Nvidia (NVDA), a large in information facilities and gaming, is supercharging investor curiosity in synthetic intelligence. Is Nvidia inventory a purchase because it exams a key stage amid the Israel-Hamas warfare?

X

Semiconductor, AI Information

On Oct. 9, Nvidia canceled its synthetic intelligence (AI) summit in Tel Aviv, scheduled for Oct. 15-16, attributable to security issues after Hamas attacked Israel over the weekend. Forward of the occasion, the chip large had described Israel as “one of many world’s most vibrant know-how hubs.”

In the meantime, key buyer Microsoft (MSFT) plans to launch unveil its personal AI chip subsequent month, The Data reported late on Oct. 6. OpenAI additionally reportedly is working by itself chips.

Per week earlier, funding financial institution Goldman Sachs added the AI chipmaker to its “conviction purchase” listing of high inventory picks.

Nvidia smashed lofty expectations for earnings in late August, and guided greater.

Earlier that month, Nvidia unveiled its next-gen AI tremendous chip: the GH200, coming subsequent yr.

Nvidia faucets the rising marketplace for generative AI. Generative AI can create content material, together with written articles, from easy phrases by analyzing huge quantities of knowledge. It will probably additionally write programming code.

For these on the lookout for the highest large-cap shares to purchase now, this is a dive into the AI chip chief.

Nvidia Inventory Technical Evaluation

Nvidia inventory has fashioned a brand new base with a 502.66 purchase level. The chip inventory cleared an early entry on Oct. 6 with its clear transfer above the 50-day shifting common.

However NVDA inventory fell 2.1% to 447.84 Oct. 9, amid a broader sell-off after the Hamas assault. It additionally undercut the 50-day line intraday, however was buying and selling round that stage in afternoon motion.

Traders might now use the Oct. 6 excessive of 457.89 as an early entry.

Shares of the chipmaker achieved a report excessive in late August on AI-fueled progress, then pulled again within the current inventory market correction.

After a painful 2022, NVDA inventory has soared about 205% yr up to now. It principally held up higher than progress shares at giant throughout current market selloffs. Nvidia joined IBD Leaderboard after gapping up on earnings in February. It surged once more in Might on AI-fueled earnings and outlook.

The relative power line rose to highs with the inventory however has now pulled again a bit, the IBD MarketSmith charts show. A rising RS line implies that a inventory is outperforming the S&P 500. It’s the blue line within the chart proven.

NVDA earns a best-possible IBD Composite Rating of 99. In different phrases, Nvidia inventory is within the high 1% of all shares by way of technical and basic metrics.

Traders usually ought to give attention to shares with Comp Rankings of 90 and even 95 and above. Nvidia inventory usually earns a spot on the IBD 50, Big Cap 20 and Sector Leaders lists.

The IBD Stock Checkup device exhibits that NVDA carries a Relative Power Ranking of 99. Meaning it has outperformed 99% of all different shares over the previous yr.

The iShares PHLX Semiconductor ETF (SOXX) holds each Nvidia inventory and AMD inventory.

IBD Live: A New Tool For Daily Stock Market Analysis

Nvidia Earnings

Nvidia’s EPS Rating is 93 out of 99 and its SMR Rating is an A, on a scale of A to a worst E. The EPS score compares an organization’s earnings progress to different shares. Its SMR Ranking gauges gross sales progress, revenue margins and return on fairness.

On Aug. 23, the chip large delivered one other large beat-and-raise report, pushed by its data-center enterprise.

12 months over yr, Nvidia earnings rocketed 429% in Q2, whereas gross sales soared 101%.

The Santa Clara, Calif.-based firm’s data-center income surged 171%. The info-center enterprise contains the A100 and H100 AI chips wanted for AI purposes.

For the present third quarter, Nvidia guided gross sales of $16 billion, up 170%, and effectively above estimates.

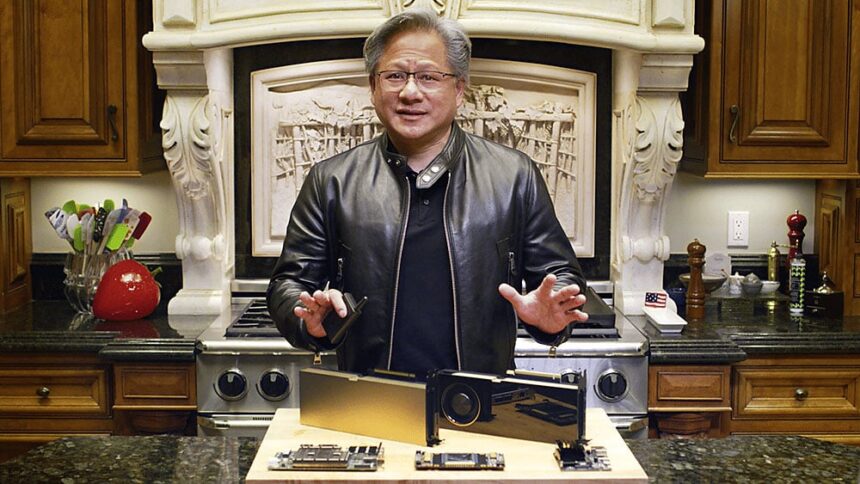

“A brand new computing period has begun,” Chief Government Jensen Huang stated in a information launch. “Corporations worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

For the complete yr, analysts now anticipate Nvidia earnings to rebound 219% as gross sales leap 103%. Final yr, Nvidia earnings fell 25% per share. Nvidia’s fiscal yr ends in January.

Out of 51 analysts protecting NVDA inventory, 49 fee it a purchase. Three have a maintain and nobody has a promote, in accordance with FactSet.

Trying For The Subsequent Large Inventory Market Winners? Begin With These 3 Steps

NVDA Backstory, Rivals

The fabless chipmaker pioneered graphics processing models, or GPUs, to make video video games extra sensible. It is increasing in AI chips, utilized in supercomputers, information facilities and drug growth.

Nvidia’s GPUs act as accelerators for central processing models, or CPUs, made by different firms. It is engaged on “supercomputers” combining its personal CPUs and GPUs.

As well as, Nvidia chips are used for Bitcoin mining and self-driving electrical vehicles.

Nvidia has made a large push into metaverse purposes.

Fabless chip shares embody Qualcomm (QCOM), Broadcom (AVGO) and Monolithic Energy Methods (MPWR).

Presently, the fabless group ranks No. 37 out of 197 business teams. Fabless firms design the {hardware} whereas outsourcing the manufacturing to a third-party agency.

For the very best returns, traders ought to give attention to firms which are main the market and their very own business group.

Is Nvidia Inventory A Purchase?

On a basic stage, Nvidia is poised for explosive progress. Earnings ought to greater than triple this fiscal yr, pushed by booming chip gross sales for information facilities and synthetic intelligence.

The fabless chipmaker is increasing in different progress areas, reminiscent of automated electrical vehicles and cloud gaming, as effectively. The adoption of the metaverse and cryptocurrencies might additional stoke demand for Nvidia chips.

Nevertheless, macroeconomic uncertainties and danger of world recession linger.

NVDA inventory has staged an enormous comeback, greater than tripling to date this yr. It is close to a brand new 502.66 purchase level however is fighting a key stage as warfare returns to the Center East.

Backside line: Nvidia inventory shouldn’t be a purchase proper now. As a chip firm with publicity to high progress markets, Nvidia is all the time one to observe.

Take a look at IBD Inventory Lists and different IBD content material to seek out dozens of the finest shares to purchase or watch.

YOU MAY ALSO LIKE:

Is AMD Inventory A Purchase?

See The Finest Shares To Purchase And Watch

Catch The Subsequent Large Successful Inventory With MarketSmith

Join IBD Live And Learn Top Chart-Reading And Trading Techniques From The Pros