Dow Jones futures rose barely in a single day, together with S&P 500 futures and Nasdaq futures, with Treasury yields persevering with to slip. Roku (ROKU) and MercadoLibre had been amongst a slew of earnings Wednesday night time, with Palantir Applied sciences (PLTR), Eli Lilly (LLY) and Apple (AAPL) due Thursday.

X

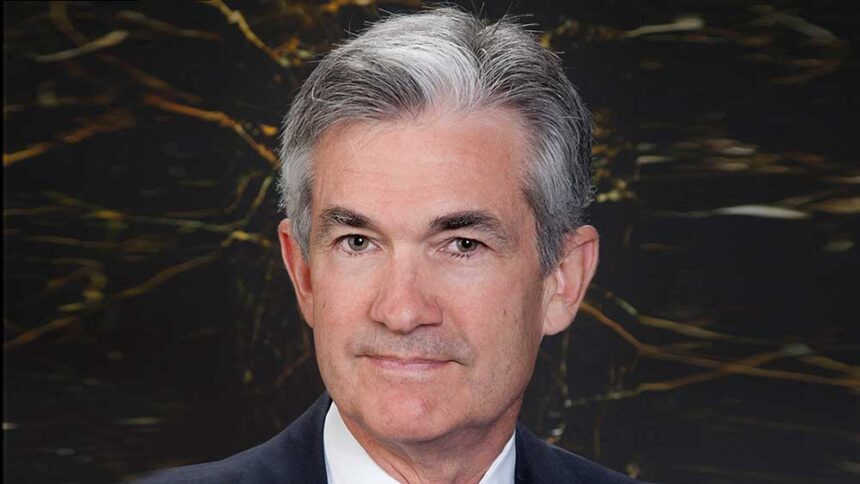

The inventory market rally try had strong positive factors Wednesday, particularly on the Nasdaq. The Federal Reserve left rates of interest unchanged, as anticipated. Fed chief Jerome Powell signaled that policymakers will stay on maintain, downplaying the “efficacy” of the Fed’s September forecast for yet another charge hike this yr.

The ten-year Treasury yield fell a number of foundation factors on Wednesday, totally on mixed-to-weak financial knowledge.

Microsoft (MSFT), Meta Platforms (META) and Amazon.com (AMZN) flashed purchase alerts, a minimum of intraday.

Earnings

MercadoLibre (MELI) jumped above the 50-day line simply earlier than the shut as some earnings knowledge leaked a couple of minutes early. After the shut, the Latin American e-commerce and funds large reported a 180% EPS achieve and 41% income rise, each displaying accelerating development and simply beating. MELI inventory roses barely after hours. That added to Wednesday’s strong 4.8% achieve. It may have an early entry Thursday.

Tremendous Micro Pc (SMCI), Remity World (RELY), McKesson (MCK), Roku, DoorDash (DASH), ELF Magnificence (ELF) and Airbnb (ABNB) reported Wednesday night time.

Winners: Roku and DASH inventory had been massive earnings winners after hours, signaling strikes again to or above key ranges. ELF inventory jumped. SMCI inventory rose modestly.

Losers: RELY inventory, which had been proper round file highs, plunged on a shock EPS miss. ABNB inventory and McKesson inventory fell modestly. MCK inventory had closed close to the highest of a purchase zone.

In the meantime, weight-loss drug giants Novo Nordisk (NVO) and Eli Lilly report early Thursday. So do PLTR inventory, Shopify (SHOP), McKesson rival Cencora (COR), Regeneron Prescribed drugs (REGN) and Marriott Worldwide (MAR).

Apple heads outcomes Thursday night time. AAPL inventory edged greater Wednesday, topping its 200-day line, however must clear its 50-day line decisively to interrupt a downtrend.

Meta, Microsoft and LLY inventory are on IBD Leaderboard, with AMZN inventory on the Leaderboard watchlist. META inventory is on SwingTrader. MSFT inventory is on IBD Lengthy-Time period Leaders. NVO inventory, Remity, Microsoft and McKesson on the IBD 50 list. Novo Nordisk, Cencora, Meta, Microsoft and MCK inventory are on the IBD Big Cap 20.

The video embedded within the article mentioned Wednesday’s market actin and analyzed Microsoft, Meta and Amazon inventory.

Dow Jones Futures As we speak

Dow Jones futures had been up 0.1% vs. honest worth. S&P 500 futures climbed 0.3%. Nasdaq 100 futures rose 0.45%.

The ten-year Treasury yield fell a number of foundation factors to 4.71%, extending Wednesday’s regular-session losses. If that held, that would not essentially break the robust uptrend, however one may a minimum of entertain the concept.

Crude futures rose 1%.

Do not forget that in a single day motion in Dow futures and elsewhere would not essentially translate into precise buying and selling within the subsequent common inventory market session.

Fed Assembly

The Federal Reserve stored its official fed funds charge at a 5.25%-5.5% charge, stunning nobody.

The central financial institution raised its financial evaluation, bolstering the case for “greater for longer” charges. Nevertheless it famous “tighter monetary and credit score situations” — a nod to greater Treasury yields — are “prone to weigh on financial exercise, hiring and inflation”

Fed chief Powell, who started talking at 2:30 p.m. ET, continued to emphasize that policymakers will proceed fastidiously. He mentioned an financial slowdown is “doubtless” wanted to convey inflation right down to reasonable ranges.

However he prompt that the Fed’s September assembly “dot plot” that pointed to at least one extra charge hike this yr is not that related in the present day. Powell mentioned “the efficacy of the dot plot decays” as time passes.

The percentages of a December charge hike fell to 19.8% vs. 28.8% on Tuesday.

Earlier Wednesday, the ADP Employment Report confirmed personal jobs elevated by 113,000 final month, under views, although September job openings got here in somewhat greater than anticipated. The October ISM manufacturing index unexpectedly sank 2.3 factors to 46.7, signaling a quicker contraction. Development spending was in line. All off that comes forward of the October jobs report on Friday.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Inventory Market Rally

The brand new inventory market rally rose solidly Wednesday with Treasury yields falling again. Shares strengthened from modest positive factors on Fed chief Jerome Powell.

The Dow Jones Industrial Common rose 0.7% in Wednesday’s inventory market buying and selling. The S&P 500 index climbed 1.05%. The Nasdaq composite jumped 1.6%. NYSE and Nasdaq trade quantity was greater than Tuesday’s commerce.

Market breadth was lackluster given the positive factors on the most important indexes.

The small-cap Russell 2000 rose simply 0.45%, nonetheless near Friday’s three-year low.

The Invesco S&P 500 Equal Weight ETF (RSP) climbed simply 0.3% whereas the First Belief Nasdaq 100 Equal Weighted Index ETF (QQEW) popped 1%, each lagging their respective indexes. Each are nicely under their 200-day traces as nicely.

U.S. crude oil costs erased early positive factors, falling 0.7% to $80.44 a barrel.

The ten-year Treasury yield sank 8 foundation factors to 4.79% on Fed chief Powell and the financial knowledge. The 2-year Treasury bond yield, extra carefully tied to Fed coverage, tumbled 10 foundation factors to 4.97%, the bottom in almost two months.

Wednesday’s motion was encouraging. The Nasdaq has rebounded from the 200-day line and retaken the 13,000 stage. Nevertheless it stays under the 21-day and particularly 50-day line. The S&P 500 is coming proper as much as the 200-day. The Dow Jones and Russell 2000 nicely under that key stage.

Extra main shares, together with tech, vitality and a few drug-related names, are establishing or flashing purchase alerts. However broader management and breadth stays poor.

ETFs

Amongst development ETFs, the iShares Expanded Tech-Software program Sector ETF (IGV) gained 0.8%, with MSFT inventory a serious holding. The VanEck Vectors Semiconductor ETF (SMH) jumped 2.5%. Reflecting more-speculative story shares, ARK Innovation ETF (ARKK) superior 0.7% and ARK Genomics ETF (ARKG) 0.9%. Roku inventory and Shopify are massive holdings throughout Ark Make investments’s ETFs.

SPDR S&P Metals & Mining ETF (XME) climbed 0.4%. The SPDR S&P Homebuilders ETF (XHB) jumped 3.1%. The Vitality Choose SPDR ETF (XLE) dipped 0.2% and the Industrial Choose Sector SPDR Fund (XLI) rose 0.3%. The Monetary Choose SPDR ETF (XLF) gained 0.65%.

The Well being Care Choose Sector SPDR Fund (XLV) nudged 0.2% greater. LLY inventory is a serious XLV holding, with Regeneron, McKesson and Cencora additionally within the ETF.

5 Finest Chinese language Shares To Watch Now

Tech Titans Flashing Purchase Indicators

Microsoft inventory rose 2.35% to 346.07, topping its Oct. 25 excessive of 346.20, providing an early entry within the consolidation going again to July. The relative power line is already at a brand new excessive, a bullish signal for MSFT inventory. The RS line, the blue line within the charts offered, tracks a inventory’s efficiency vs. the S&P 500.

Meta inventory climbed 3.5% to 311.85, retaking its 50-day line after tumbling under that key stage amid final week’s earnings. That supplied an early entry.

Amazon inventory gained 2.9% to 137, shifting decisively above the 50-day line in addition to short-term resistance at 134.48. The official purchase level is 145.86, however buyers may deal with the sample as a brief double-bottom with a 134.48 entry.

Time The Market With IBD’s ETF Market Technique

What To Do Now

The brand new market rally is gaining momentum. Some shares are flashing purchase alerts whereas others are shifting into place.

Traders may have added some publicity Wednesday afternoon, and will preserve doing so if the market makes extra progress. However achieve this progressively. The foremost indexes have plenty of potential resistance ranges. Whereas some shares are trying fascinating, it is not a flood of shopping for alternatives as breadth stays weak.

Nevertheless it’s positively a time to be in search of shopping for alternatives in addition to shares which are shifting in place or a minimum of are displaying robust relative power.

Earnings season remains to be in full swing, so positively preserve that in thoughts together with your positions and potential buys.

Learn The Massive Image every single day to remain in sync with the market path and main shares and sectors.

Please comply with Ed Carson on X/Twitter at @IBD_ECarson, Threads at @edcarson1971 and Bluesky at @edcarson.bsky.social for inventory market updates and extra.

YOU MAY ALSO LIKE:

Catch The Subsequent Massive Successful Inventory With MarketSmith

Finest Development Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation As we speak

Tesla Vs. BYD: EV Giants Vie For Crown, However Which Is The Higher Purchase?