-

JPMorgan’s bearish 2024 inventory market outlook might be derailed by a surge in small cap shares.

-

Technical strategist Jason Hunter expects the S&P 500 to fall 23% by mid-2024.

-

However a risk-on surge in shares which have largely missed out on this 12 months’s rally may trigger a rethink.

JPMorgan’s high chart skilled Jason Hunter was bearish on the inventory market heading into 2024, however a threat has emerged that would derail that view.

He predicted the S&P 500 will re-test its bear market bottom reached in October 2022, forecasting a dive to three,500. That is by far one of the most bearish projections on Wall Street, much more downbeat than JPMorgan’s home view that the S&P 500 falls to 4,200 subsequent 12 months.

Hunter’s pessimism is predicated on the truth that a lot of this 12 months’s rally has been driven by only a handful of mega-cap tech stocks. The dearth of breadth, or market participation within the present rally, is regarding to him.

However a latest breakout above main resistance ranges for the broad inventory market averages is beginning to problem Hunter’s bearish view.

“A pure chart-based evaluation leaves our bearish first half fairness outlook tactically on the backfoot going into the fourth quarter,” he stated in a word late final month.

On the time, he stated a surge in inventory market laggards can be “a really low chance occasion.” However since Hunter’s outlook was revealed, these laggards have actually surged additional.

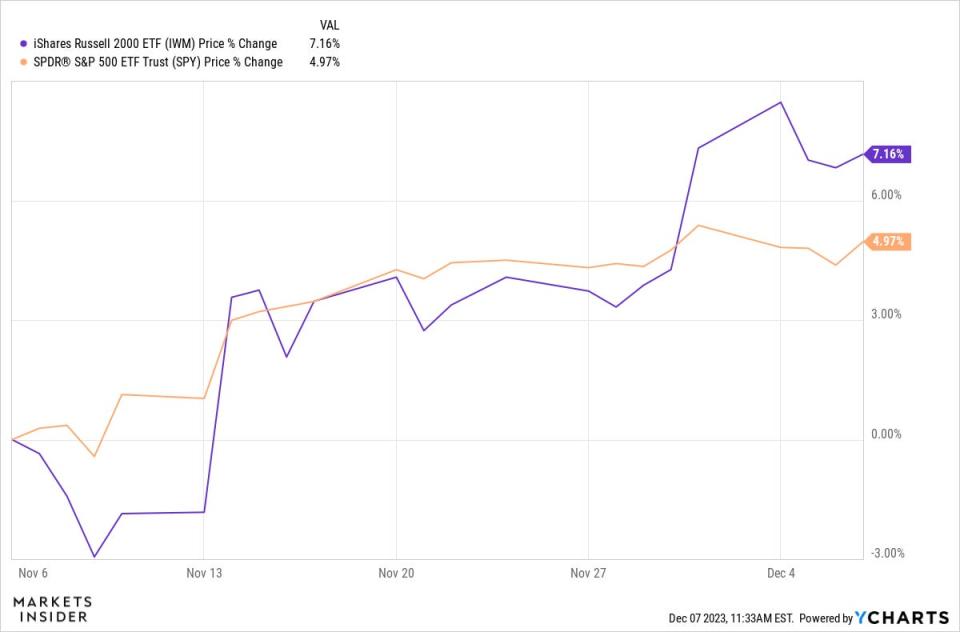

The small-cap Russell 2000, which largely sat out this 12 months’s inventory market rally, has begun to outperform the S&P 500. Over the previous week, the Russell 2000 is up almost 3% whereas the S&P 500 is about flat.

That places the Russell 2000 up about 7% over the previous 4 weeks, outpacing the S&P 500’s acquire of about 4.8% over the identical time interval.

It alerts that buyers might be lastly rotating into laggard shares and pushing them greater. And in keeping with Hunter, that sort of value motion would derail his bearish outlook for 2024.

“We’re due to this fact on the lookout for giant cap to type short-term distribution patterns into the early weeks of subsequent 12 months, or for indicators that the laggards are beginning to breakout. The latter is clearly the chance situation for our base-case outlook and can go away us having to rethink the 2024 trajectory,” he stated.

Learn the unique article on Business Insider