-

Low stock, excessive mortgage charges, and excessive costs have created a tough housing market.

-

Owners have seen fairness climb, however home hunters are having a tough time breaking into the market.

-

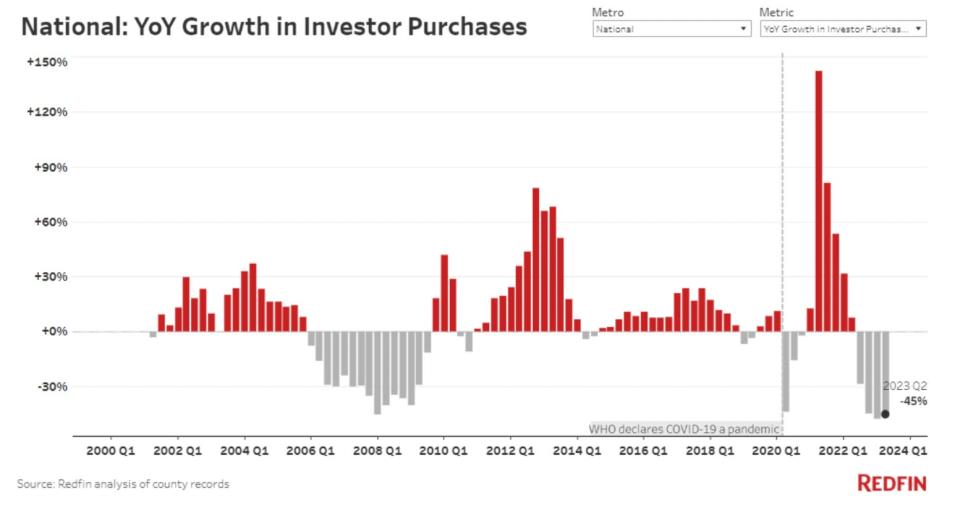

Purchases by actual property traders plunged 45% within the second quarter in comparison with final 12 months.

It is a robust time to be navigating the US housing market.

Low stock, excessive mortgage charges, and high prices have put the housing market into a state of unaffordability that is weighing on home hunters, present owners, and even actual property traders.

The Federal Reserve’s aggressive rate of interest hikes during the last 18 months have led to mortgage charges hovering round two-decade highs, however to this point house costs have not fallen as they normally do when charges climb.

Throw in distorted provide and demand dynamics and economists see little reason to expect easing affordability. Present owners are reluctant to maneuver and threat giving up decrease charges they secured earlier than, and that retains properties off the market and leaves consumers with fewer choices.

As issues stand, roughly one-quarter of house owners are sitting on mortgage rates of less than 3%, close to the very best on file.

Excessive house costs

The Case-Shiller US Nationwide Composite House Worth Index confirmed house costs climbed for the fifth straight month in June, and now the index is just 0.02% below the all-time high reached last summer. The seasonally-adjusted knowledge confirmed costs climbed in each single metropolis within the group’s 20-city index.

“As we have famous beforehand, the restoration in house costs is broadly based mostly,” Craig J. Lazzara, managing director at S&P DJI, mentioned. “During the last 12 months, 10 cities present optimistic returns. In any other case mentioned, half the cities in our pattern now sit at all-time excessive costs.”

A latest Redfin survey discovered that younger adults particularly are going through headwinds. Thirty-eight p.c of consumers below 30 in a survey mentioned they needed to rely on family to help afford a down payment, within the type of both money or inheritance. The stat led Redfin chief economist Daryl Fairweather to label the cohort as “nepo-homebuyers.”

To that time, People are contending with the most expensive starter homes ever. The median sale value for the everyday starter house hit an all-time excessive of $243,000 in June.

Hovering costs are even making it robust for these with deeper pockets. A separate Redfin report discovered that actual property investors bought 45% fewer homes in the second quarter in comparison with a 12 months in the past.

That outpaced the 31% general dip in house gross sales, and signified the most important drop since 2008, excluding the primary quarter of this 12 months.

“Gives from hedge funds have dried up; I have never acquired a suggestion from one in a very long time, besides unrealistically low affords,” Las Vegas Redfin agent Shay Stein mentioned. “From mid-2020 till early 2022 when rates of interest began going up, hedge funds purchased up a ton of properties and instantly turned them into leases, pricing out native consumers. Now an enormous portion of our properties are owned by traders, however they are not including to their portfolios.”

No reduction in sight

Zillow’s newest forecast says house costs might climb another 6.5% by July 2024, and knowledge from Realtor.com confirmed whole house listings simply dropped for the fourth consecutive month in August, suggesting elevated prices will persist.

The report additionally confirmed that house sellers had been much less energetic in August, with 7.5% fewer newly listed properties in comparison with the identical time final 12 months. Stock within the largest 50 metros, Realtor.com mentioned, stays 45% beneath pre-pandemic ranges.

In the meantime, the most recent mortgage delinquency knowledge additionally suggests widespread price declines aren’t on the horizon. Fannie Mae reported critical delinquencies fell to 0.54% in July from 0.55% in June — the bottom fee since earlier than the housing bust of 2008 and likewise beneath the pre-pandemic low of 0.60%.

“Since lending requirements have been strong and most householders have substantial fairness there is not going to be an enormous wave of single-family foreclosures this cycle,” veteran actual property commentator Invoice McBride wrote in an August 28 observe. “Which means we is not going to see cascading value declines like following the housing bubble.”

Learn the unique article on Business Insider