Share costs of Tremendous Micro Pc (NASDAQ: SMCI) took off up to now yr, gaining 1,180% as of this writing, and an enormous cause behind the inventory’s red-hot surge is the booming demand for Nvidia‘s (NASDAQ: NVDA) synthetic intelligence (AI) graphics playing cards.

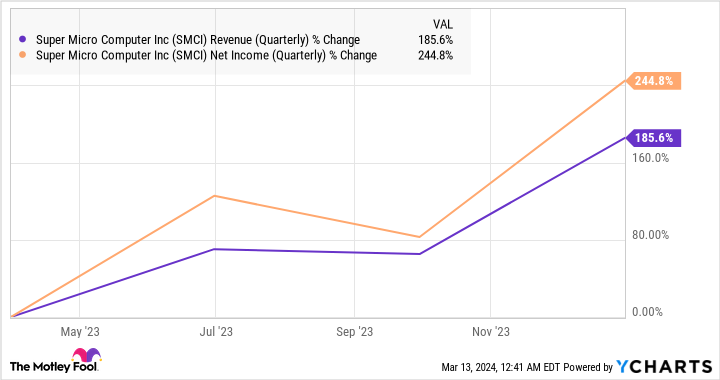

Supermicro’s modular server rack-scale techniques are getting used to mount AI-related graphics playing cards from Nvidia, in addition to different chipmakers. Because the demand for Nvidia’s playing cards has elevated, Supermicro has additionally witnessed a terrific soar in demand for its server options, resulting in fast progress within the firm’s high and backside traces.

And now, a current revelation from Nvidia CEO Jensen Huang means that Supermicro’s eye-popping progress will proceed.

Nvidia’s adoption of liquid-cooled techniques ought to give Tremendous Micro Pc a lift

Nvidia’s present flagship AI graphics card, the H100, reportedly performs effectively below air cooling. What’s extra, the upcoming H200 processor can be anticipated to carry out optimally whereas being air-cooled, in keeping with Tom’s {Hardware}. However at an financial summit at Stanford this week, Huang mentioned that certainly one of Nvidia’s next-generation computer systems goes to be liquid-cooled.

Nvidia’s next-generation AI graphics processing items (GPUs) based mostly on the Blackwell structure are anticipated to eat 40% extra energy than the present choices based mostly on the Hopper structure. In line with another claims, Nvidia’s next-generation AI chips may even eat double the ability of the present lineup. That is the place liquid-cooled server techniques are going to return into the image.

When launching what Supermicro claimed to be the primary liquid-cooled server techniques for Nvidia’s H100 processors final yr, the corporate mentioned:

Financial savings for an information heart are estimated to be 40% for energy when utilizing Supermicro liquid cooling options in comparison with an air-cooled knowledge heart. As well as, as much as 86% discount in direct cooling prices in comparison with current knowledge facilities could also be realized.

A have a look at third-party research suggests one thing related. Liquid cooling reportedly consumes simply 20% of the power required for air cooling. In different phrases, liquid cooling is thought to scale back power consumption in knowledge facilities considerably, whereas additionally serving to cut back working bills by utilizing much less water than air-cooled knowledge facilities.

Supermicro appears to have been forward of the curve, because it took the initiative to launch liquid-cooling options for Nvidia’s AI chips final yr. The corporate is now working to spice up the manufacturing capability of liquid-cooled server racks. On its January earnings convention name, Supermicro administration remarked: “By this June quarter, we may have high-volume, devoted capability for manufacturing 100-kilowatt to 120-kilowatt racks with liquid-cooling capabilities, offering DLC, direct liquid cooling racks capability, as much as 1,500 racks per thirty days, and our complete rack manufacturing capability will likely be as much as 5,000 racks per thirty days by then.”

The corporate’s concentrate on increasing its capability of liquid-cooled servers won’t solely let it make the most of Nvidia’s power-hungry AI chips but in addition enable it to make a dent within the fast-growing marketplace for liquid-cooled knowledge facilities as an entire. The liquid-cooled knowledge heart market is anticipated to generate annual income of $40 billion in 2033, in contrast with simply $4.5 billion final yr, clocking an annual progress charge of 24% over the subsequent decade.

As such, it will not be stunning to see Supermicro sustaining its wholesome tempo of progress for a very long time to return.

The inventory’s valuation makes shopping for it a no brainer

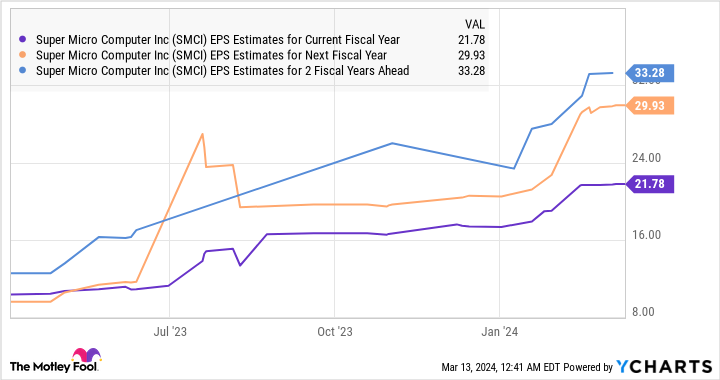

Although Supermicro has been on a tear on the inventory market over the previous yr, its gross sales a number of stands at simply 6.7. That is cheaper than the know-how sector’s price-to-sales ratio of seven.1. Furthermore, Supermicro’s ahead earnings a number of of 36 factors towards an enormous soar in its backside line, contemplating its trailing earnings a number of of 84.

As the next chart suggests, Supermicro’s earnings are set to take off massive time from the earlier fiscal yr’s studying of $11.81 per share.

It is also value noting that analysts have raised their earnings progress expectations from the corporate, and there is a good likelihood that they could maintain elevating these estimates contemplating added catalysts such because the rising demand for liquid-cooled techniques. That is why now could be time for buyers to purchase this AI inventory, because it appears able to sustaining its beautiful rally in the long term.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Tremendous Micro Pc wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 11, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

Nvidia Just Dropped Great News for Super Micro Computer Stock was initially revealed by The Motley Idiot