The inventory market has offered off a bit not too long ago, nevertheless it has nonetheless been an total glorious begin to the 12 months, with the S&P 500 up 7% as of market shut March 6. Nevertheless, some main shares are underneath strain.

The “Magnificent Seven” — Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA) — collectively make up 29% of the S&P 500. The efficiency of those firms has ripple results all through the broader market.

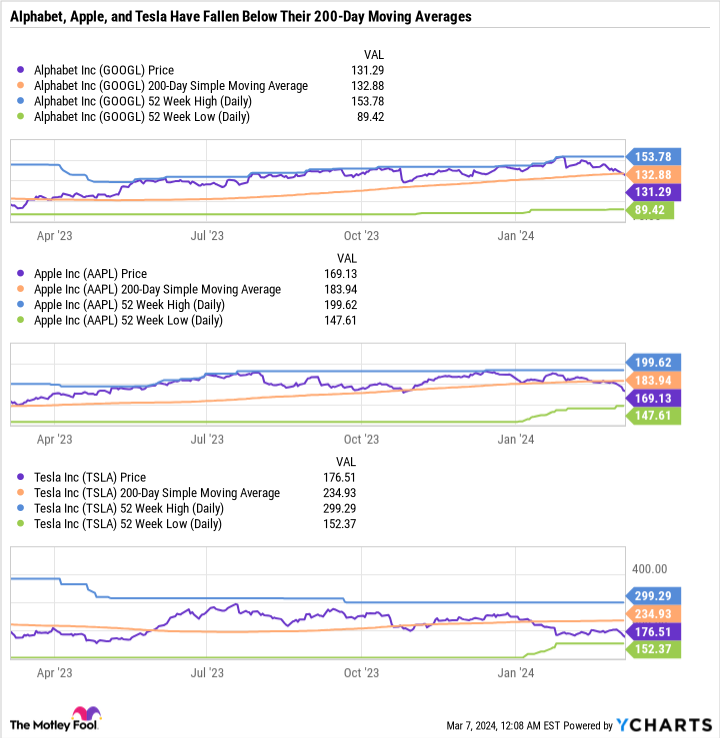

Alphabet, now down 6% 12 months so far, simply joined Apple and Tesla in falling under its 200-day transferring common. This is why I am watching that metric. It is not a purchase or promote sign, nevertheless it’s attention-grabbing.

Watching the place a inventory has been

The 200-day transferring common exhibits the common closing value of a inventory during the last 200 buying and selling days. Merchants observe transferring averages to gauge a inventory’s momentum.

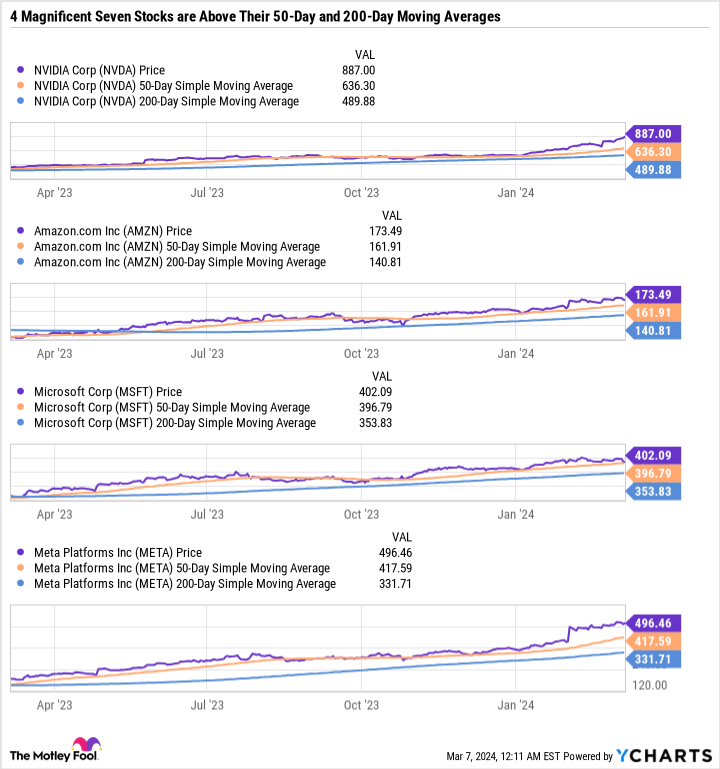

For instance, a so-called golden cross is when the 50-day transferring common passes the 200-day transferring common, an indication that traders are getting bullish on a inventory. Curiously sufficient, the present value of 4 Magnificent Seven shares is above the 50-day transferring common and the 200-day transferring common — which is a really bullish signal.

The 200-day transferring common is commonly seen as a important stage of assist. If a inventory’s value falls under the common, it’s a bearish signal that traders have turned destructive on the inventory.

Discover that the 200-day transferring common will be fairly totally different from the midpoint between the 52-week excessive and the 52-week low.

Within the case of Apple, its 200-day transferring common is barely 8% under the 52-week excessive however almost 25% above the 52-week low. That often means the 52-week low was short-lived, or the inventory has hovered across the 52-week excessive for some time.

Understanding market sentiment

An incredible divide has shaped within the Magnificent Seven between shares which can be in favor and people which can be out of favor. Realizing how the market feels a few inventory may also help you brace for volatility, nevertheless it would not essentially imply a inventory is value shopping for or promoting.

The market will get issues unsuitable on a regular basis. Among the finest current examples is Meta Platforms. Because the finish of 2022, Meta Platforms is up over 310%. In 2022, it misplaced over 64% of its worth.

Should you had been following transferring averages alone, you might have been promoting Meta Platforms in 2022 and would have missed out on the epic rally since then. Should you merely held the inventory, you’d have performed fairly nicely.

One other current instance is Goal (NYSE: TGT). On Nov. 9, 2020, Goal collapsed to a three-year low. Since then, it’s up a staggering 62.5% in simply 4 months — a monster transfer for a stodgy dividend-paying inventory.

In sum, transferring averages point out market developments and might result in accelerated shopping for and promoting.

Utilizing transferring averages to your benefit

One of the simplest ways to make use of transferring averages is to grasp how the market is reacting to one thing and see when you agree or not. For instance, when you assume that Alphabet has some challenges, however they do not warrant the inventory falling under the worth that’s its 200-day transferring common, you could possibly use it as a shopping for alternative.

Equally, when you consider Nvidia is doing very nicely, however not so nicely that the inventory’s value must be 80% increased than the worth of its 200-day transferring common, then it’s possible you’ll need to maintain off shopping for the inventory.

In different phrases, you should utilize the worth of a inventory relative to the 200-day transferring common to see if the market agrees with you or not. If it would not agree and a inventory is oversold, it might be an excellent shopping for alternative. If it does agree, then the positives might already be priced in and the chance/reward is not value it.

A number of the best wealth-generating moments are when the market turns destructive on a inventory despite the fact that the funding thesis hasn’t modified. There could also be some challenges, however oftentimes the sell-off is overblown.

It occurred in 2022 with many tech firms. Earlier than that, there was the pandemic-induced plunge. There was additionally the notable 2018 U.S.-China commerce warfare sell-off.

The purpose is that sell-offs occur on a regular basis, and so they typically go too far. Proper now, there could also be some shares which have run up too far too quick, whereas others are going through a wave of criticism that could be overblown.

What the Alphabet sell-off tells us

The most important takeaway from the worth motion of the Magnificent Seven shares is that the market can maintain going up even when essential, closely weighted shares are promoting off.

Apple was essentially the most worthwhile firm on the planet and a transparent market chief. Alphabet was as soon as the third-most-valuable firm. Tesla was as soon as value over $1 trillion, and was the only best-performing inventory in 2020. And but all three shares at the moment are transferring in the other way of the market.

The market is rewarding firms which can be rising, have robust earnings, and/or have a transparent runway towards monetizing synthetic intelligence (AI). Additionally it is punishing firms that must be main AI however have lagged behind the competitors (like Alphabet).

The market as a complete can offset the losses from Apple, Alphabet, and Tesla largely as a result of different sectors are doing nicely, too. Industrials, financials, and shopper staples are examples of sectors outdoors of huge tech which can be all making new 52-week highs.

Alphabet breaking under its 200-day transferring common is an indication that there might be additional promoting strain. However when you consider the funding thesis hasn’t modified, then it’s possible you’ll need to ignore this sign.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Alphabet wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Goal, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

A Third “Magnificent Seven” Stock Just Broke Below This Key Indicator. Should Investors Be Worried? was initially printed by The Motley Idiot