-

The inventory market is more likely to see file highs in early 2024 after an “extraordinarily uncommon” sign simply flashed.

-

That is in keeping with Carson Group chief market strategist Ryan Detrick, who highlighted one other signal that breadth is bettering.

-

“We proceed to count on shares to do fairly effectively and we stay obese equities,” Detrick stated.

An “extraordinarily uncommon” sign simply flashed within the inventory market, suggesting to Carson Group chief market strategist Ryan Detrick that file highs are imminent.

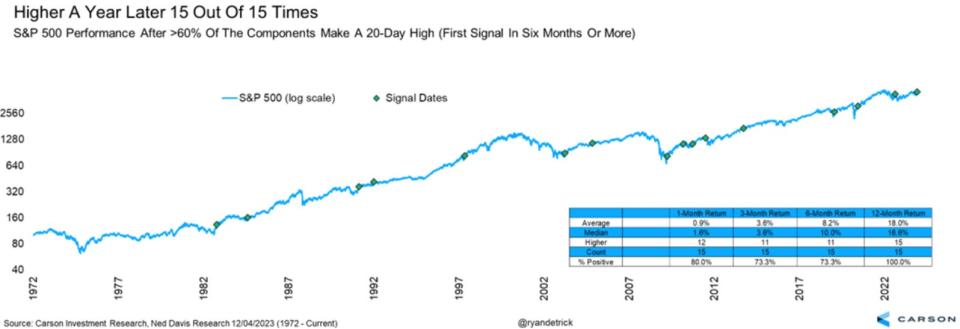

Detrick highlighted in a Thursday word that greater than 60% of all elements within the S&P 500 hit a brand new 20-day excessive final week. This runs counter to the concept mega-cap tech firms are driving the majority of the beneficial properties within the inventory market.

“Final week, we noticed a really uncommon breadth thrust, which steered many shares have been surging, which tends to be a sign of impending energy,” Detrick stated. “That is extraordinarily uncommon and confirmed a whole lot of shopping for has taken place not too long ago, not simply in a number of giant shares.”

Since 1972, this uncommon sign has flashed 15 instances, not counting final week’s sign. The S&P 500 was larger a 12 months later 100% of the time after the sign flashed, producing a median return of 18%.

If the same achieve happens over the following 12 months, the S&P 500 would commerce at simply above 5,400, which exceeds even the most bullish stock market forecasts.

Detrick highlighted that there have been different bullish indicators within the inventory market in current weeks, including the S&P 500 surging 8.9% in November, representing its 18th best month ever.

When measuring the S&P 500’s 20 finest months of efficiency, shares have been larger 80% of the time a 12 months later, with a median achieve of 13%. And when counting the 30 months within the S&P 500’s historical past when beneficial properties have been at the very least 8%, shares went on to rise 90% of the time within the following 12 months.

“As soon as once more, this alerts the energy we simply noticed was seemingly the start to extra energy, not the top,” Detrick stated.

Lastly, he famous that the S&P 500 hasn’t hit a file excessive since January 2, 2022, practically two years in the past. With stocks less than 5% away from new highs, Detrick stated he expects a file excessive to be hit in early 2024, and if that occurs, it could be yet another bullish sign.

“Earlier instances shares went at the very least one full 12 months with out new highs after which hit one, the long run returns have been very stable. The truth is, shares have been up 13 out of 14 instances a 12 months later and up 14.9% on common after lengthy streaks with no new excessive after which lastly making one,” Detrick defined.

When mixed with the “extraordinarily uncommon” technical breadth thrust sign that flashed final week, all indicators are pointing for a continued bull market in 2024.

“Any one in every of these alerts by themselves could possibly be argued to be random, however while you begin stacking all of them on prime of one another, we proceed to count on shares to do fairly effectively and we stay obese equities,” he stated.

Learn the unique article on Business Insider