Superior Micro Gadgets (AMD) on Wednesday launched its clearest problem but to the dominance of Nvidia (NVDA) within the red-hot marketplace for chips that energy synthetic intelligence purposes. AMD inventory wavered following the announcement.

X

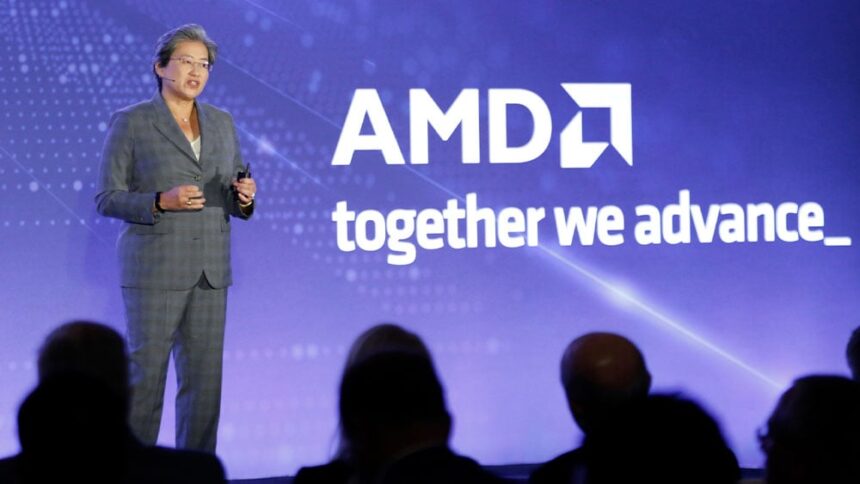

At an organization occasion Wednesday, AMD launched its Intuition MI300 Sequence accelerator household. As previewed earlier this yr, the chips are designed to deal with the huge workloads in AI purposes.

“This tempo of innovation is quicker than something I’ve ever seen earlier than,” Chief Govt Lisa Su stated on the San Jose, Calif. occasion. “For us at AMD, we’re so properly positioned to energy that end-to-end infrastructure that defines this new AI period.” Su forecast that the marketplace for AI accelerator chips in information facilities will surge 70% yearly to succeed in greater than $400 billion in 2027.

AMD unveiled the MI300 household of chips designed to deal with the heavy computing workloads in AI methods. The corporate had projected greater than $2 billion in 2024 gross sales from the brand new chips.

The rise of AI, together with generative AI purposes equivalent to OpenAI’s ChatGPT and Google’s Bard, sparked robust demand for chips that may supply extra vital processing energy. Nvidia, recognized for highly effective chips used for gaming and Hollywood particular results, took the early lead when AI began to turn into an enormous pattern a decade in the past. Now, AMD is trying to problem Nvidia, whose H100 AI chip is taken into account the market chief.

On the inventory market at present, AMD inventory slipped 1.6% to 116.45 in latest motion. NVDA inventory, in the meantime, is down greater than 2% at 456.22.

AMD Inventory: Focus On Inference

CEO Su stated AMD’s latest chip has industry-leading capability and bandwidth. The chip is the same as current competitors in working coaching for information fashions, Su stated. However she stated AMD’s chip is anticipated to outperform rivals in inference, or working AI purposes after the fashions have been educated.

“I’ve to say that is really probably the most superior product we have ever constructed,” Su stated. “And it’s the most superior AI accelerator within the {industry}.”

Su additionally up to date AMD’s projection for the marketplace for AI chips for information facilities, which the corporate had estimated would develop from $30 billion in 2023 to $150 billion by 2027. The corporate now sees the full market as a substitute reaching greater than $400 billion.

“It is actually clear that the demand is simply rising a lot, a lot sooner,” than anticipated, Su stated.

The AMD occasion additionally featured executives from Microsoft (MSFT), Meta (META) and Oracle (ORCL) who shared how their corporations are working with the chip large. Microsoft stated AMD’s new chips can be found for patrons of its cloud enterprise to judge beginning at present.

Difficult Nvidia

Nvidia’s processors run most information facilities which are powering generative synthetic intelligence merchandise. That has helped energy back-to-back quarters with triple digit gross sales progress for Nvidia. Additional, NVDA inventory’s 215% achieve this yr is tops within the S&P 500.

However challengers are coming. Together with AMD’s announcement Wednesday, Intel (INTC) subsequent week will host an occasion known as AI In every single place to spotlight new processors for information facilities.

AMD inventory has gained about 70% this yr, helped by its push into AI information middle merchandise.

Additional, the corporate’s newest earnings report broke a streak of three quarters with year-over-year earnings declines for AMD. AMD inventory gained almost 10% the day after it printed its outcomes on Oct. 31, headlined by the corporate’s projection of greater than $2 billion in 2024 gross sales for its MI300 AI accelerators.

The 2024 gross sales projection “helps the view that AMD is well-positioned to take part within the massive and rising Gen AI compute market,” wrote Goldman Sachs analyst Toshiya Hari in a Nov. 1 consumer notice.

Additional, Raymond James analysts led by Srini Pajjuri wrote in a consumer notice previewing Wednesday’s occasion that “We see no motive why AMD cannot seize 10%-20% share of the $100 billion+ AI accelerator market long term, which may imply double-digit income progress and margin growth for the following 2—3 years.”

YOU MAY ALSO LIKE: