The double-digit tariff hikes imposed by america’ Trump administration have buckled Asia to its knees. Markets have plummeted, prices have risen, and outlooks on the financial way forward for the area are quick approaching the dismal. There isn’t any query that the extent of those tariffs was bigger than anticipated. However america is just one participant on this recreation, and Asia holds just a few trump playing cards as effectively.

The U.S., China, and the Relaxation

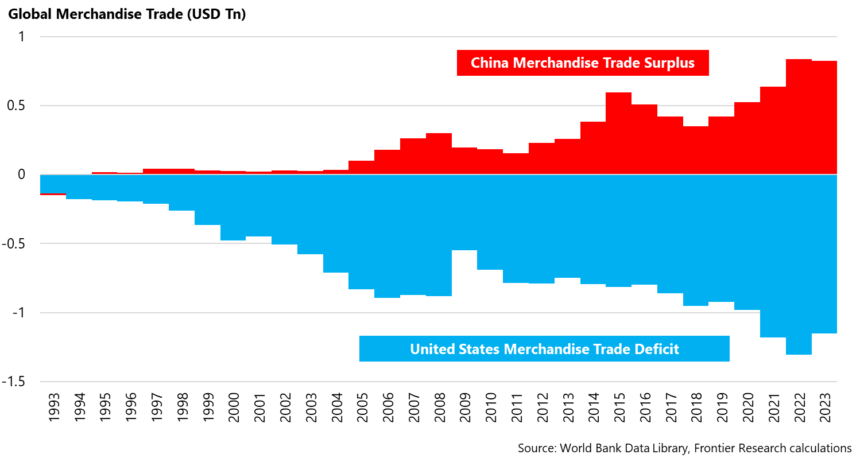

The U.S. operating deficits has been a key a part of the worldwide system of commerce for over 50 years now. These deficits have been countered with surpluses being run by various nations over time. Throughout the final 20 years, the main counterparty to U.S. deficits has ended up being China’s surpluses. U.S. deficits and Chinese language surpluses coincide very carefully, as seen within the chart beneath. This creates two essential gamers within the international economic system: China produces, and america consumes.

This technique works so long as each events comply with maintain enjoying this recreation. For america, this implies utilizing their deep monetary markets to borrow from the world, after which pay the world again in return for the products different nations produce. Steady will increase within the U.S. deficit, and within the U.S. debt, have been the consequence.

For another nation, this might have probably resulted in a disaster far, far earlier. Nevertheless, america holds an “exorbitant privilege” because of being the worldwide deficit hegemon: they’ll borrow with none actual price. China coming in as the only largest producer has helped in some ways. Now not does america need to cope with rising and falling surplus counterparts – China alone acts as a steady move of capital into the U.S.

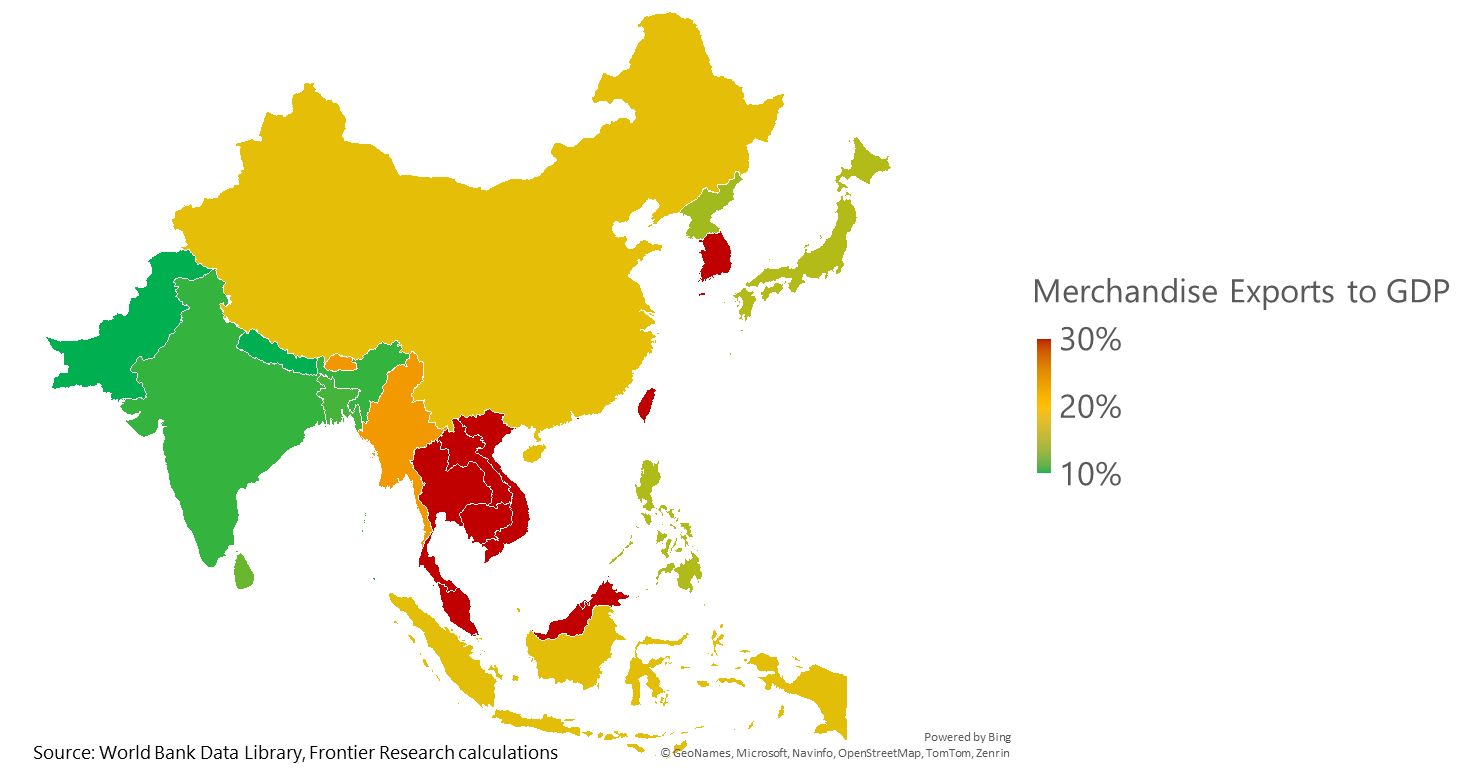

The remainder of the world stays essential in their very own proper, however within the international economic system their function as an middleman between america and China is arguably extra essential. The remainder of Asia, particularly, performs this function. Right here, East and Southeast Asia mix alongside China to create a broad “Manufacturing facility Asia.” South Asia performs a unique function. South Asian nations do act as a slight middleman of China-U.S. commerce, however extra importantly, their consuming households find yourself performing as an middleman of capital.

This has been the essential cause why, even when China has diminished their direct lending into america, there hasn’t actually been a consequence to the worldwide system. Any surpluses that China holds need to go someplace in the long run. And no matter who receives stated capital straight from China, the top level nonetheless finally ends up being america. Nowhere else provides such protected returns at an excellent rate of interest.

Manufacturing facility Asia is a transparent pathway for this intermediation. Chinese language capital has flowed into the remainder of East and Southeast Asia over time, build up manufacturing facility capability inside these nations. Commerce then flows from these nations into america. Even South Asia performs a essential function right here, significantly as a result of they’ve far bigger service economies than Manufacturing facility Asia – and capital cycles by means of them again into the bigger deficits of america.

What Card Will China and the Remainder of Manufacturing facility Asia Play?

If China, supported by Manufacturing facility Asia, is the clear counterpart to the U.S. deficits, then any motion america takes to scale back that deficit will closely influence China. The cardboard that the U.S. has performed proper now’s that of tariffs. For a world that has two essential gamers, no matter China does in response – thus far, enacting its personal tariffs – will matter nearly as a lot because the U.S. tariffs have.

Manufacturing facility Asia has two essential playing cards it may possibly play, although neither is a certain guess. On one hand, Asian nations can select to double down on their manufacturing economies and flood the world with cheaper items. The final time round, that is what they ended up doing. For any shopper on the earth, that helps rather a lot. Nevertheless, this hurts different producers – and particularly people who wish to be producers.

Then again, Manufacturing facility Asia can select to remain put, shut down just a few factories, persuade just a few households to begin consuming extra, and attempt to make do throughout the area itself. Such a large restructuring of the economic system will nearly positively have political and social prices at house. For the remainder of the world, this might create a state of affairs the place a budget imports they’ve gotten used to now not exist.

Both method, no matter China and Manufacturing facility Asia find yourself doing in response to the playing cards that america have performed, the worldwide economic system should cope with the ripple results. There isn’t any U.S. deficit with out the Chinese language surplus, in any case.

Will South Asia’s Shoppers Have New Playing cards to Put Down?

South Asia doesn’t actually have factories. Any international commerce slowdown is extra prone to have an effect on the nations of South Asia by means of weaker providers as a substitute. If the factories of East and Southeast Asia begin closing down, that may imply South Asia’s economies need to search for a greater hand to play. Nevertheless, if Manufacturing facility Asia decides to export extra, then South Asia’s households would possibly find yourself being much more essential to the world.

It is a fairly new place for South Asia to be in. Notably if Manufacturing facility Asia begins pumping low-cost items internationally, that makes it a lot tougher to be a producer in South Asia. Nevertheless, low-cost imports and low-cost capital have a profit as effectively: They’ll actually push progress. When China ramped up its manufacturing from the mid-2000s onwards, it pushed an enormous cycle of progress for South Asia. A rising South Asian shopper isn’t out of the image right here, particularly if america deficits begin closing. Another person would possibly have to step up.

If Manufacturing facility Asia closes down, the fee to South Asia is totally different. Now not would commerce move throughout the South Asian coasts in the identical method, and the service industries which have helped assist the South Asian shopper would possibly decelerate. What would they do in such a context? Traditionally, South Asians have left their house nations, discovered jobs elsewhere, and despatched a reimbursement for his or her households to spend. Will there be such jobs in a world with out Manufacturing facility Asia?

The Two Huge Arms Will Preserve Taking part in, and the World Will Be Watching

Over the following few months, it appears more and more probably that the world will probably be enjoying an entire new recreation. In a single nook, america is claiming its deficits are an issue. Tariffs are the cardboard they began with. China is the opposite massive participant – you’ll be able to’t play the sport with out them. What is going to they do? Which card will they play, if none of their choices are nice? These two fingers would be the essential movers that the world should maintain watching.

How will the remainder of Asia go alongside in such a tough context?