Dividend shares may be a wonderful supply of passive earnings. These which can be finest have sturdy money flows that assist and develop their dividend payout. One inventory yielding traders almost 4% that has raised its dividend for 36 consecutive years is Chevron (NYSE: CVX).

The integrated oil and gas company has benefited from sturdy tailwinds to its enterprise lately. These tailwinds have it raking in money circulate hand over fist, which it has used to make strategic acquisitions and return capital to shareholders by means of a rising dividend and inventory repurchase program. This is why this cash-gushing dividend inventory is usually a strong addition to your portfolio at this time.

Chevron has raised its dividend for 36 consecutive years due to its balanced enterprise

Investing in oil and fuel shares comes with threat, since these corporations may be unstable primarily based on the underlying worth of these commodities. Corporations with heavy drilling operations profit when oil costs enhance, leading to engaging margins and money flows. This enterprise, often known as upstream operations, consists of exploring, producing, and transporting crude oil and pure fuel.

Conversely, if oil costs decline, the businesses’ backside line takes successful. A method oil and fuel corporations steadiness this out is thru downstream operations. Chevron’s downstream enterprise consists of refining crude oil into petroleum, transporting refined merchandise by means of pipelines, and working fuel stations worldwide.

As an built-in oil and fuel firm, Chevron can higher journey out unstable oil costs. This balanced enterprise mannequin is why Chevron has raised its dividend payout for 36 consecutive years regardless of being a significant participant within the unstable oil and fuel trade.

Macroeconomic tailwinds helped Chevron rake in money hand over fist

Lately, macroeconomic components have labored in oil and fuel corporations’ favor. Within the early days of the pandemic, demand fell, costs plunged, and the provision of oil tightened considerably in response. The Russia-Ukraine battle additional constrained oil provide, inflicting costs to skyrocket final 12 months.

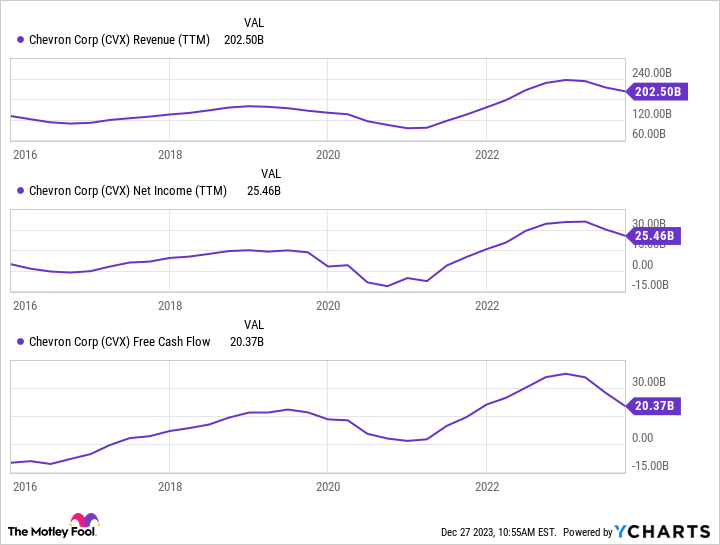

Chevron has benefited huge time from the rise in oil costs. Final 12 months, its upstream operations enterprise earned $30 billion, a 91% enhance from the prior 12 months, whereas web earnings of $35.5 billion elevated by 127%. Its free money circulate, or the money left over after paying for working prices and capital expenditures, was $37.6 billion.

Oil costs have come down this 12 months, and Chevron’s earnings have not been fairly as sturdy. By Sept. 30, the corporate’s complete income is down 19% from final 12 months, and web earnings has fallen 34%.

The inventory has underperformed the Dow Jones this 12 months and is down 10% in comparison with the index, which has gained 15%. Nevertheless, zooming out over the previous three years, Chevron inventory nonetheless far outpaces the Dow Jones, returning 102% versus 32%.

Placing money to work for long-term progress

Buyers can take consolation in realizing that the corporate has used its windfall from the previous couple of years to lift its dividend payout, enhance its inventory buyback program, pay down debt, and make acquisitions this 12 months.

In the beginning of the 12 months, Chevron raised its dividend payout by 6% whereas approving a $75 billion inventory repurchase program. By Sept. 30, the corporate has repurchased $7.8 billion beneath the repurchase program.

Chevron has additionally used its windfall to make a number of acquisitions to spice up its future earnings. Final 12 months, the oil and fuel big acquired Renewable Power Group for $3.15 billion, making it the second-largest biorenewable gasoline producer within the U.S. It additionally made an enormous splash in October when it agreed to purchase Hess for $60 billion in debt and fairness, which ought to shut in early 2024.

Chevron is effectively positioned to proceed rewarding shareholders

Chevron ought to proceed to learn from tailwinds from a decent oil provide and underinvestment within the trade. Key acquisitions ought to assist it concentrate on core positions and strengthen its already sturdy steadiness sheet, permitting it to return much more capital to shareholders — making this cash-gushing dividend inventory a strong long-term purchase for traders at this time.

Do you have to make investments $1,000 in Chevron proper now?

Before you purchase inventory in Chevron, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Chevron wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Courtney Carlsen has positions in Chevron. The Motley Idiot recommends Chevron. The Motley Idiot has a disclosure policy.

Beat the Dow Jones With This Cash-Gushing Dividend Stock was initially printed by The Motley Idiot