Dow Jones futures have been little modified in a single day, together with S&P 500 futures and Nasdaq futures. CrowdStrike (CRWD) soared in a single day, headlining key earnings studies with Fed chief Jerome Powell looming Wednesday morning.

X

The inventory market rally suffered sharp losses Tuesday, with the Nasdaq main the declines. Apple (AAPL) and Tesla (TSLA) continued to slip whereas software program names bought off. In the meantime, financial institution shares continued to do effectively, whereas homebuilders held regular.

Bitcoin jumped to a report above $69,000 on Tuesday morning however reversed sharply decrease. Crypto-related shares resembling Coinbase (COIN) and Marathon Digital (MARA) additionally tumbled.

Cybersecurity chief CrowdStrike surged whereas database software program shares Field (BOX) and Couchbase (BASE) rose on their Tuesday evening earnings studies. Oddity Tech (ODD) plunged whereas Ross Shops (ROST) edged decrease.

Retail standout Abercrombie & Fitch (ANF) is due early Wednesday.

CRWD inventory is on the IBD 50.

The video embedded within the article mentioned Tuesday’s market motion and analyzed Duolingo (DUOL), PNC Monetary Companies (PNC) and Lennar (LEN).

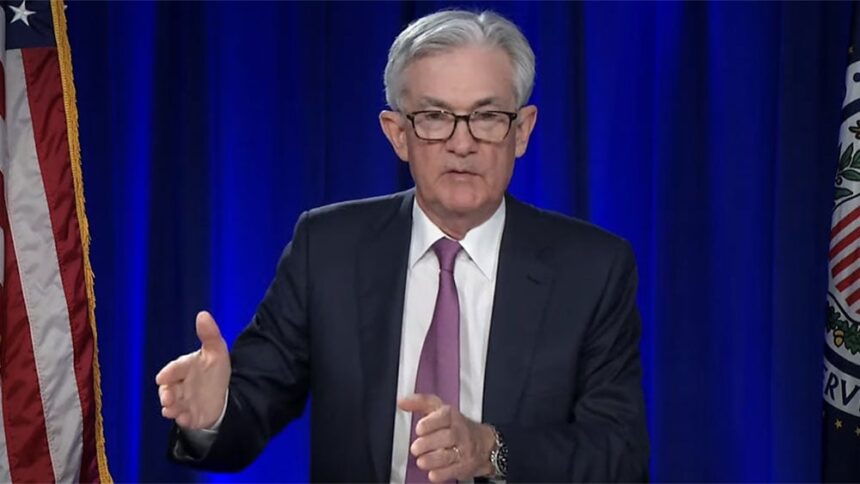

Fed Chief Powell Testifies Wednesday

Fed Chief Jerome Powell testifies earlier than the Home Monetary Companies Committee at 10 a.m. ET Wednesday. He’ll converse earlier than the Senate Banking Committee on Thursday. Powell is anticipated to bolster his latest feedback and people of fellow policymakers, that there is not any rush to chop charges.

Markets now anticipate Fed fee cuts to start out in June, although these odds have firmed up prior to now few days.

The ISM providers index on Tuesday fell barely greater than anticipated in February, however nonetheless confirmed continued development. On Friday, the ISM manufacturing index unexpectedly fell, persevering with to contract.

On Friday, the Labor Division will launch the February jobs report.

Dow Jones Futures At the moment

Dow Jones futures tilted decrease vs. honest worth. S&P 500 futures edged larger. Nasdaq 100 futures rose 0.3%.

The ten-year Treasury yield edged as much as 4.15%.

Keep in mind that in a single day motion in Dow futures and elsewhere does not essentially translate into precise buying and selling within the subsequent common inventory market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Earnings

CrowdStrike earnings beat with the cybersecurity chief providing sturdy steering. CRWD inventory soared effectively over than 20% in in a single day motion. Shares tumbled 5.2% to 297.56 in Tuesday’s common session, closing above the 50-day line.

Field earnings beat although income simply fell brief. Field inventory rose modestly in prolonged commerce after initially hovering. Shares slipped 2.3% to 27.25 on Tuesday, however discovering assist on the 200-day line after leaping simply over 5% Monday.

Couchbase reported a smaller-than-expected loss whereas income topped. BASE inventory raced greater than 10% larger in a single day. Shares retreated 3.9% on Tuesday to 26.87, falling beneath the 21-day line however nonetheless close to a two-year excessive.

Oddity earnings beat however steering disillusioned. ODD inventory plunged in prolonged motion. Shares slipped 1.1% to 45.89 on Tuesday. The specialty magnificence merchandise agency has a 50.36 consolidation purchase level.

Ross Shops earnings beat views with the off-price attire retailer climbing its dividend and saying a brand new buyback. ROST inventory declined 1% in in a single day commerce. Shares edged down 0.5% on Tuesday to 149.17, simply blow report highs.

Inventory Market Rally

The inventory market rally had a tricky day, although they main indexes did pare losses shortly earlier than the shut.

The Dow Jones Industrial Common fell 1% in Tuesday’s inventory market buying and selling. The S&P 500 index retreated 1%. The Nasdaq composite tumbled 1.65%. The small-cap Russell 2000 slumped 1%.

The Nasdaq has given up its sturdy good points from final Thursday-Friday to report excessive. Whereas AI chip leaders resembling Nvidia (NVDA) are nonetheless holding all or the majority of these good points, different techs have fallen again arduous.

Software program was a giant loser Tuesday, with traders cautious forward of CrowdStrike and following massive latest earnings sell-offs in Palo Alto Networks (PANW), Snowflake (SNOW) and GitLab (GTLB).

In the meantime, Apple inventory sank 2.8%, weighing on the main indexes and hitting its worst ranges since late October. That got here amid contemporary proof of tumbling iPhone gross sales in China. That information additionally hit iPhone chipmakers resembling Qorvo (QRVO).

Tesla inventory slumped 3.9% after Monday’s 7.2% tumble, approaching 2024 lows amid a number of destructive headlines. The relative power traces for each giants are at 52-week lows, reflecting their underperformance vs. the S&P 500 index.

The Nasdaq, barely prolonged once more on the finish of final week, has fallen from 5.8% above the 50-day transferring common to simply 3.3%. It examined assist on the 21-day line on Tuesday earlier than bouncing barely. Together with bitcoin reversing decrease, among the speculative froth available in the market could also be coming off, no less than quickly.

However after massive good points or losses prior to now week, not many tech performs are in place.

On the plus facet, numerous financial institution shares, particularly superregional banks, have been breaking out or flashing purchase indicators prior to now few days. Homebuilders and plenty of construction-related names are nonetheless performing effectively.

Bitcoin ran to a report $69,208.79 Tuesday morning, however bought off arduous, briefly undercutting $60,000 earlier than transferring again above $63,000 round 5 p.m. ET. COIN inventory hit a two-year excessive earlier than falling 5.4%. Marathon Digital plunged 13.4% because the upcoming bitcoin halving will slash rewards for bitcoin miners.

The ten-year Treasury yield slumped 8 foundation factors to 4.14%, beneath the 200-day transferring common for the primary time in weeks.

U.S. crude oil costs dipped 0.75% to $78.15 a barrel.

ETFs

Amongst development ETFs, the iShares Expanded Tech-Software program Sector ETF (IGV) skidded 3.8%, with CRWD inventory a notable holding. The VanEck Vectors Semiconductor ETF (SMH) fell 1.5%.

Reflecting more-speculative story shares, ARK Innovation ETF (ARKK) slumped 3.5% and ARK Genomics ETF (ARKG) gave up 3.2%. Coinbase is the No. 1 holding throughout Ark Make investments’s ETFs. Tesla inventory is Cathie Wooden’s No. 2 holding.

SPDR S&P Metals & Mining ETF (XME) retreated 1.4% and the World X U.S. Infrastructure Improvement ETF (PAVE) declined 0.9%. U.S. World Jets ETF (JETS) was flat. SPDR S&P Homebuilders ETF (XHB) gave up 1.1%. The Vitality Choose SPDR ETF (XLE) gained 0.7% and the Well being Care Choose Sector SPDR Fund (XLV) fell 0.75%.

The Industrial Choose Sector SPDR Fund (XLI) dropped 0.8%.

The Monetary Choose SPDR ETF (XLF) rose a fraction. The SPDR S&P Regional Banking ETF (KRE) jumped 4%.

Time The Market With IBD’s ETF Market Technique

What To Do Now

The market rally has fallen again, with many software program names breaking key ranges. Plenty of latest earnings gaps, together with Duolingo and Li Auto (LI), have rapidly faltered. That is after earnings gaps largely labored effectively available in the market rally.

Extra broadly, there aren’t many shares to purchase, particularly within the tech sector. As a substitute, traders in all probability needs to be trying to scale back publicity, no less than in know-how.

Whereas the Nasdaq and S&P 500 have held assist on the 21-day line all through the market rally, sooner or later they won’t. And even when the market rebounds, your shares might not. So hold that in thoughts.

Financial institution shares are exhibiting power. That might be a option to preserve total publicity whereas additionally decreasing AI/tech focus.

Be sure to are operating watchlists to identify rising leaders and sectors.

Learn The Huge Image on daily basis to remain in sync with the market course and main shares and sectors.

Please observe Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MAY ALSO LIKE:

Why This IBD Device Simplifies The Search For High Shares

Catch The Next Big Winning Stock With MarketSurge

Need To Get Fast Earnings And Keep away from Huge Losses? Attempt SwingTrader

Greatest Development Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation At the moment