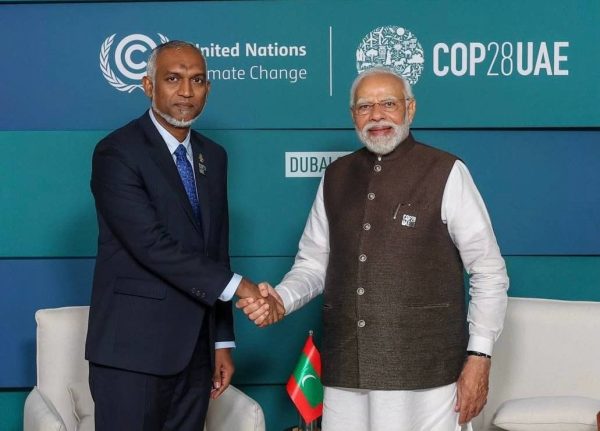

Maldives President Dr. Mohamed Muizzu is expected to go to India subsequent week as his authorities scrambles to keep away from a disastrous debt default.

“The president is scheduled to go to India very quickly. Discussions are ongoing between Maldives and India on the perfect date,” spokesperson Heena Waleed told the press on September 10, with out offering any additional particulars in regards to the journey.

After ostensibly mending strained ties with the Maldives’ large neighbor, Muizzu’s first official go to to India since assuming workplace final yr comes with the central bank seeking a $400 million currency swap arrangement beneath the South Asian Affiliation for Regional Cooperation (SAARC) framework.

The swap deal would successfully be an Indian bailout to assist the Maldives make impending curiosity funds, and shore up dangerously depleted overseas foreign money reserves.

On September 11, credit score rankings company Moody’s downgraded the Maldives based mostly on an evaluation that “default dangers have risen materially,” casting doubt on the nation’s potential to service substantial debt obligations due over the subsequent two years.

“Whereas the federal government is engaged on securing some exterior financing, complete financing to fulfill sizeable forthcoming maturities stays unsure,” Moody’s warned.

The federal government must search financing “primarily from bilateral sources” as a result of prohibitive charges rule out worldwide bond markets, the company noticed. Securing monetary assist would purchase time to replenish reserves and implement overdue reforms, “thereby avoiding default for the foreseeable future.”

However buyers see “no signal” of forthcoming assist from both India or China, the Monetary Instances reported.

The Maldives owes the majority of its $3.4 billion overseas debt to the 2 Asian rivals after an infrastructure boom with Chinese and Indian loans over the previous decade. In line with the World Financial institution, whole public debt reached $8 billion or 122.9 p.c of GDP in 2023, ballooning after a debt-fueled financial stimulus to outlive the COVID-19 crisis.

To keep away from defaulting on collectors, the Maldives wants $114 million this yr, $557 million in 2025, and a staggering $1.07 billion in 2026. The latter determine eclipses a gross overseas foreign money reserve that stood at $437 million on the finish of August. This quantity – the bottom in eight years – was solely adequate to cowl about 1.5 months of imports, Moody’s famous, portending a dire scenario for a small island state reliant on imported meals, gasoline, and medication.

In line with the central financial institution, the usable reserve – funds available after deducting short-term overseas liabilities – improved to $61 million final month after falling to a report low of $44 million in July.

Regardless of comparatively wholesome financial development and U.S. greenback receipts from almost 2 million vacationers yearly, the Maldives’ overseas change reserves have been dwindling beneath strain from exterior debt funds, authorities borrowing to plug funds deficits, and an import invoice elevated by excessive world commodity costs.

On high of the deficits, printing cash to handle the federal government’s money stream throughout the pandemic created a surplus liquidity of the Maldivian rufiyaa. The upper provide of native foreign money “weighs additional on restricted reserves because the central financial institution commits extra overseas change sources to take care of the [15.42 rufiyaa exchange rate] peg to the U.S. greenback,” Moody’s defined.

“Within the absence of a complete financing package deal or very drastic coverage changes, vast twin deficits and FX imbalances level to vital draw back dangers with an growing likelihood of default,” the company concluded.

The brand new Moody’s ranking echoed an analogous downgrade to “junk” standing by Fitch in late August. Fitch cited “a rising diploma of uncertainty” relating to the federal government’s plans to repay a $500 million sukuk, an Islamic Shariah-compliant type of debt due in 2026.

After double-digit losses in August, the Fitch downgrade prompted a selloff as buyers dumped the Islamic bonds. Bondholders had been additionally spooked by an aborted transfer by the Financial institution of Maldives to impose restrictions on overseas foreign money transactions. The dollar-denominated sukuk subsequently fell to a report low of 70 cents on the greenback, down from about 93 cents in June.

Doubts over a $25 million coupon fee due on October 8 raised fears that the Maldives may develop into the primary nation to default on a sukuk.

“Barring an eleventh-hour infusion of overseas change from a pleasant abroad authorities corresponding to China, GCC [Gulf Cooperation Council] or India, the non-payment of the October coupon is a believable chance,” Purvi Harlalka, a senior emerging-market sovereign debt strategist at M&G, informed Bloomberg.

“The large query is now whether or not the Muslim nations will ‘enable’ Maldives to default on a sukuk bond,” Soeren Moerch, a portfolio supervisor at Danske Financial institution, was quoted as saying by Bloomberg. In line with the Monetary Instances, Gulf states have beforehand prolonged assist to stop sovereign defaults for sukuks, bailing out Bahrain in 2018.

On September 4, Maldives International Minister Moosa Zameer visited Abu Dhabi with a message from Muizzu to the UAE president. It was Zameer’s fourth visit to the UAE in lower than a yr.

The sukuk has since recovered slightly after the Maldives central financial institution provided “complete assurance” over the bond reimbursement in October.

“There stays little doubt that the MMA [Maldives Monetary Authority] and the federal government of the Maldives, along with all associated authorities establishments, will be capable to meet all future exterior debt obligations,” the central financial institution asserted on September 11 in response to the Moody’s downgrade.

After a 10-year hiatus, open market operations will begin this yr to mop up the 6.7 billion rufiyaas ($434 million) surplus liquidity within the banking system, the MMA introduced.

Regulatory adjustments may also be introduced this month “to spice up the quantity of overseas foreign money coming into the home banking system,” the central financial institution revealed. Such rules have lengthy been advocated to deal with an entrenched black market and be sure that a bigger share of U.S. greenback income from tourism – valued at $3.6 billion in 2023 – is retained within the Maldives.

In a bid to alleviate the persistent dollar shortage, the federal government can be planning to collect some import duties and revenue taxes in U.S. {dollars} whereas elevating dollar-denominated airport service charges.

Addressing issues over delays in enacting spending cuts and tax hikes introduced in June, the Finance Ministry said that “the federal government has accomplished the required technical work, and preparations for implementation are at the moment ongoing.” The Maldives has been partaking with “bilateral and multilateral companions to fulfill the financing necessities,” it added.

“With the anticipated financial development pushed by the sturdy efficiency of the tourism sector, coupled with the profitable implementation of those income and expenditure measures, the federal government stays assured in restoring fiscal and debt sustainability.”