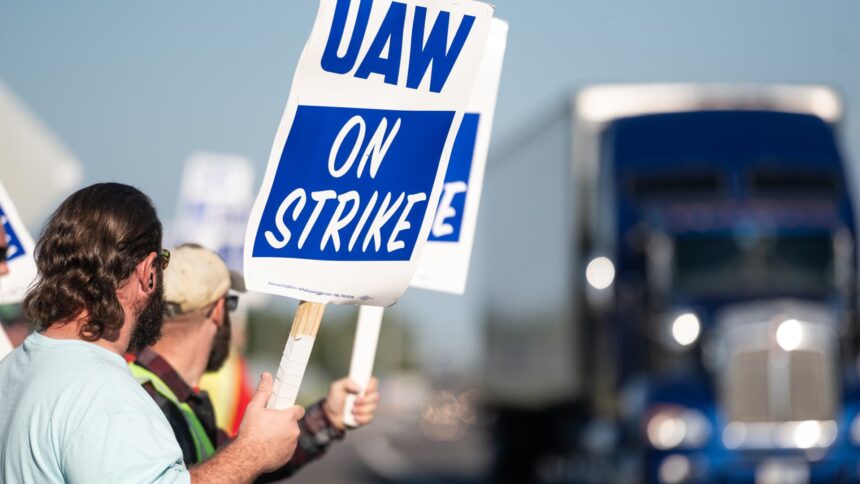

GM employees with the UAW Native 2250 union strike exterior the Basic Motors Wentzville Meeting Plant in Wentzville, Missouri, Sept. 15, 2023.

Michael B. Thomas | Getty Photographs

Try the businesses making headlines in noon buying and selling.

Basic Motors, Ford, Stellantis — Shares of Ford was close to flat, whereas Basic Motors gained 0.9% and Stellantis was up 2.2% as a focused strike by the United Auto Employees started. Employees walked off the job at a number of meeting crops belonging to the three automakers Thursday night time after a key deadline to settle a brand new labor contract handed.

Planet Health — Shares slid 15.9% after the fitness center chain’s board pushed out CEO Chris Rondeau. The transfer was surprising to staff near Rondeau, an individual accustomed to the matter advised CNBC. Board member Craig Benson, recognized for his position as the previous governor of New Hampshire, is the interim CEO.

Nucor — The steelmaker fell 6.1% after providing worse-than-expected steerage for third-quarter earnings, with the corporate pointing to pricing and quantity challenges. Nucor stated to anticipate earnings between $4.10 and $4.20 per share, whereas analysts polled by LSEG, previously referred to as Refinitiv, forecast $4.57.

PTC Therapeutics — The therapeutics inventory plummeted 29.8% after the European Medicines Company’s Committee for Medicinal Merchandise for Human Use issued a destructive opinion on a conversion of conditional to full advertising authorization for a PTC drug to deal with nonsense mutation Duchenne muscular dystrophy. Raymond James downgraded the inventory to underperform from outperform following the information.

Core & Principal — The infrastructure inventory retreated 4.1% a day after it introduced a secondary inventory providing. The providing of 18 million Class A shares by promoting shareholders will likely be held concurrently with the repurchase of three.1 million Class A shares. Partnership pursuits in an organization unit additionally will likely be purchased again.

Arm Holdings — Shares slipped 4.5% throughout its second session as a public firm. Funding banking agency Needham initiated protection of the inventory at maintain and not using a value goal following Arm’s debut that valued the corporate at about $60 billion. Needham analyst Charles Shi cautioned, nonetheless, that the inventory’s worth already “seems to be full.”

Insulet, Dexcom — Shares of the diabetes-focused health-care firms fell Friday after Bloomberg News reported Thursday afternoon that Apple has chosen a brand new chief for its staff working to develop a noninvasive blood sugar monitoring gadget. Shares of Insulet shed 2.9%, whereas Dexcom sank 5.1%.

Chipmakers — Chip tools shares ASML Holding, KLA, Lam Analysis and Utilized Supplies all dropped following a report that Taiwan Semiconductor is telling distributors to delay deliveries resulting from demand issues. U.S.-listed shares of Taiwan Semiconductor misplaced 2.4%.

Adobe — Shares of the Photoshop maker dropped 4.2% following Adobe’s fiscal third-quarter earnings Thursday. The corporate reported an earnings and income beat and ahead steerage that matched Avenue projections. Whereas Goldman Sachs and Financial institution of America reiterated purchase rankings, JPMorgan remained impartial, citing macroeconomic headwinds and a excessive premium for Adobe’s pending acquisition of Figma for $20 billion.

Apellis Prescribed drugs — The biopharmaceutical firm superior 2.6% following a Wells Fargo improve to chubby from equal weight. The financial institution stated Apellis has a positive danger/reward forward of third-quarter earnings.

DoorDash — Shares of the meals supply firm fell 2.5% after MoffettNathanson downgraded the inventory to market carry out from outperform. The Wall Avenue agency stated the resumption of mortgage repayments introduce bookings danger to meals supply. The inventory continues to be up greater than 60% this 12 months.

Axis Capital — The insurance coverage inventory rose 3.1% following an improve to purchase from underperform by Financial institution of America. The Wall Avenue agency stated its pessimistic outlook was altering regardless of current underperformance within the reinsurance house.

Estée Lauder — The cosmetics inventory superior practically 1% after Redburn Atlantic Equities turned much less bearish. The agency upgrades shares to impartial from promote, saying the corporate was feeling technical advantages as buyer ordering patterns normalize.

Casella Waste Programs — The waste inventory traded about 1.6% increased after getting initiated by Goldman Sachs at purchase. Goldman referred to as the corporate a “compounder with pricing.”

— CNBC’s Yun Li, Jesse Pound, Samantha Subin, Pia Singh, Brian Evans and Lisa Kailai Han contributed reporting.