents felt that the pace of China’s technological improvement will surpass South Korea’s over the subsequent 5 years.

Competitors, Commerce, and Geopolitics

The notion that the advantages to South Korea and Japan of commerce complementarity with China are declining, whereas the financial threats of competitors are considerably intensifying, provides another rationalization for the rising rapport between the 2 democratic nations.

In view of the latest spate of diplomatic spats between Beijing and each Seoul and Tokyo, additionally it is value reflecting on whether or not this pattern is undermining the financial ballast that has hitherto helped stabilize their relations with China. Bilateral ties seem to now be deteriorating in opposition to the backdrop of issues about Beijing’s growing authoritarianism, assertiveness, and alleged hegemonic ambitions.

This might in flip deliver Japan and South Korea nearer into the orbit of Washington. The USA is selling “friend-shoring” and different measures to develop resilient provide chains, which may present new commerce alternatives for its allies, and is searching for to determine a broader entrance amongst superior economies to include China’s technological improvement.

It additionally prompts interrogation on the inflection level the place financial competitors turns into predominantly political – or when the degradation of key industries threatens to have a profound influence on nationwide power and worldwide affect.

Relative to the opposite nations, that is arguably one thing that has been approached extra overtly and with some sophistication in Northeast Asia, the place Japan, South Korea, and China share roughly related concepts on the nexus between technological improvement, nationwide power, and company within the worldwide sphere.

This has prompted the event, and ample safety, of extremely parallel, and inter-competitive, superior sector economies. That could be an understated issue underlying frequent tensions within the neighborhood, which have hitherto usually been primarily attributed to historic, ethnic, and territorial animosities.

To the extent that that is the case, the influence of those animosities could stretch additional. As EV sector competitors escalates, EV batteries, and the essential minerals wanted to provide them equivalent to lithium, are more and more being securitized.

Canada ordered three Chinese language corporations to divest from its lithium mines late final 12 months, whereas the USA’ Inflation Discount Act will quickly require EV producers to supply 40 % of the essential minerals of their batteries from pleasant nations. Australia, which exports the overwhelming majority of the lithium it extracts to China, has been earmarked as a possible beneficiary of the act, and has not too long ago seen rising curiosity in lithium, hydrogen, and different essential minerals utilized in EV batteries from each South Korea and Japan.

Having flagged the “have to be… cognizant of the position Australia’s essential minerals will play within the safety of our trusted regional mates and allies,” Canberra’s commerce conundrums, too, could finally rely by itself solutions as to how the somber actuality of geopolitical issues, and the precept of unfettered international commerce, can renegotiate their coexistence in a post-unilateral international order.