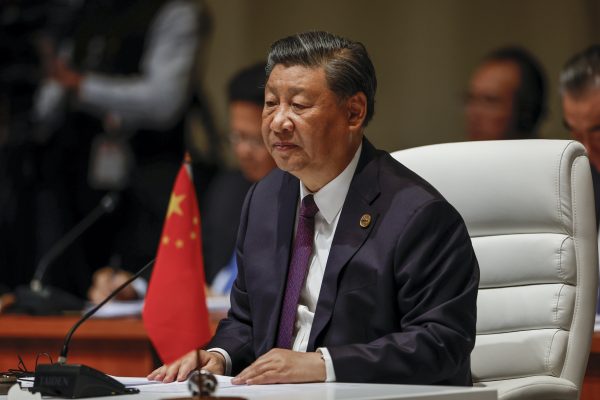

Within the safety state that Chinese language chief Xi Jinping is constructing, financial safety issues. However within the “securitization of everything” that’s emblematic of his governing model, how essential is it precisely?

Financial safety is simply one of many 16 areas outlined in Xi’s 2014 imaginative and prescient of “complete nationwide safety” (总体国家安全). This idea encompasses a broad vary of points, from tradition to “ecological safety.” When he first introduced the notion on the founding session of the Central Nationwide Safety Fee, Xi Jinping referred to as financial safety the “basis” of China’s complete strategy. As such, it ranked under the “bedrock” (根本) of “political safety,” which facilities on preserving China’s regime stability.

Among the many different parts listed, army and technological safety are supposed to present an “assurance” (保障) to that overarching purpose. The remaining domains, resembling deep sea and house, are areas the place the party-state goals to defend Chinese language pursuits from threats.

China’s “complete nationwide safety” idea was first articulated throughout a important juncture in Xi Jinping’s first time period on the high of the Politburo Standing Committee, when his nationwide safety prioritization began changing into apparent. Since then, China’s worldwide surroundings has significantly deteriorated, largely because of pushback in opposition to Xi’s insurance policies. An element behind this deterioration is the rise of financial safety agendas in the USA, Japan, Europe, and South Korea, which complicates Chinese language nationwide and company methods to broaden internationally.

Most international locations’ methods don’t explicitly point out China, a fig-leaf strategy referred to by the EU as “country-agnostic.” The USA makes use of the designation “foreign countries of concern” (China, North Korea, Iran, and Russia), saying its purpose is to ensure “malign actors should not have entry to cutting-edge expertise that can be utilized in opposition to America and our allies.”

Whether or not these insurance policies overtly state it or disguise it behind diplomatic language, all of them reply to the identical dangers: China’s extreme leverage ensuing from its funding in important infrastructure and its significance in lots of provide chains, which creates choices for financial coercion or the restriction of entry to important uncooked supplies; leakage of civilian expertise that leads to army initiatives; and a listing of points linked to an uneven enjoying subject with China’s state-led financial system, and its highly effective industrial insurance policies.

Financial safety is hotly debated in the European Union. Some argue that by securitizing financial relations with China, the European Fee is gaining extreme energy on the expense of EU nationwide governments. Others criticize a very defensive posture, with dangers for the European single market, and query the extent to which the Fee’s agenda is pushed by the USA.

In contrast, there’s little public debate in China in regards to the notion, besides within the space of provide chain resilience. Naturally, nobody can contest absolutely the precedence positioned on “political safety” and the designation of “financial safety” as a instrument for attaining it. Framing “financial safety” from the outset because it pertains to regime stability sidesteps questions raised within the West, particularly the central distinction between a narrower EU strategy prioritizing army applied sciences, coercion, and extreme leverage versus a broader strategy favored by the USA and Japan, centered on financial competitiveness.

Xi’s absolute precedence on nationwide safety displays the Chinese language Communist Occasion’s evaluation that the “interval of strategic alternative,” beforehand emphasised by all Chinese language leaders since Deng Xiaoping, has now come to an finish, changed by a interval of “modifications unseen in a century.” In Xi’s “New Period,” one would possibly add that the highest precedence has shifted from the prosperity of the Chinese language individuals to a quest for state energy on the worldwide stage.

With clearly established strategic priorities, the house for coverage debate lies in how you can pragmatically implement environment friendly insurance policies. China undoubtedly faces provide chain challenges, delivered to mild by U.S. semiconductor restrictions. The answer to this? “Vertical integration,” the place main market gamers leverage their measurement to construct a self-reliant provider community, or at the least one with decreased disruption dangers. Right here, firms are the implementers of a method designed by the social gathering management. As well as, Chinese language views appear to favor public stockpiling of important uncooked supplies, an strategy usually dismissed in Europe as a pricey waste of assets.

In terms of relations with the EU, Chinese language commentaries depart from “de-risking is simply decoupling in disguise” line, as goes a now well-known Xinhua commentary. Since 2022, there was a flurry of diplomatic exercise to numb the European de-risking agenda. This effort culminated with the Germany go to of Chinese language Prime Minister Li Qiang, who within the presence of German high firms executives, rejected “de-risking” and referred to as for all events to undertake as a substitute a “dialectical view of dependence,” that means “one ought to chorus from exaggerating ‘the diploma of dependence’ and even merely equating interdependence with insecurity.”

The message right here is that the 2 sides are in a position to co-manage the dependence dangers they pose to one another. What goes unmentioned is the asymmetry within the decision-making course of that results in imposing prices – China below Xi Jinping has a well-established file of financial coercion, whereas the EU anti-coercion instrument, newly adopted in October 2023, requires the exhaustion of all diplomatic choices earlier than the EU can resort to defensive retaliatory measures.

Chinese language alerts are considerably contradictory. On the one hand, China makes use of high international leaders’ visits to Beijing to safe public statements in opposition to decoupling. However, China welcomes the European rejection of decoupling, and focuses on managing the concrete challenges that the EU’s de-risking insurance policies will proceed to pose to China-EU interactions. There appears to be an understanding that European strikes are rational and justified. In spite of everything, Europe stays extremely extra open to China than the other.

In sum, China seeks to reduce the European “de-risking” agenda whereas additionally selling its personal national-security-first strategy in China-EU commerce and funding relations. That is primarily what the Chinese language ambassador to the EU, Fu Cong, stated when he argued that “in our view, dependency shouldn’t be harmful. What’s harmful is to weaponize the dependency. If the EU has the political will to alleviate their considerations, China is able to speak to them and are available to some form of settlement. We should always not weaponize the dependencies that one aspect might have on the opposite.”

China, nevertheless, has a confirmed observe file of weaponizing dependencies and can be speeding to scale back its personal reliance on international suppliers. Whereas Fu’s assertion could also be inadequate to construct belief, it however has the advantage of underlining China’s diplomatic tactic of downplaying the issue.

This text was initially revealed because the introduction to China Trends 17, the quarterly publication of the Asia Program at Institut Montaigne. Institut Montaigne is a nonprofit, impartial suppose tank primarily based in Paris, France.