On this photograph illustration, a visible illustration of the digital Cryptocurrency Ripple is displayed on January 30, 2018 in Paris, France.

Chesnot | Getty Photos

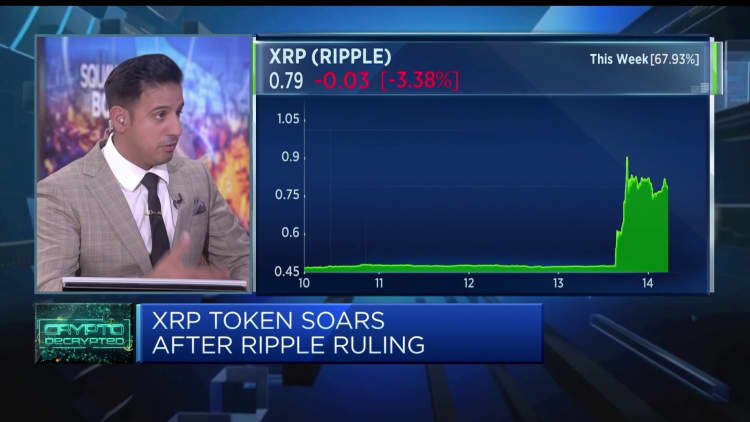

Blockchain startup Ripple is assured that US banks and different monetary establishments within the nation will present curiosity in adopting it XRP cryptocurrency in cross-border funds after a landmark ruling decided that the token in itself was not essentially a safety.

The San Francisco-based firm expects to start discussions with U.S. monetary companies within the third quarter about utilizing its On-Demand Liquidity (ODL) product, which makes use of XRP for cash transfers, Ripple normal counsel Stu Alderoty advised CNBC in an interview final week.

associated funding information

Final week, a New York decide issued a decisive ruling for Ripple, discovering that XRP itself is “not essentially a safety on the face of it,” partially disputing U.S. Securities and Change Fee claims in opposition to the corporate.

Ripple has been battling the SEC for the previous three years over allegations from the company that Ripple and two of its executives carried out an unlawful $1.3 billion providing by means of the sale of XRP. Ripple disputed the claims, insisting that XRP can’t be thought-about a safety and is extra like a commodity.

Ripple’s enterprise suffered consequently, shedding not less than one buyer and investor. MoneyGram, the US cash switch large, discontinued its partnership with Ripple in March 2021.

In the meantime, Tetragon, a UK-based investor who beforehand backed Ripple, bought its stake again to Ripple after unsuccessfully attempting to sue the corporate to refund its cash.

When requested if the ruling meant US banks would return to Ripple to make use of their ODL product, Alderoty mentioned, “I feel the reply to that’s sure.”

Ripple additionally makes use of blockchain in its enterprise to ship messages between banks, type of a blockchain-based various to Swift.

“I feel we’re hopeful that this determination would offer some consolation to monetary establishment purchasers or potential purchasers to not less than are available in and begin the dialog in regards to the points they’re experiencing of their enterprise, actual points by way of transferring worth throughout borders with out incurring obscene prices,” Alderoty advised CNBC on Friday.

“Hopefully this quarter will generate plenty of conversations with clients in the US, and hopefully a few of these conversations will really result in actual enterprise,” he added.

Ripple now sources most of its enterprise from exterior the US, with Alderoty beforehand telling CNBC: “[Ripple]his clients and his revenues are all pushed exterior the US, regardless that we nonetheless have plenty of workers within the US,” he added.

Ripple has greater than 750 workers worldwide, about half of them within the US

XRP is a cryptocurrency Ripple makes use of to maneuver cash throughout borders. It’s presently the fifth largest cryptocurrency in circulation, with a market cap of $37.8 billion.

The corporate is utilizing the token as a “bridge foreign money” between transfers from one fiat foreign money to a different — US {dollars} to Mexican pesos, for instance — to resolve the issue of needing pre-funded accounts on the opposite facet of a switch to ready for the cash to course of.

Ripple says XRP permits split-second cash motion.

Nonetheless, the ruling didn’t mark a complete victory for Ripple. Whereas the decide acknowledged that XRP was not a safety, additionally they mentioned that some gross sales of the token certified as securities transactions.

For example, about $728.9 million in gross sales of XRP to establishments the corporate labored with certified as securities, the decide mentioned, declaring that there was a three way partnership, a revenue expectation.

Alderoty admitted it wasn’t a complete win for Ripple and that the corporate would research the choice sooner or later to see the way it impacts its enterprise.

“She [Judge Analisa Torres] discovered – though we disagreed along with her – that our previous gross sales on to institutional patrons had the traits of a safety and may have been recorded,” he mentioned.

He mentioned Ripple’s present operations aren’t affected by that a part of the ruling, as its clients are primarily situated exterior the US.

“We’ll research the decide’s determination, we’ll take a look at our clients’ wants to take a look at the market, and see if there is a state of affairs right here that meets the 4 corners of what the decide discovered in terms of establishments, ” he mentioned.