Of their quest for financial development and vitality safety, China and India share the curiosity of dependable, seamless connectivity with Central Asia. To pursue this curiosity, Beijing and New Delhi have launched into main initiatives to bolster their linkages with the 5 Central Asian states. A scrutiny of the information reveals that regardless of the shared pursuits and ambitions, China’s and India’s financial footprints within the area differ considerably. China has considerably strengthened its clout within the area over time, whereas New Delhi’s presence stays muted as a result of limitations in state capability, geography, and strategic preferences.

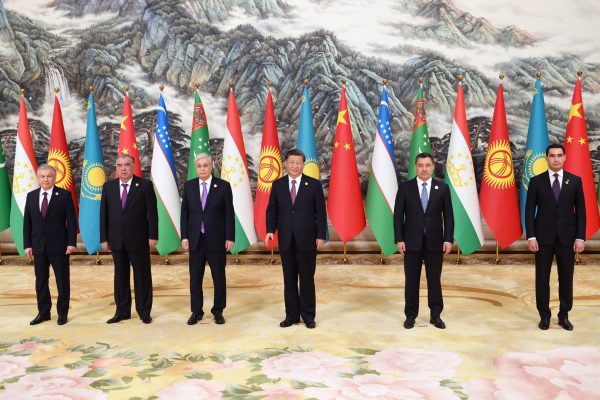

China and India are among the many greatest economies on the planet. To maintain their development, they want reliable, diversified access to exterior markets and energy resources. Central Asia emerges as an important companion within the Sino-Indian pursuit of financial improvement, because it was reiterated at individually organized summit meetings between China, India, and the 5 Central Asian states in 2022.

The collective inhabitants of the 5 Central Asian states – Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan – is close to 80 million, with increasing client demand, entailing enterprise alternatives. The world is located in a geostrategic location that connects Europe with Asia, nestled between main powers like Russia, China, and India. Moreover, Central Asia holds greater than 4 % of a few of the world’s key resources, reminiscent of oil, gasoline, and important supplies.

In opposition to this backdrop, Central Asian states can develop into invaluable commerce companions, commerce conduits, and vitality suppliers to China and India. To double down on these business alternatives, Beijing and New Delhi set out insurance policies geared toward strengthening their ties to Central Asia.

India, which considers the area to be its “extended neighborhood,” proposed the “Connect Central Asia” coverage throughout Minister of State E. Ahamed’s go to to Kyrgyzstan in 2012. The initiative goals to boost safety, political, financial, and cultural ties between India and Central Asia. India pledged to cooperate with the Central Asian republics in quite a lot of fields, reminiscent of sources, metal manufacturing, air and land connectivity in addition to banking.

In a similar way, China additionally reached out to Central Asia in an effort of enhancing connectivity to abroad markets. President Xi Jinping proposed the “Silk Street Financial Belt” (SREB), a large connectivity program in 2013 throughout a state go to to Kazakhstan. The SREB is the land-based pillar of China’s “Belt and Street Initiative” (BRI), that mixes varied types of connectivity to deepen worldwide relations and commerce. At current, the variety of collaborating international locations exceeds 150, including states from Europe, Africa, Asia, Oceania, and the American continent.

Regardless of their shared pursuits and ambitions relating to Central Asia, there are stark variations between China’s and India’s financial footprint within the area.

China consolidated its ties to Central Asia by finishing varied connectivity tasks. The Khorgos Gateway, a container terminal in Kazakhstan, opened in 2015, facilitating land transportation between China and Europe. In the present day, China and Kazakhstan are linked by way of not less than 5 oil and gasoline pipelines, railway trunk hyperlinks, and an International Border Cooperation Center. In Uzbekistan, the China Railway Tunnel Group completed the Qamchiq Tunnel in 2016, which is part of the Angren-Pap railway line.

China’s dedication to large-scale infrastructure tasks led to a gradual growth of funding within the area. In keeping with aggregated data from Central Asian statistical and financial institution authorities, China’s investments into Central Asia surpassed $1 billion in annually throughout the 2018-2023 interval, and in 2023 amounted to roughly $2 billion. This makes China a top overseas investor within the area, together with the Netherlands, america, Russia, and Switzerland. China has been Tajikistan’s biggest supply of overseas funding for not less than 5 years, and Chinese language investments represented roughly 7 % of Kazakhstan’s gross direct funding inflows in 2023.

China-Central Asia business ties additionally deepened via the years. China’s two-way commerce with Central Asia greater than doubled from $41 billion in 2018 to just about $90 billion in 2023. This represents roughly 1.5 % of China’s whole commerce, a share that’s comparable to that of France, which is Beijing’s third greatest commerce partner within the EU. China has been a top commerce counterpart of Central Asian international locations for years and became Kazakhstan’s greatest business companion in 2023.

In distinction, New Delhi’s footprint within the area is characterised by partial achievements. 2017 marked the inauguration of the primary section of Iran’s Chabahar port, an India-supported connectivity node that enables New Delhi to achieve Central Asia via Afghanistan. In 2018, New Delhi joined the Ashgabat Settlement, enabling it to collaborate with Uzbekistan, Turkmenistan, and Kazakhstan, amongst others, to deepen connectivity between Europe and Asia. In 2022, the jap part of the Worldwide North-South Transport Hall – a multimodal logistics route connecting India with Russia – started working, delivering items by way of Central Asia.

No matter these preliminary outcomes, India’s investments within the area are merely a fraction of China’s. In 2018, direct funding flows from India to Central Asia surpassed $45 million, however they slowed right down to roughly $30 million in 2023. Kazakhstan is a key vacation spot of Indian investments inside Central Asia, however in 2023, India was not among the many high 30 sources of gross overseas direct funding inflows there. India ranks barely greater as a overseas investor in Kyrgyzstan, nevertheless it lags far behind China and different key gamers like Russia or america.

Simply as its investments, India’s commerce with the area has lengthy been working beneath potential. As an illustration, New Delhi’s precise commerce turnover with Central Asia in 2015 was six to 10 instances beneath potential, according to calculations primarily based on a gravity mannequin of commerce. The development persists to today. Within the interval between 2018 and 2023, India’s two-way commerce with Central Asia was round $1-3 billion per yr, and it even declined not too long ago. In 2023, India’s commerce turnover with Central Asia barely exceeded $1 billion, representing lower than 0.5 % of India’s whole commerce, and solely a fraction of China’s combination commerce with the area.

The pronounced variations between China’s and India’s financial presence in Central Asia are rooted in three components: state capability, geography, and competing strategic imperatives.

By way of state capability, China is the second greatest economic system of the world with vast monetary resources at its disposal. Because it seeks to diversify its business routes to Europe to strengthen linkages with its key commerce companions like Germany and France, Beijing can leverage these sources and rely on its huge community of state-owned enterprises to implement the BRI.

Whereas India is among the many fastest rising economies of the globe, it nonetheless lags behind China. On the subject of outbound investments, non-public firms act as dominant gamers in abroad monetary activities. Such entities are extra concerned with earnings than coverage implementation, so monetary flows gravitate towards developed economies slightly than Central Asia. Whereas India’s abroad funding profile is improving, it’s but to catch up with China by way of scale and effectivity.

India’s state capability problem is compounded by the tyranny of geography relating to Central Asia. Whereas China is a direct neighbor to Central Asia, India struggles to achieve the market within the first place. Afghanistan, and an unfriendly Pakistan, sit between India and Central Asia, blocking direct entry to the area.

India might mitigate these challenges by collaborating in China-funded tasks. The BRI is an open-ended program and China has been trying to get India on board with it. India, nonetheless, has been reluctant to increase assist to the BRI. On the one hand, the BRI’s flagship undertaking, the China-Pakistan Financial Hall (CPEC,) traverses via Kashmir, a territory beneath dispute between Pakistan and India, and the ensuing sovereignty concern prevents India from getting on board with China’s initiative. Alternatively, India is worried concerning the monetary sustainability of BRI tasks, additional impeding New Delhi’s participation.

Lengthy story quick, Central Asia options prominently within the strategic calculus of China and India. China has a head begin by way of financial clout within the area. Given the strategic divergences in Sino-Indian relations, India’s initiatives of connecting to Central Asia are impartial from China’s.

Central Asian states stand to learn from this dynamic, as they’ll diversify their commerce and funding companions to cut back their dependence on different powers, reminiscent of Russia or america. Recognizing this chance, Kazakhstan has already been leveraging its relationship with a number of main powers to domesticate its financial development and independence. Because the Sino-Indian pursuit for markets and vitality unfolds, different Central Asian states could comply with swimsuit.