Mario Tama | Getty Photographs

Inflation was unchanged in September, however value pressures appear poised to proceed their broad and gradual easing in coming months, in line with economists.

In September, the patron value index elevated 3.7% from 12 months earlier, the identical price as in August, the U.S. Bureau of Labor Statistics said Thursday.

The newest studying is a big enchancment on the Covid pandemic-era peak of 9.1% in June 2022 — the very best price since November 1981.

“The velocity of the decline is all the time going to be unsure,” stated Andrew Hunter, deputy chief U.S. economist at Capital Economics. “However anyplace you look, [data] suggests inflation needs to be falling somewhat than rising.”

The CPI is a key barometer of inflation, measuring how shortly the costs of something from fruit and veggies to haircuts and live performance tickets are altering throughout the U.S. financial system.

Regardless of latest enhancements, economists say it is going to take some time for inflation to return to regular, steady ranges.

The Federal Reserve goals for a 2% annual inflation price over the long run. Fed officers do not expect that to occur till 2026.

“In the end, inflation continues to be probably the most menacing concern within the financial system proper now,” stated Sarah Home, senior economist at Wells Fargo Economics. “We’re edging our manner again [to target], however there’s nonetheless fairly a little bit of floor to cowl,” she added.

Gasoline costs nonetheless one thing shoppers ‘cope with’

Gasoline costs had been up 2.1% in September, on a month-to-month foundation — a “main contributor” to inflation final month, the BLS stated.

Nevertheless, that is a giant enchancment from August, when costs on the pump jumped 10.6% through the month largely on account of dynamics out there for crude oil, which is refined into gasoline.

Extra from Private Finance:

Lawmakers goal bank card charges, charges as debt tops $1 trillion

Treasury to make it simpler to get $7,500 EV tax credit score in 2024

77-year-old widow misplaced $661,000 in a standard tech rip-off

“It is nonetheless one thing shoppers need to cope with, however not as huge a rise as what households had been having to cope with in August,” Home stated.

Costs have fallen in October, too. The typical value per gallon was $3.68 as of Oct. 9, down 15 cents a gallon since Sept. 25, in line with the Energy Information Administration.

Housing inflation continues to maneuver downward

When assessing underlying inflation tendencies, economists typically like to have a look at a measure that strips out vitality and meals costs, which are usually unstable from month to month.

This pared-down measure — generally known as the “core” CPI — fell to an annual price of 4.1% in September from 4.3% in August.

Shelter — the typical family’s biggest expense — has accounted for greater than 70% of that complete improve within the core CPI over the previous yr. Housing inflation elevated in September, to its highest month-to-month price since Could.

Nevertheless, the housing-price pattern “stays firmly downward,” and may proceed to gradual by way of roughly summer season subsequent yr, Home stated.

“That shall be an necessary supply of the general price of disinflation as we transfer by way of 2024,” she stated.

Different classes with “notable” will increase prior to now yr embrace motorized vehicle insurance coverage (up 18.9%), recreation (up 3.9%), private care (up 6.1%) and new automobiles (up 2.5%), the BLS stated.

Why inflation is returning to regular

At a excessive stage, inflationary pressures — which have been felt globally — are on account of an imbalance between provide and demand.

Vitality costs spiked in early 2022 after Russia invaded Ukraine. Provide chains had been snarled when the U.S. financial system restarted through the Covid-19 pandemic, driving up costs for items. Shoppers, flush with money from authorities stimulus and staying residence for a yr, spent liberally. Wages grew at their quickest tempo in many years, pushing up enterprise’ prices.

Now, these pressures have largely eased, economists stated.

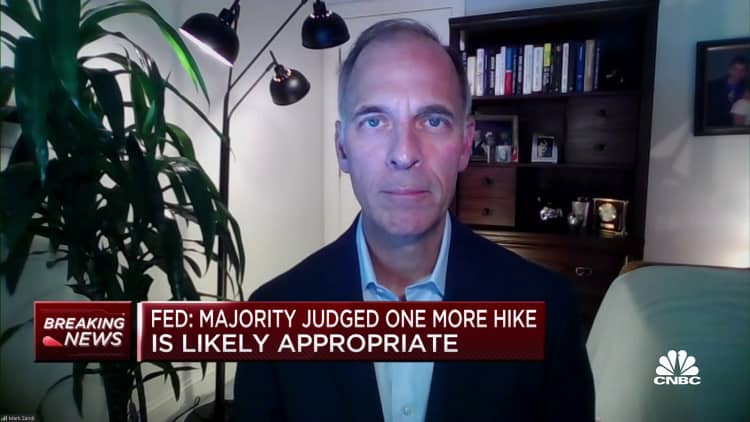

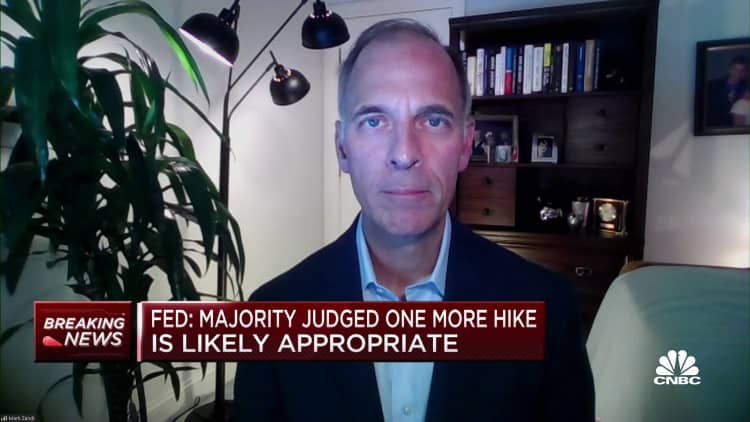

Plus, the Federal Reserve has raised rates of interest to their highest stage since the early 2000s to chill the financial system. This instrument goals to make it costlier for shoppers and companies to borrow, and subsequently rein in inflation.

Common wage progress additionally declined to 4.4% in September, from a peak 9.3% in January 2022, in line with Certainly information.

“Many of the proof suggests the financial system continues to be robust, however possibly cooling a bit,” Hunter stated. “Labor market circumstances are persevering with to steadily cool as effectively.”

That stated, there are a number of potential sources of upward stress on inflation, economists stated. For instance, the Israel-Hamas warfare has the potential to nudge up international vitality costs. United Auto Staff strikes may elevate costs for vehicles if stock declines.