Discovering profitable progress shares to purchase generally is a problem, however the Relative Energy Blue Dot inventory display in IBD MarketSmith rapidly identifies rising leaders. It is no shock that NVDA inventory appeared on the record of 70 names, however two others are value highlighting.

X

The inventory display is a part of the MarketSmith experiences, and lists all shares that had a blue dot on their chart on the time of the screening.

The dot marks shares whose relative power line is at new highs whereas the inventory is close to a purchase level or whereas forming a base. That is a bullish mixture. (The RS line compares a inventory’s value efficiency with that of the S&P 500 on every day and weekly charts.)

NVDA Inventory Hits New Excessive

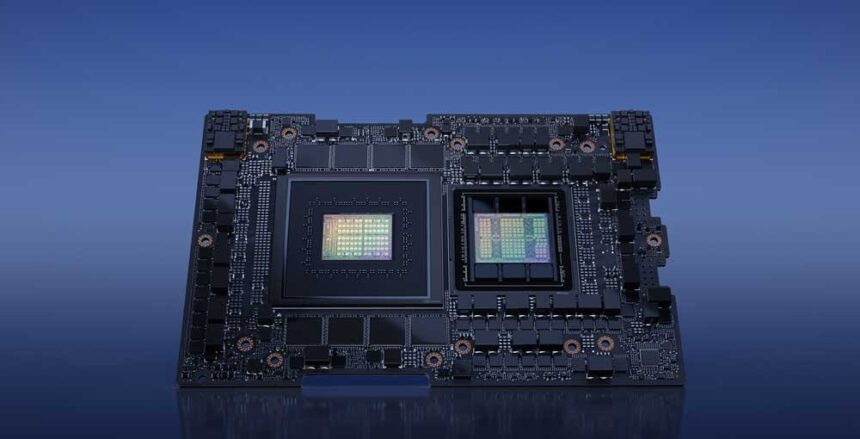

Nvidia (NVDA) continues to outperform the S&P 500 by a protracted shot. NVDA inventory gained over 230% over the previous 12 months, whereas the S&P 500 has gained round 19%.

The IBD 50 inventory is prolonged from a flat base with a 505.48 purchase level. NVDA inventory broke out of the bottom on Jan. 8 in heavy quantity, and climbed to one more all-time excessive on Tuesday. The AI chipmaker’s fiscal 2024 earnings are anticipated to develop a whopping 241% within the fiscal 12 months ending this month, and 69% within the subsequent fiscal 12 months, per MarketSmith. Nvidia continues to steer within the specialty chip and AI area.

Cruise Line Inventory Finds Assist

Outdoors of NVDA inventory, Royal Caribbean (RCL) is prolonged from the 5% purchase zone of a cup base with a 112.95 purchase level. Shares climbed from the underside of the cup after the cruise line operator reported better-than-expected Q3 earnings and gross sales on Oct. 26, and raised its full-year revenue steering.

The inventory has pulled again however discovered assist at its 10-week shifting common. That units up a purchase zone from about 119 to 130.

Royal Caribbean is anticipated to put up full-2023 earnings per share of $6.61 after three years of losses. Its 2024 EPS is anticipated to soar to $9.16. RCL gained round 93% over the past 52 weeks and much outpaced the S&P 500.

Domino’s Pizza (DPZ) is within the purchase zone reaching to 436.60 from a flat-base purchase level of 415.81. The pizza restaurant jumped 3.6% on Tuesday, after a Gordon Haskett analyst upgraded DPZ to a purchase score from maintain. Domino’s inventory has had quite a few analysts’ value goal hikes within the final month or so.

The corporate beat its third-quarter earnings estimates however missed gross sales expectations on Oct. 12. Quarterly EPS grew 50% as gross sales dropped 4% vs. a 12 months earlier. Analysts count on 16% EPS progress for 2023 and 9% for 2024, in line with MarketSmith.

NVDA inventory, RCL and DPZ are prime shares to purchase and watch.

Observe Kimberley Koenig for extra inventory market information on X/Twitter @IBD_KKoenig.

YOU MAY ALSO LIKE:

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

What Is CAN SLIM? If You Need To Discover Successful Shares, Higher Know It

IBD Live: Learn And Analyze Growth Stocks With The Pros

Wanting For The Subsequent Massive Inventory Market Winners? Begin With These 3 Steps

Need Extra IBD Insights? Subscribe To Our Investing Podcast