When discussing the geopolitics of electrical automobiles (EVs), many individuals instantly consider the tariffs imposed on Chinese language EVs and the associated points about overcapacity. However these points don’t encapsulate the entire image of geopolitics and EVs. To completely grasp the geopolitics of EVs, it’s essential to look past market entry and delve into the complexities of the availability chain.

The EV provide chain comprises three streams: uncooked supplies, intermediate items, and the ultimate product, the car. Whereas completely different, every section is interconnected and presents distinctive insights into the broader geopolitical dynamics at play. This angle reveals a way more intricate and nuanced image, difficult the standard concentrate on tariffs and market issues.

Upstream

The upstream of the EV provide chain encompasses the extraction and processing of crucial minerals, equivalent to lithium, cobalt, nickel, and uncommon earth components.

Lithium, key for battery manufacturing, is basically discovered within the well-known “lithium triangle” nations, Argentina, Chile, and Bolivia, which account for about 75 percent of worldwide reserves. Nevertheless, lithium reserves don’t equal manufacturing; Chinese language corporations at present management almost half of the world’s lithium manufacturing in varied ways.

Nickel is principally utilized in lithium-ion battery cathodes to extend the battery’s vitality density and prolong driving vary. The rising demand for nickel in EV batteries has intensified competitors for nickel assets amongst completely different industries. The world’s main nickel producers embody Indonesia, Australia, and Brazil.

Cobalt’s thermal stability and excessive vitality density can contribute to the battery’s cost and discharge course of. The Democratic Republic of the Congo (DRC) holds over half of the world’s cobalt reserves, and greater than 70 percent of manufacturing, although the manufacturing from Indonesia can also be promising. The mining of cobalt in DRC faces authorized, human rights, and environmental concerns, triggering the event of alternative applied sciences.

Uncommon earth metals are important in electrical motors on account of their magnetic properties. China accounts for almost 70 percent of the world’s manufacturing and imposes strict export laws, which prompted many Western corporations to develop rare earth-free motor know-how to cut back dependence on Chinese language provides. In the meantime, nations just like the United States are exploiting their very own assets to safe provide.

The geopolitical implications of the upstream provide chain are multifaceted. First, the rising debates over “provide chain safety” and techno-nationalism have created advanced dynamics between suppliers and shoppers. Uncooked materials suppliers undertake strategic measures equivalent to nationalization, export regulations, or rejection of overseas acquisitions of mines to tighten their control over the assets. In the meantime, consuming nations are utilizing each business and political means equivalent to free trade agreements (FTA) and administrative acts to make sure or diversify the availability, or to cut Chinese language dominance.

Second, environmental issues on mining not solely expose the mining nations to worldwide criticism, but in addition present an incentive to enhance and collaborate to stick to environmental, social, and governance requirements.

Third, regional powers might leverage plentiful assets to safe a greater place within the provide chain. Endowed with wealthy nickel and cobalt reserves, Indonesia has attracted vital investment, and goals to make itself a key player in EV battery manufacturing.

Midstream

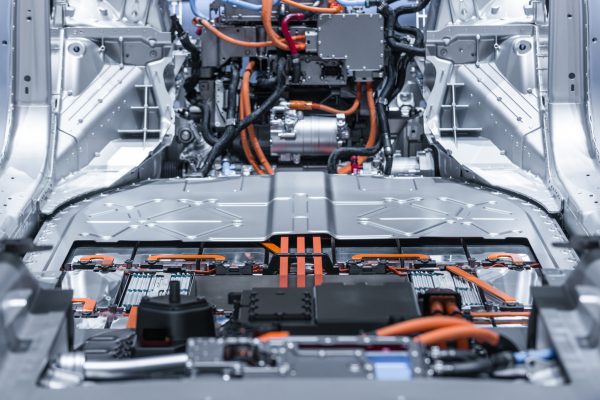

The midstream of the EV provide chain includes batteries, motors, and digital management techniques. Semiconductors, built-in into each nook of EVs, additionally play a significant function within the midstream.

Chinese language, Japanese, and Korean corporations dominate the EV battery sector. China’s CATL and BYD maintain vital market shares. Japan and South Korea focus extra on export markets, with Korean corporations like LG main in European manufacturing capability.

Lithium-ion batteries at present maintain the most important market share, with ongoing improvements to enhance effectivity. Rising options like sodium-ion batteries and solid-state batteries additionally symbolize vital technological competitors and point out a possible change within the present context.

The manufacturing of motors and digital management techniques is numerous, with applied sciences tailor-made to useful resource availability and effectivity. U.S. carmakers, for instance, initially favored AC induction motors to mitigate uncommon earth constraints, whereas Japanese producers choose everlasting magnet synchronous motors (PMSMs) on account of Japan’s adequate uncommon earth provides. China’s plentiful uncommon earth reserves have made PMSMs the dominant motor know-how in Chinese language EVs, highlighting the strategic useful resource benefit.

EVs use extra semiconductors than inner combustion engine automobiles. Most automotive semiconductors are mature course of chips and fewer superior than these used for smartphones, laptops, and AI. Nevertheless, the demand for high-end and AI-related chips is rising as autonomous driving and infotainment techniques are pushing EVs towards better intelligence.

Technological improvements will largely form the long run aggressive panorama of the midstream. International locations with technological and useful resource benefits will proceed to advance even within the subsequent part of the EV business. Furthermore, the geopolitics of chips may inform a distinct story sooner or later, that’s, the “second half” of the competitors, the event towards Intelligent Connected Vehicles (ICVs).

Ought to the US prolong high-end chip controls to EVs, Chinese language producers, although striving to localize production, may face challenges on account of lowered provide within the brief time period. In the long run, if China can not independently develop and mass-produce high-end semiconductor chips, the event of its sensible automobile business shall be severely restricted.

Downstream

The downstream of the EV provide chain focuses on market entry and Unique Tools Producer (OEM) manufacturing. OEMs are accountable for designing, manufacturing, and promoting automobiles, together with the general manufacturing course of, meeting, and model advertising. Main EV corporations globally comply with this mannequin, incorporating elements from varied suppliers into their remaining assembled and branded merchandise. China, the US, and Europe are key gamers within the downstream.

Geopolitics impacts the downstream EV provide chain by way of commerce insurance policies. The U.S. and EU have imposed various tariffs on Chinese language EVs, pushed by completely different motivations and strategies. The Biden administration’s tariffs on Chinese language strategic industries, together with a 100 percent tariff on EVs, are largely preventive, aiming to localize provide chain manufacturing inside the US. This technique offers the U.S. with time and alternatives to restructure its provide chain and scale back its dependence on Chinese language corporations.

In distinction, the EU’s anti-dumping measures and short-term tariffs are remedial, as Chinese language EVs have already captured a major share of the European market, with localized provide chains starting to take form. As well as, because of the various pursuits and concerns amongst EU member states, the inner decision-making course of is cautious and topic to a number of constraints.

The temporary tariff coverage targets EVs “pushed solely by a number of electrical motors,” making the scope and implementation of those commerce instruments fairly restricted. The influence of those tariffs on Chinese language EV producers stays inside an appropriate vary, permitting mainstream EV corporations to nonetheless be worthwhile or scale back prices by way of provide chain shifts.

Past tariffs straight imposed on EVs, information compliance has grow to be a key a part of market entry. International locations have carried out varied regulations requiring multinational automotive corporations to retailer driving information regionally or on approved servers. These measures are designed to make sure transparency, traceability, and safety all through the info lifecycle.

For instance, the EU’s General Data Protection Regulation imposes stringent necessities on corporations from non-approved nations dealing with particular person identifiable information, typically necessitating partnerships with native entities or the usage of public cloud techniques to attain compliance, as seen in BYD China’s cooperation with CARIAD. Related measures had been developed in China, the US, and different nations, with various focuses.

Ongoing geopolitical developments in market entry points concerning information compliance and tariffs will form the way forward for the downstream EV provide chain. The distinct information laws have two implications for multinational automotive corporations. First, automakers are compelled to adapt their practices to completely different markets, which could result in tailored features for automobiles from distinct areas.

Second, the fragmentation of information compliance pointers might stop automobile automakers from effectively allocating their assets in direction of the event of self-driving applied sciences, important for ICVs.

Equally, commerce insurance policies, significantly within the type of tariffs, can have a profound influence. In the US, insurance policies to localize provide chains and scale back dependency on Chinese language imports might enhance home industries however threat increased prices and slower inexperienced vitality progress if mismanaged. In Europe, the steadiness between defending native industries and attracting overseas funding will evolve, with the EU’s cautious strategy to tariffs and anti-dumping measures probably persisting, thereby influencing market dynamics and aggressive methods amongst European and Chinese language producers.

A provide chain perspective offers a complete and nuanced image of the geopolitics of EVs. Sadly, competitors, accusation, and techno-nationalism overshadow the cooperation and the “inexperienced” facet of the business. The way forward for the geopolitical panorama – and the worldwide EV business – stays undecided. In a pessimistic view, present insurance policies might escalate costs and hinder the inexperienced transition, whereas an optimistic prediction could be that the commercialization of alternative technologies will lighten the tensions and convey the “inexperienced” ingredient again.