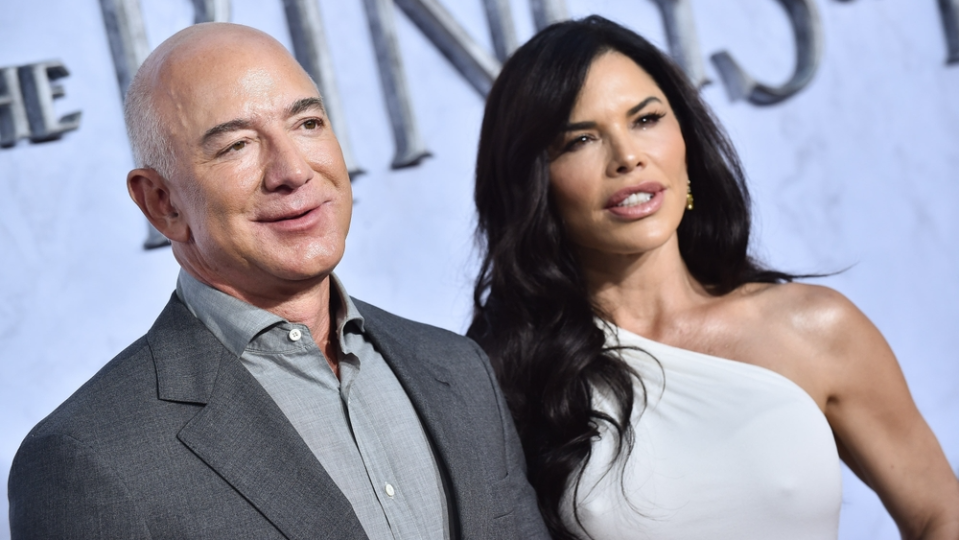

With a internet price of $153 billion, founder Jeff Bezos of Amazon.com Inc. most likely afford any home he needs. However proper now he is renting.

Bezos and his fiancé Lauren Sanchez reportedly lease a home in Malibu, California, from legendary jazz saxophonist Kenny G for $600,000 a month.

The 5,500-square-foot home has an enormous yard, swimming pool, film room, and recording studio. It additionally has a 3,500 sq. foot visitor home.

The property provides the couple entry to Little Dume Seaside, certainly one of Malibu’s most unique seashores.

With rents in extra of half one million {dollars} a month, you would count on the property to return totally furnished. However that is not the case right here: Kenny G’s issues are saved away and the home is embellished with Bezos and Sanchez’s personal furnishings.

Trying out:

Responding to rising rents

In response to the New York Put up, Kenny G bought the six-bedroom home in 1998 for $12.5 million. The musician then bought the adjoining lot in 2000 and constructed one other 3,500-square-foot residence. Its development price him about $3 million.

Contemplating the property brings in $600,000 in lease monthly — that is $7.2 million per yr — it is a fairly good funding from the musician.

For many Individuals who lease, the month-to-month cost is nowhere close to $600,000. However the quantity has elevated.

In response to the most recent client value index (CPI) report, rents for a major residence within the US rose 8.7% in Could from a yr in the past. In case you look additional again, the lease of a foremost residence has risen by nearly 60% since 2010.

This upward development has led to an growing rental revenue stream for landlords.

However it’s not simple to be a landlord nowadays. Dwelling costs are excessive and rising rates of interest imply patrons should grapple with greater mortgage funds. And once you purchase a home, you must keep in mind greater than the mortgage prices. Owners are additionally on the hook for property taxes, insurance coverage, upkeep and repairs.

However nowadays, you do not have to be a landlord to gather rental revenue. New firms – together with one supported by Bezos – have modern methods for individuals to earn passive income on the actual property market. This is how invest in rental properties with just $100 whereas remaining utterly hands-off.

Publicly traded Actual Property Funding Trusts (REITs) that target residential properties can also be price contemplating. Listed here are three that Wall Avenue finds enticing.

Central America House Communities Inc. (NYSE:MAA): Mid-America House Communities is a REIT primarily targeted on house communities within the quickly rising Solar Belt area of the US. On the finish of the primary quarter, it had an possession curiosity in 101,986 house items, together with communities at present beneath growth. With a quarterly dividend charge of $1.40 per share, the REIT gives an annual return of three.6%. Goldman Sachs analyst Chandni Luthra has a purchase ranking for Central America and a value goal of $180. Since shares are buying and selling at $153.25 right now, the value goal implies a possible upside of 17%.

AvalonBay Communities Inc. (NYSE:AVB): AvalonBay Communities is an house REIT that focuses on metropolitan areas in areas it believes are characterised by rising employment in sectors with excessive wages and decrease housing affordability. These areas embrace New England, the New York/New Jersey metro space, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California. The inventory is up 18% year-to-date, and Truist Securities analyst Michael Lewis sees extra upside on the horizon. The analyst has a purchase ranking on AvalonBay and a value goal of $211, about 11% above the inventory’s present value goal. AvalonBay gives an annual dividend yield of three.5%.

Camden Property Belief (NYSE:CPT): Camden Property Belief owns, manages, develops and acquires multi-family flats. On April 30, the portfolio consisted of 172 properties with a complete of 58,702 flats. The REIT pays quarterly dividends of $1 per share, which interprets to an annual return of three.6%. Barclays analyst Anthony Powell has an Chubby ranking on Camden and a value goal of $137, implying a possible upside of 24%.

Learn extra:

Do not miss real-time alerts about your shares – be part of us Benzinga Pro free! Try the tool that helps you invest smarter, faster and better.

This text Jeff Bezos Pays $600K Monthly Rent To This Famous Musician – Here’s How To Collect Rental Income Without Becoming A Landlord initially appeared on Benzinga. com

.

© 2023 Benzinga.nl. Benzinga doesn’t present funding recommendation. All rights reserved.