On November 15, 2022, Indonesian President Joko Widodo and a gaggle of countries led by the USA announced a $20 billion climate finance deal to assist Indonesia curb its energy sector’s reliance on coal, and transition in the direction of a carbon-free power system. This deal is formally known as the Simply Vitality Transition Partnership (JETP). A yr later, Indonesia released implementation plans for the settlement, outlining quite a few targets and insurance policies to assist Indonesia obtain carbon neutrality and develop its home renewable know-how business. Nonetheless, not one of the advisable insurance policies tackle essentially the most important menace to Indonesia’s power transition: fossil gasoline subsidies.

On November 21, 2023, the federal government of Indonesia launched a draft implementation plan outlining its technique to make the most of the assist supplied by the JETP. The draft implementation plan, formally referred to as the Complete Funding and Coverage Plan (CIPP), outlines three main targets for Indonesia’s electrical energy system: 1) to cap energy sector emissions by 2030 at a degree of 250 megatons of CO2; 2) to succeed in renewable power technology of 44 p.c by 2030; and three) to realize web zero emissions within the energy sector by 2050.

The CIPP estimates that to succeed in these targets, Indonesia should entice funding of at the least $97.1 billion by 2030 and $500 billion from 2030 to 2050. The $20 billion in financing from the JETP is “anticipated to function a catalyst” to assist entice additional funding from different sources.

The CIPP outlines 5 precedence areas of funding to concentrate on by means of 2030: $19.7 billion overlaying new transmission strains and grid upgrades; $2.4 billion to retire or retrofit coal vegetation; $49.2 billion to construct 16.1 GW of dispatchable renewable capability (bioenergy, geothermal, and hydropower); $25.7 billion to construct 40.4 GW of variable renewable capability (photo voltaic and wind); and an unspecified quantity to enhance Indonesia’s renewable power provide chain, notably photo voltaic PV manufacturing. Indonesia’s continued use of fossil gasoline and electrical energy subsidies threatens these targets.

Indonesia’s authorities gives beneficiant gasoline and electrical energy subsidies to assist poorer households and spur financial improvement by holding costs low. These subsidies started under the Suharto regime (1966-1998) when Indonesia nonetheless had important home oil reserves. Nonetheless, for the reason that Nineties, Indonesia’s home oil manufacturing has fallen whereas demand for oil and electrical energy has skyrocketed.

Consequently, power subsidies have reached as much as 2 p.c of Indonesia’s complete GDP. Moreover, these subsidies primarily profit wealthier Indonesians. The World Bank notes that Indonesia’s center and higher class “devour between 42 and 73 p.c of sponsored diesel.”

At present, the next subsidies and worth caps are in place. This checklist doesn’t define all authorities market interventions however contains those who might negatively impression Indonesia’s power transition.

First, Indonesia maintains a subsidy for gasoline and diesel. In 2022, the Indonesian authorities raised the worth of sponsored gasoline and diesel, however the price of these items remains to be beneath market charges for Indonesian customers. Often, these subsidies come as reimbursements to Pertamina, Indonesia’s state-owned oil and gasoline firm. Pertamina owns a lot of the gasoline stations in Indonesia. Indonesia’s central authorities compensates Pertamina for the distinction between the price of buying oil and gasoline and the ultimate worth customers pay.

Second, a home gross sales mandate and coal worth cap pressure Indonesian coal mining corporations to promote 25 p.c of their coal to PLN, Indonesia’s state electrical energy utility. Comparable mandates exist for oil and pure gasoline, although these two fossil fuels comprise a a lot smaller portion of complete power technology than coal.

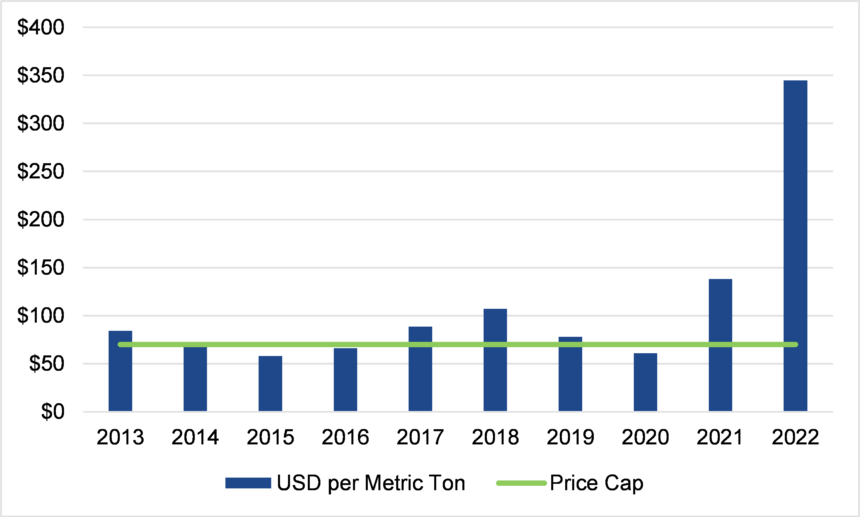

These coal producers can not promote coal to PLN for greater than $70 per metric ton. Determine 1 beneath compares coal’s yearly common market worth in opposition to the $70 worth cap. In yearly however three, the market worth exceeded the worth cap, and in 2021 and 2022, the market worth was considerably increased than the worth cap. The gross sales mandate and worth cap artificially decrease PLN’s price of producing electrical energy with coal energy vegetation, which helps preserve electrical energy prices for end-users low.

Determine 1: Value of thermal coal vs. $70 home worth cap.

Third, a below-market tariff construction ensures that Indonesian customers pay lower than the price of producing and distributing electrical energy. The Indonesian authorities compensates PLN on an annual foundation for this shortfall. Till 2012, all electrical energy clients benefitted from this below-market tariff construction, however the authorities removed tariff support for wealthier segments of society in that yr.

The “coverage enablers” outlined within the CIPP don’t sufficiently alter Indonesia’s subsidy regime. As a substitute, the insurance policies Indonesia’s authorities outlines within the CIPP merely try to handle the anti-competitive results of those subsidies. It is a important weak spot, as a lot of the funding for brand new renewable technology should come from the personal sector. Few personal sector corporations will put money into renewable power tasks in a non-competitive market.

One enabling coverage outlined within the CIPP is titled “supply-side incentives” and focuses on strategies of decreasing home assist for the coal business. The CIPP outlines Indonesia’s home market obligation, which requires coal producers to promote 25 p.c of their complete manufacturing to the home marketplace for not more than $70 per metric ton.

These subsidies impression PLN’s electrical energy planning selections. As a result of PLN can entry a assured coal provide at a low worth, coal-fired electrical energy is considerably inexpensive than different sources, similar to renewables or pure gasoline. Consequently, PLN is extra more likely to construct coal-fired energy vegetation or signal contracts with impartial coal vegetation. These insurance policies don’t incentivize PLN to decarbonize or interact with renewable power builders.

The CIPP recommends eradicating the home worth cap of $70 per metric ton whereas sustaining the 25 p.c home market obligation. As this might improve PLN’s prices of buying coal, the CIPP recommends accumulating fees from mining corporations to assist pay PLN’s increased prices (the Indonesian authorities pays PLN for the distinction between the price of producing electrical energy and the ultimate price charged to clients). Nonetheless, the CIPP notes that Indonesia’s authorities is formulating completely different reforms that will not take away the home market obligation or the worth ceiling.

If Indonesia implements the CIPP’s suggestion, PLN will use “a coal worth that’s nearer to market costs in its dispatch and funding selections.” Nonetheless, “nearer” could not change PLN’s funding or dispatch selections. If PLN can entry coal or coal-fired energy at below-market costs, renewable builders will probably be hard-pressed to compete, limiting funding and undercutting Indonesia’s power transition.

A second enabling coverage outlined within the CIPP focuses on energy buy agreements (PPAs). An influence buy settlement is a contract between an influence producer (similar to an influence plant proprietor) and an off-taker (often a utility). In Indonesia, PLN is the lone off-taker; thus, signing a PPA with PLN is critical to draw funding and develop a brand new renewable power mission. The Indonesian authorities dictates the construction of those contracts. The CIPP outlines suggestions to enhance Indonesia’s PPA framework, together with standardizing PPA templates to make negotiations simpler and creating laws to extra clearly allocate danger between PPA signatories. Nonetheless, these measures are usually not sufficient to make renewables aggressive with coal.

Renewable PPAs in Indonesia are topic to a tariff ceiling, a cap on the worth they will promote electrical energy to PLN. Indonesian legislation requires PLN to make sure that signing a brand new renewable power PPA doesn’t improve clients’ electrical energy costs. Consequently, the worth of power produced at a photo voltaic or wind farm “needs to be equal to or decrease than the price of supplying electrical energy generated by sponsored fossil [fuels].” So long as PLN’s can buy sponsored coal, renewables is not going to be aggressive in Indonesia.

Probably the most obvious results of continued fossil gasoline subsidies in Indonesia is a continued dependence on fossil fuels. A extra insidious result’s the stagnation of Indonesia’s inexperienced know-how provide chain. If these subsidies proceed, Indonesia might miss out on a possibility to develop into a renewable power powerhouse regardless of the funding made accessible beneath the JETP.

Given Indonesia’s quickly increasing nickel mining capability, the nation will present a big portion of the dear metals wanted to construct electrical autos, long-term battery storage programs, and different renewable applied sciences. The CIPP outlines “renewable power provide chain enhancement” because the fifth main space of funding by means of 2030, alongside extra tangible efforts to construct new renewable power capability. Constructing a sturdy renewable power provide chain in Indonesia would strengthen its place globally, permitting it to develop and export extra complicated merchandise than newly mined nickel alone.

Nonetheless, the CIPP additionally identifies “cultivating a sustainable, long-term home market” as a major problem. Coal worth caps will forestall buyers from constructing renewable technology services. With out renewable facility development in Indonesia, there will probably be no home demand for Indonesian photo voltaic or battery producers. Equally, petroleum subsidies will forestall Indonesian customers from searching for electrical autos as gasoline autos will proceed to be cheaper. Solely by dismantling these subsidies can Indonesia use the JETP to decarbonize its power system and develop into a pacesetter within the world power transition.