“Purchase-now, pay-later” agency Klarna goals to return to revenue by summer time 2023.

Jakub Porzycki | NurPhoto | Getty Pictures

Purchase now, pay later agency Klarna has established a holding firm within the U.Ok. that can sit on the prime of its company construction, in a symbolic transfer that paves the trail for an eventual itemizing.

A Klarna spokesperson confirmed to CNBC that the Stockholm-based enterprise, which lets customers defer funds over a interval of installments, has begun a authorized entity restructuring to arrange the holding firm.

Preparations for the brand new firm have been agreed with a few of Klarna’s largest shareholders, together with Sequoia and Heartland, the spokesperson mentioned.

The Klarna spokesperson mentioned the transfer was a precursor to a proper itemizing, however added these are nonetheless “very early days,” and the corporate has no immediate-term plans to go public.

Klarna additionally hasn’t selected the place it will choose to record, the spokesperson mentioned, and organising its new authorized entity within the U.Ok. doesn’t essentially imply that the corporate will go public there.

It does, nonetheless, give Klarna flexibility over which inventory change it decides on.

The restructuring “is an administrative change that has been within the works for over 12 months and doesn’t have an effect on anybody’s roles, nor Klarna’s Swedish operations,” the Klarna spokesperson informed CNBC by way of e mail.

“Klarna Holding will proceed to be the regulated monetary holding firm underneath the direct supervision of the SFSA [Swedish Financial Services Authority] and we’ll proceed to carry a Swedish banking license.”

Klarna is an enormous participant within the European funds business, price $6.7 billion.

Like PayPal and Stripe, it permits retailers so as to add checkout performance to their on-line shops. It differs from these rivals in its versatile fee plans, referred to as purchase now, pay later.

On the top of the Covid-driven increase in e-commerce, Klarna was price a whopping $46 billion, onboarding SoftBank as an investor. Its valuation was slashed by 85%, to $6.7 billion after the pandemic-fueled increase in expertise valuations deflated.

Klarna, which was included in CNBC and Statista’s record of the highest 200 fintech corporations, has raised greater than $4 billion in funding to this point from buyers together with Sequoia, Silver Lake and China’s Ant Group.

The U.Ok. was initially set to implement robust new rules on the purchase now, pay later business, with plans to require affordability checks and clearer communication within the commercial of such providers.

Britain has reportedly been considering shelving those plans after plenty of the most important gamers mentioned, in talks with the federal government, that they might be pressured to go away the U.Ok. if they’re subjected to “heavy-handed” regulation.

Bosses at Klarna and Block, which owns purchase now, pay later service Clearpay, had lashed out at sure points of the U.Ok.’s regulation plans, together with a measure which might have exempted e-commerce large Amazon from being subjected to the foundations.

Klarna has since been pushing aggressively towards profitability, reporting its first month of revenue earlier this 12 months for the primary time since 2020.

Klarna has been investing closely in synthetic intelligence merchandise, most not too long ago launching an AI picture recognition software that may determine sure merchandise, like a jacket or a pair of headphones.

Individually this weekend, Klarna additionally reached a take care of employees in Sweden to place an finish to plans to go on strike.

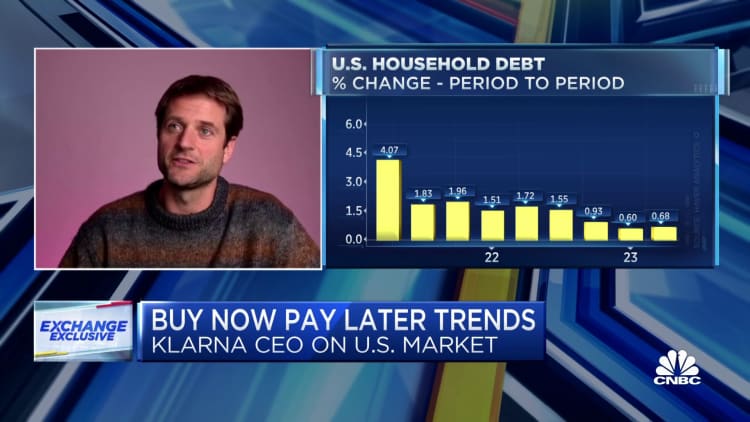

WATCH: Klarna’s purchase now pay later losses are 30% beneath business commonplace, says CEO Sebastian Siemiatkowski