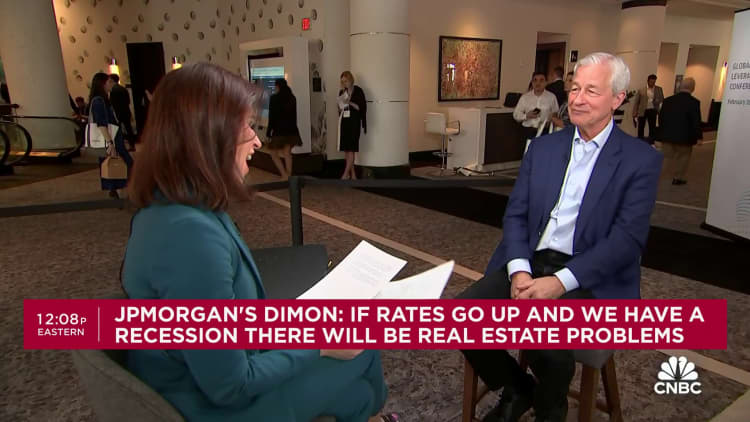

Jamie Dimon, President and CEO of JPMorgan Chase, talking on CNBC’s “Squawk Field” on the World Financial Discussion board Annual Assembly in Davos, Switzerland, on Jan. 17, 2024.

Adam Galici | CNBC

JPMorgan Chase CEO Jamie Dimon is not fearful in regards to the added competitors from a bulked-up Capital One if its $35.3 billion takeover of Uncover Monetary will get accepted.

“My view is, allow them to compete,” Dimon mentioned. “Allow them to strive, and if we expect it is unfair, we’ll complain about that.”

Dimon, talking to CNBC’s Leslie Picker at a Miami convention, acknowledged that if regulators approve the Capital One-Uncover deal, his financial institution will likely be eclipsed because the nation’s greatest bank card lender.

However that did not cease him from praising Capital One CEO Richard Fairbank, who he credited with shaking up the cardboard trade in a method that in the end led Dimon to turning into CEO of a predecessor agency to JPMorgan greater than 20 years in the past.

“Richard is why I am right here,” Dimon mentioned.

In regards to the transaction, he added, “I am not fearful about it actually, however we do observe every part he does.”

Final week, Capital One introduced the largest proposed merger of the 12 months, one that would rework the trillion-dollar bank card trade. By buying Uncover, Fairbank is each bulking up as a lender and boosting the smallest of the funds networks after Visa, Mastercard and American Categorical.

“The bank card enterprise … they will be larger and [have] extra scale,” Dimon mentioned. “They’re excellent at it. I’ve monumental respect for Richard Fairbank and Capital One.”

It is unclear if Capital One can create a real various to the dominant card networks with this deal, Dimon mentioned.

He added that Capital One could have an “unfair benefit versus us” in debit funds, owing to the truth that laws referred to as the Durbin Modification caps debit charges for big banks, however not Uncover or American Categorical.

“In fact, I’ve an issue with that,” Dimon mentioned. “, like why ought to they be allowed to cost debit completely different than we worth debit simply due to a legislation that was handed?”

Extra broadly, Dimon mentioned he additionally favored permitting small banks to merge. A wave of trade consolidation has been anticipated after the tumult of final 12 months’s regional banking disaster, however solely a trickle of smaller offers have occurred as far as executives are uncertain if they’ll cross regulatory muster.

The most important query remaining in regards to the Capital One deal is whether or not regulators will approve it. Greater than a dozen Democrat lawmakers together with Sen. Elizabeth Warren, D-Mass., signed a letter to the Federal Reserve and the Workplace of the Comptroller of the Forex on Sunday urging them to dam the settlement.

“To guard customers and monetary stability, we urge you to dam this merger and strengthen your proposed coverage assertion to stop dangerous offers sooner or later,” they wrote.

Do not miss these tales from CNBC PRO: