As equities soared in 2020 and shoppers flocked to buying and selling apps like Robinhood, Apple and Goldman Sachs have been engaged on an investing function that will let shoppers purchase and promote shares, in response to three folks aware of the plans.

The mission was shelved final 12 months because the markets turned south, stated the sources, who requested to not be named as a result of they weren’t licensed to talk on the matter.

The trouble, which has not been beforehand reported, would have added to Apple’s suite of economic merchandise powered by Goldman. Apple first teamed up with the Wall Avenue financial institution to supply a bank card in 2019, after which added purchase now, pay later (BNPL) loans and a high-yield financial savings account. The corporate said last month that the financial savings account providing had climbed previous $10 billion in consumer deposits.

Representatives for Apple and Goldman declined to remark.

Apple CEO Tim Cook dinner holds a brand new iPhone 15 Professional through the ‘Wonderlust’ occasion on the firm’s headquarters in Cupertino, California, U.S. September 12, 2023.

Loren Elliott | Reuters

Apple was engaged on the investing function at a time of zero rates of interest throughout Covid, when shoppers have been caught at dwelling and spending extra of their time and their file financial savings in buying and selling shares, together with meme shares like GameStop and AMC, from their smartphones.

Apple’s conversations with Goldman started throughout that hype cycle in 2020, two sources stated. Their work progressed, and an Apple investing function was meant to roll out in 2022. One hypothetical use case pitched by executives concerned the flexibility for iPhone customers with additional money to place cash into Apple shares, one individual stated.

However as markets have been roiled by larger charges and hovering inflation, the Apple staff feared consumer backlash if folks misplaced cash within the inventory market with the help of an Apple product, the sources stated. That is when the iPhone maker and Goldman switched instructions and pushed the plan to launch financial savings accounts, which profit from larger charges.

The standing of the stock-trading mission is unclear after Goldman CEO David Solomon bowed to inside and exterior stress and determined to retrench from practically the entire financial institution’s client efforts. One supply stated the infrastructure for an investing function is generally constructed and able to go ought to Apple finally resolve to maneuver ahead with it.

The Apple Card launched with a lot fanfare three years in the past, however the enterprise introduced regulatory warmth and racked up losses as its consumer base expanded. Earlier this 12 months, Goldman rolled out a high-interest savings account for Apple Card customers, providing a 4.15% annual proportion yield.

Goldman was additionally central to Apple’s BNPL providing. The product, known as Apple Pay Later, can be utilized for purchases of $50 to $100 “at most web sites and apps that settle for Apple Pay,” in response to the support page. Debtors can cut up a purchase order into 4 funds over six weeks with out incurring curiosity or charges.

Earlier than Goldman’s pivot away from retail banking, the corporate examined methods to broaden its partnership with Apple, sources stated. Extra lately, Goldman was in discussions to dump each its card and financial savings account to American Categorical.

Had plans for the buying and selling app progressed, Apple would have entered a market with stiff competitors, that includes the likes of Robinhood, SoFi and Block’s Sq., together with conventional brokerage corporations corresponding to Charles Schwab and Morgan Stanley’s E-Commerce.

Inventory buying and selling has develop into one other approach for monetary corporations to maintain prospects and drive engagement on their platforms. Apple was pursuing the identical strategy, one supply stated. It is a transfer that would seize the curiosity of regulators, who’ve scrutinized Apple for its App Retailer practices. Robinhood has additionally been grilled by regulators for what they described as “gamifying” markets.

Different tech corporations have been pushing into the house. Elon Musk’s X, previously generally known as Twitter, is engaged on a method to let customers purchase shares and cryptocurrencies by a partnership with eToro. PayPal had plans to launch inventory buying and selling after hiring a key trade govt in 2021. However the firm deserted these plans, and stated on an earnings name that it could reduce spending and refocus on its core e-commerce enterprise.

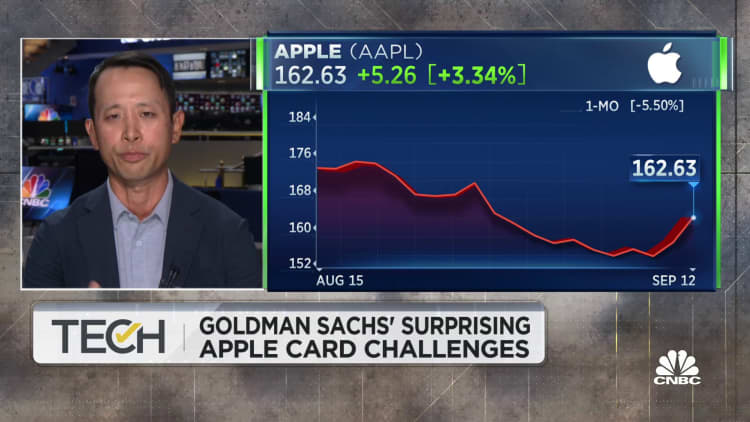

WATCH: Goldman’s Apple Card faces mounting credit score losses