Elf Magnificence’s internet gross sales rose 14% year-on-year to $343.9 million within the second quarter of fiscal 2026, the corporate stated on Wednesday. It was the primary spherical to incorporate outcomes from Rhode, which the corporate acquired simply previous to its Q1 earnings in August.

“Our Q2 outcomes, which included 140 foundation factors of market share features for our namesake Elf model and a record-breaking launch of Rhode in Sephora North America, are a continuation of the constant, category-leading development we’ve delivered over the previous 27 quarters,” Tarang Amin, Elf Magnificence chair and CEO, stated in a press release. “We stay assured in our technique to develop market share and capitalize on the numerous whitespace forward of us.”

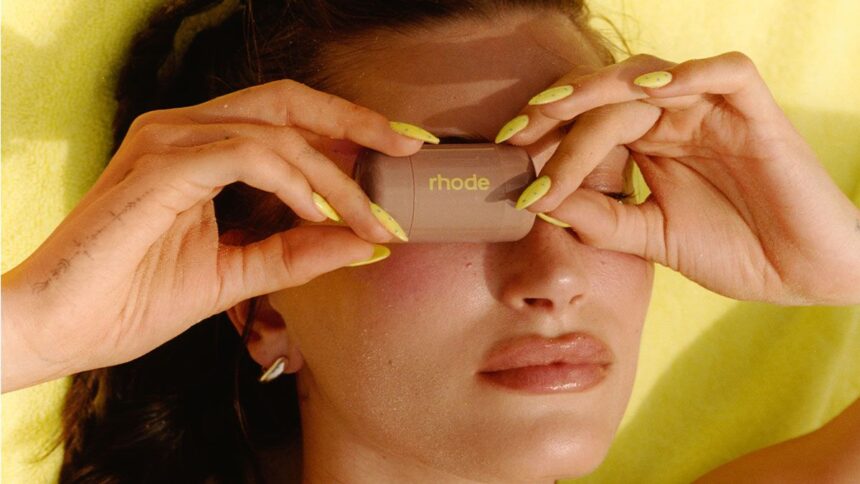

For the second quarter, US revenues have been up 18% and worldwide up 2%. By model, newly minted Rhode was a standout, CFO Mandy Fields informed Vogue Enterprise forward of at this time’s earnings name, flagging the model’s Sephora launch as a spotlight. “The launch was [by far] the second greatest launch that they’ve had in North America, which is unbelievable to see,” Fields stated. “Rhode continues to have momentum behind it.” Elf expects Rhode to ship $200 million to the corporate’s internet gross sales this yr, post-acquisition (from August by way of the tip of March). “On an annualized foundation, $300 million is what we count on Rhode to be for this fiscal yr, and that might be 40% year-on-year development,” she added. “So actually only a great efficiency out of Rhode.”

Rhode will launch in Sephora within the UK on November 10. The corporate is taking a look at the place to go from there, Fields stated. “Rhode has over 70% of its followers exterior the US,” she defined. “We’re going to proceed to comply with the place Hailey’s followers are.” As as to if this can be by way of extra worldwide Sephoras, Fields stated that it’s the “largest world magnificence retailer”, and that presents alternatives for the model.

Whereas final quarter Elf declined to present full-year steering attributable to tariff uncertainty, this quarter, the corporate stated it expects an 18% to twenty% enhance in internet gross sales in comparison with fiscal 2025, and an adjusted EBITDA of $302 million to $306 million, up 2% to three% from $297 million in fiscal 2025. “Tariffs have had a big impact on us this yr,” stated Fields. “Take into consideration the place we’ve been — final yr, we have been at 25% China tariffs; this yr, on a weighted common foundation, we’re about 60%. [That’s] greater than double the affect, however we’re nonetheless capable of ship EBITDA development.”