A few of the fastest-growing, most worthwhile, and strongest companies in historical past have been born the previous few many years. Over the past 12 months, this assortment of firms has develop into generally known as the “Magnificent Seven.”

The rise of those prime investments is because of the relentless advance of knowledge expertise, computing energy, and the web — collectively constructed atop the sensible software of semiconductors. However there’s been an enormous shake-up within the ordering of the Magnificent Seven shares in latest weeks. Here is what buyers must know.

“Tiny” Nvidia sails previous Alphabet and Amazon

In mid-February 2024, Nvidia (NASDAQ: NVDA) — by far the smallest of the Magnificent Seven firms as measured by income and complete workers — surpassed Google-parent Alphabet and Amazon in complete market capitalization worth. Occasions are altering, and buyers are loading up on what’s more and more seen because the emergent chief within the new synthetic intelligence (learn: accelerated computing) financial system.

|

Firm |

Yr Based |

Market Cap |

Trailing-12-Month Income |

~Complete Staff |

|---|---|---|---|---|

|

Microsoft |

1975 |

$3.02 trillion |

$228 billion |

221,000 |

|

Apple |

1976 |

$2.84 trillion |

$386 billion |

161,000 |

|

Nvidia |

1993 |

$1.80 trillion |

$44.9 billion |

26,000 |

|

Alphabet |

1998 |

$1.78 trillion |

$307 billion |

183,000 |

|

Amazon |

1994 |

$1.76 trillion |

$575 billion |

1.5 million |

|

Meta Platforms |

2004 |

$1.23 trillion |

$135 billion |

67,000 |

|

Tesla |

2003 |

$639 billion |

$96.8 billion |

140,000 |

Information supply: YCharts and firm monetary filings, as of Feb. 16, 2024.

If you happen to consider in compounding progress, it is smart Microsoft and Apple are the biggest firms by market capitalization. They have been across the longest and have thus had essentially the most time to construct their empires.

Nvidia hitting the No. 3 spot in market cap is notable, and never simply due to its comparatively diminutive measurement. After Microsoft and Apple, Nvidia is the oldest enterprise of the businesses on this checklist of magnificent long-term investments.

However there are another parts to Nvidia’s enterprise price declaring. The opposite six companies have catapulted to stardom with very consumer-oriented enterprise fashions: Microsoft and Apple are pioneers of the PC period, and Apple ushered within the cellular machine explosion. Google nonetheless makes most its cash from web search, whereas Amazon e-commerce is ubiquitous in North America (though its cloud computing infrastructure unit AWS nonetheless pays many of the payments). And Tesla has efficiently gotten the ball rolling on the electrical car and software-defined automotive market.

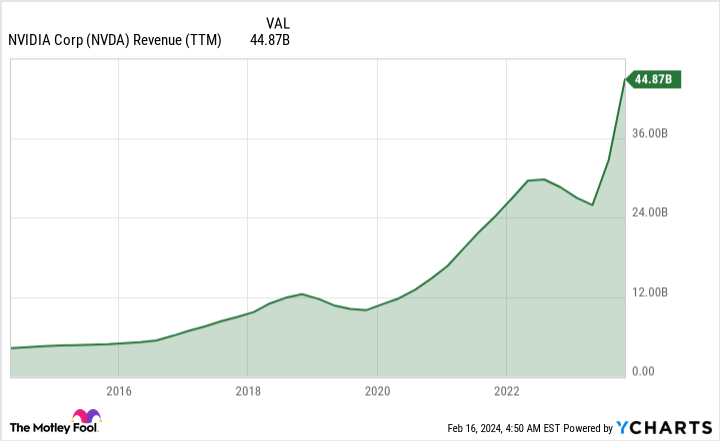

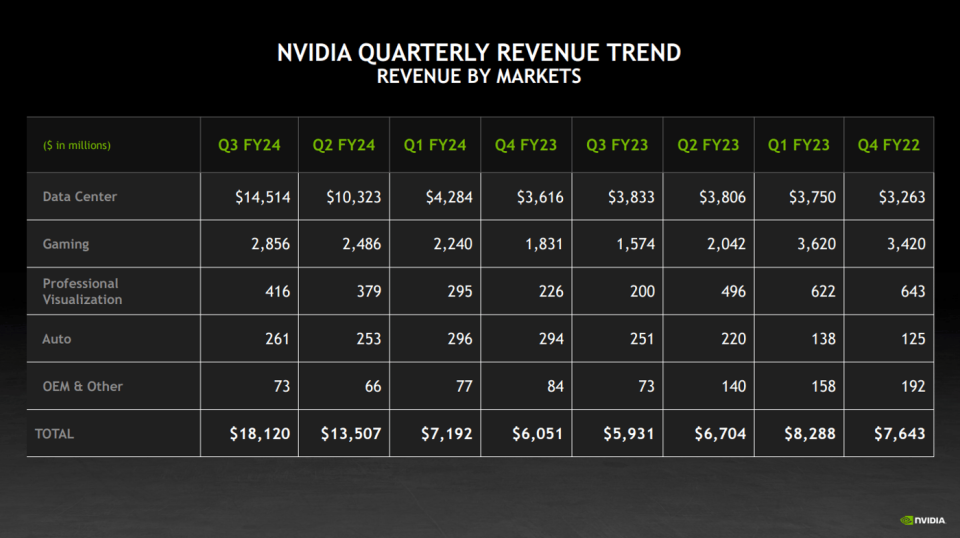

Nvidia’s explosion onto the scene is because of AI infrastructure, a decidedly much more nebulous enterprise to the common particular person. After all, Nvidia is a consumer-facing firm too, and for those who’re into PC video video games, you have most likely been very conscious of Nvidia’s existence since a minimum of the early 2000s.

However video video games are the minority income generator today. Nvidia CEO Jensen Huang determined to go all in on creating semiconductors and accelerated computing infrastructure a variety of years in the past, propelling the info heart phase to dizzying heights within the final 12 months.

Three stats, and what they imply for buyers

Regardless of the way you slice it, although, Nvidia’s rise to the third-largest Magnificent Seven inventory as measured by market cap is astonishing. Paired with the 2 different stats within the aforementioned chart — income and complete worker rely — buyers are clearly betting that Nvidia’s precise enterprise goes to get lots larger over the following few years.

Let’s emphasize the phrase betting. Nvidia’s foundational work round next-gen computing infrastructure has been happening for years, nevertheless it was solely considerably just lately acknowledged by the investor group at giant. Many are scrambling for a reduce and minimizing the truth that Nvidia has extremely cyclical income, as do most analysis and development-driven semiconductor companies.

The purpose is, Nvidia inventory’s newest surge should not be anticipated to proceed going up and to the correct perpetually. It is a secure assumption to make that at some unknown level sooner or later, there might be a cooldown in AI infrastructure spending. When that occurs, count on Nvidia inventory to notch a major sell-off, similar to it has up to now.

As a longtime completely happy shareholder of Nvidia, it is thrilling to see the corporate’s speedy progress. However be cautious of all of the hype as the corporate’s standing as a frontrunner among the many Magnificent Seven heats up. Actually, as fantastic as all these companies are as prime investments, all of them undergo cycles of progress and intervals of extra lackluster efficiency (like Tesla, which hasn’t been so “magnificent” currently). A wholesome dose of warning will serve long-term buyers properly at this juncture.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 12, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Nick Rossolillo and his shoppers have positions in Alphabet, Amazon, Apple, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

“Magnificent Seven” Stock Shake-Up — 3 Business Stats You Need to See Right Now was initially revealed by The Motley Idiot