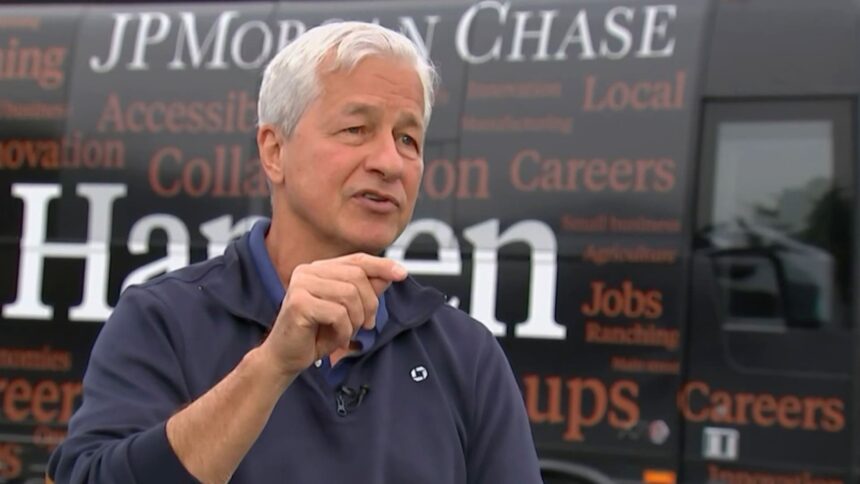

Jamie Dimon, CEO of JPMorgan Chase talking with CNBC’s Leslie Picker in Bozeman, MT on Aug. 2nd, 2023.

CNBC

JPMorgan Chase CEO Jamie Dimon on Tuesday warned in regards to the risks of locking in an outlook in regards to the financial system, significantly contemplating the poor latest monitor file of central banks just like the Federal Reserve.

Within the newest of a number of warnings about what lies forward from the pinnacle of the most important U.S. financial institution by property, he cautioned that myriad elements enjoying out now make issues much more tough.

“Put together for prospects and possibilities, not calling one plan of action, since I’ve by no means seen anybody name it,” Dimon mentioned throughout a panel dialogue on the Future Funding Initiative summit in Riyadh, Saudi Arabia.

“I need to level out the central banks 18 months in the past have been 100% useless unsuitable,” he added. “I’d be fairly cautious about what may occur subsequent 12 months.”

The feedback reference again to the Fed outlook in early 2022 and for a lot of the earlier 12 months, when central financial institution officers insisted that the inflation surge can be “transitory.”

Together with the misdiagnosis on costs, Fed officers, in response to projections launched in March 2022, collectively noticed their key rate of interest rising to simply 2.8% by the tip of 2023 — it’s now north of 5.25% — and core inflation at 2.8%, 1.1 share factors under its present stage as measured by the central financial institution’s most popular gauge.

Dimon criticized “this all-powerful feeling that central banks and governments can handle via all these items. I am cautious.”

A lot of Wall Road has been targeted on whether or not the Fed may enact one other quarter share level fee hike earlier than the tip of 2023. However Dimon mentioned, “I do not assume it makes a bit of distinction whether or not the charges go up 25 foundation factors or extra, like zero, none, nada.”

In different latest warnings, Dimon warned of a possible state of affairs during which the fed funds fee may eclipse 7%. When the financial institution launched its earnings report earlier this month, he cautioned that, “This can be probably the most harmful time the world has seen in many years.”

“Whether or not the entire curve goes up 100 foundation factors, I’d be ready for it,” he added. “I do not know if it will occur, however I have a look at what we’re seeing at this time, extra just like the ’70s, lots of spending, lots of this may be wasted.” (One foundation level equals 0.01%.)

Elsewhere in finance, Dimon mentioned he helps ESG rules however criticized the federal government for enjoying “whack-a-mole” with no concerted technique.

“You possibly can’t construct pipelines to scale back coal emissions. You possibly can’t get the permits to construct photo voltaic and wind and issues like that,” he mentioned. “So we higher get our act collectively.”

Do not miss these CNBC PRO tales: